Why NASDAQ: AMPG Is An ‘Under The Radar’ Juggernaut You NEED To Know About

After combing the NASDAQ exchange for weeks, we think we found a true juggernaut in the Communication Equipment Industry. The kicker… As of April 20, 2023, it’s trading at around the low low price $3.20 per share. The Company is Amplitech Group Inc. (NASDAQ: AMPG) and we think you NEED to know about this one BEFORE it becomes a household name.

Alright, without further adieu, let’s get started.

Company Details

- Stock Details

- Ticker Symbol: AMPG

- Exchange: NASDAQ

- Location: United States

- Founded: 2002

- Industry: Communication Equipment

- Sector: Technology

- Employees: 34

- CEO Mr. Fawad A. Maqbool

- Website: https://www.amplitechinc.com/

AmpliTech designs, develops, and manufactures custom and standard state‐of‐the‐art RF components for the Commercial, SATCOM, Space, and Military markets. These designs cover the frequency range from 50 kHz to 40 GHz Eventually, offering designs up to 100 GHz. AmpliTech also provides consulting services to help with any microwave components or systems design problems.Our growth has come about because we can provide complex, custom solutions. Therefore, AmpliTech is committed to providing immediate responses to any custom requirements that are presented to us. AmpliTech, Inc. has developed and supplied LNAs to Fortune 500 companies, the Military and Government Agencies such as:

- Lockheed Martin

- NASA

- L3 Communications

- Boeing

- Northrop Grumman

- Raytheon

- Government of Israel

Think this sounds like any one of the other hundreds of small-cap companies trying to make a name for themselves without any financial backing, eh?… Well, think again because AMPG has a market cap of $30.72 million. The enterprise value is $21.76 million. In fact, in the last 12 months, AMPG had revenue of $19.39 million and -$677,107 in losses. Meaning, Their FY 2022 results BEAT Revenue Guidance and Reports Record 267% YoY!

BUT THAT’S NOT ALL!

AMPG Highlights

Fundamentals:

- Financial Position: AMPG has a current ratio of 12.08, with a Debt / Equity ratio of 0.16.

- Income Statement: In the last 12 months, AMPG had revenue of $19.39 million

- Balance Sheet: The company has $13.54 million in cash and $4.67 million in debt, giving a net cash position of $8.87 million

2022 Earnings:

- In the last 12 months, AMPG had revenue of $19.39 million and -$677,107 in losses.

- AmpliTech Reports FY 2022 Results; Beats Revenue Guidance and Reports Record 267% YoY Annual Revenue Increase to $19.4 Million

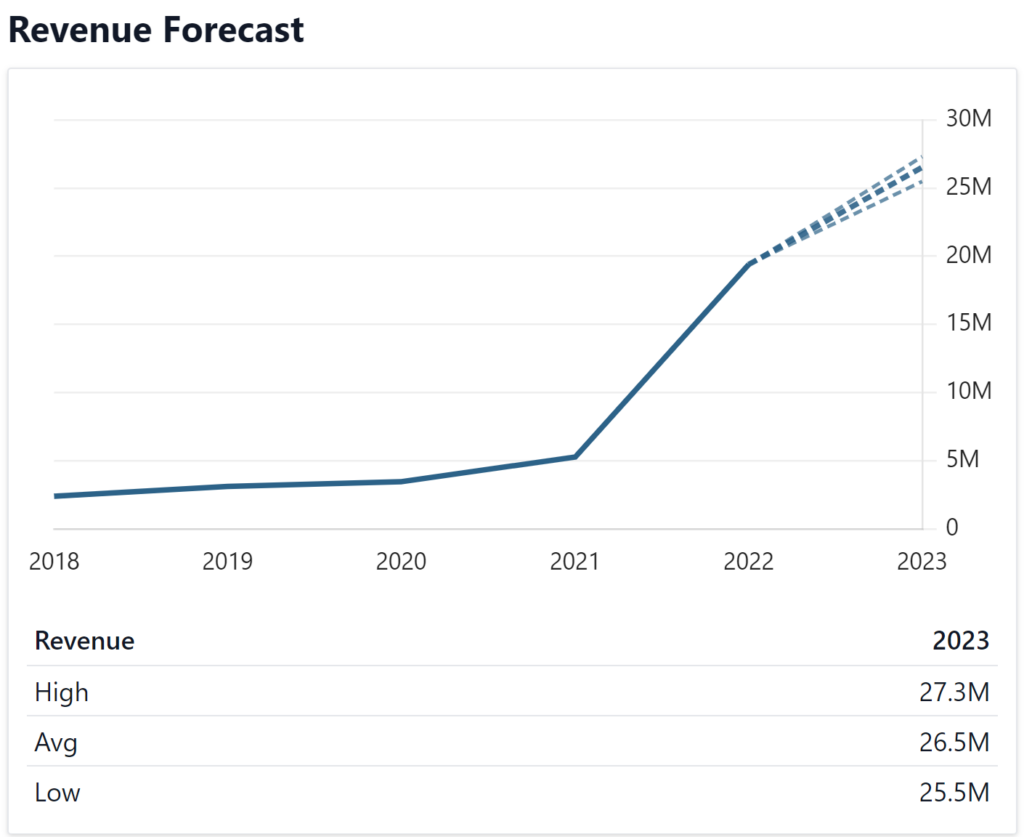

Analyst Forecast:

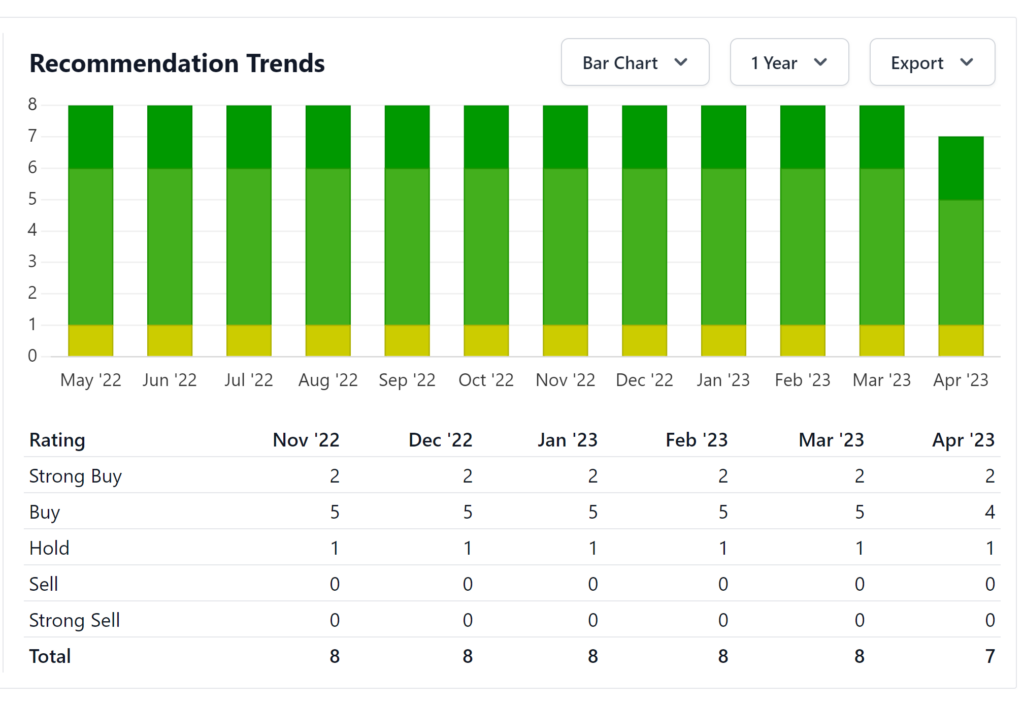

- The consensus rating for AMPG from 7 stock analysts is “Buy”.

- This means that analysts believe this stock is likely to outperform the market over the next twelve months.

Stock Price Forecast:

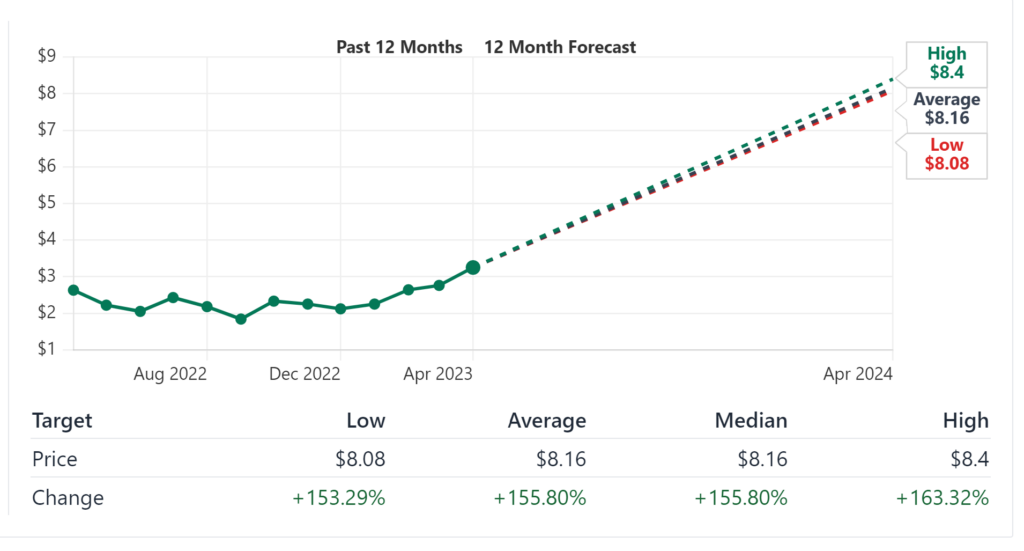

- According to 7 stock analysts, the average 12-month stock price forecast for AMPG stock is $8.16, which predicts an increase of 155.80%.

- The lowest target is $8.08 and the highest is $8.4.

- On average, analysts rate AMPG stock as a buy.

Share Statistics:

- Float: AMPG has 9.63 million shares outstanding with a low float of only 6.75 million shares

- Short Interest: The latest short interest is 89,377, so 0.93% of the outstanding shares have been sold short.

Continue reading to get our FULL BREAKDOWN of AMPG’s Highlights.

AMPG Fundamentals

- Financial Position: AMPG has a current ratio of 12.08, with a Debt / Equity ratio of 0.16.

- Balance Sheet: The company has $13.54 million in cash and $4.67 million in debt, giving a net cash position of $8.87 million

- Income Statement: In the last 12 months, AMPG had revenue of $19.39 million

The current ratio, also known as the working capital ratio, measures the capability of a business to meet its short-term obligations that are due within a year. The ratio considers the weight of total current assets versus total current liabilities. It indicates the financial health of a company and how it can maximize the liquidity of its current assets to settle debt and payables. The current ratio formula (below) can be used to easily measure a company’s liquidity.

So, if a currently has a current ratio of 2, then it can easily settle each dollar on loan or accounts payable twice. A rate of more than 1 suggests financial well-being for the company. Well, Financial Position: AMPG has a current ratio of 12.08. Meaning, it can easily settle each dollar on loan or accounts payable 12 times over.

That said, a very high current ratio may indicate that a company has excess cash in hand. Well, after looking into it, AMPG does have cash in hand… A lot of cash in hand… $13.54 MILLION to be exact.

Saving the best for last, In the last 12 months, AMPG had revenue of $19.39 MILLION. Let’s take a closer look at how great a year it’s been for this company.

2022 Earnings

In the last 12 months, AMPG had revenue of $19.39 million and -$677,107 in losses.

AmpliTech Reports FY 2022 Results; Beats Revenue Guidance and Reports Record 267% YoY Annual Revenue Increase to $19.4 Million

March 31, 2023:

2022 Annual Revenue increases nearly 3x to $19.4M, Gross Profit increases nearly 7-fold, Gross Margin almost doubles

AmpliTech Reports FY 2022 Results; Beats Revenue Guidance and Reports Record 267% YoY Annual Revenue Increase to $19.4 Million

- Gross Profit Increases nearly 7-fold, Gross Margin Expands 2,150 basis points to 46.0%

- 2022 Annual Revenue increases nearly 3x to $19.4M, Gross Profit increases nearly 7-fold, Gross Margin almost doubles

Full Year 2022 Highlights

- Revenue increased 267% to $19,394,000 in FY’22 compared to $5,275,000 in FY’21.

- FY’ 22 gross profit grew to $8,925,000, an almost 7-fold increase from FY’ 21 gross profit of $1,293,000. The gross profit margin increased by 2150 basis points to 46.0% compared to 24.5% a year ago.

- FY’22 net loss was $677,000 compared to a FY’21 net loss of $4,759,000, a positive swing of approximately $4.1 million. The net loss includes a one-time revenue earnout of approximately $816,000 as a result of Spectrum’s beating sales expectations for the years 2021 and 2022. It is important to note that without this earnout payment, the Company would have been profitable.

- As of December 31, 2022, cash and equivalents totaled $13,290,000 and working capital was $20,331,000, which is sufficient capital for AmpliTech to fund all of its strategic growth initiatives.

- AmpliTech experienced great success at trade shows such as Satellite 2022, IMS 2022, the AOC 2022, and the APS March Meeting 2022 , achieving positive customer engagement and setting company records at each event for the number of meetings with new and existing customers.

- Customers have begun to sample AGMDC’s new MMIC chip products which have received very positive praise and feedback.

Forward-Looking Update

- MMIC chips, or ICs, have been released to customers for testing and are expected to begin generating revenue in Q2 2023.

- Management expects sustained profitability going into 2023.

- Team is increasing sales exposure through enhanced strategic partnerships with sales representatives and distributors globally.

Full Earnings Report: https://finance.yahoo.com/news/amplitech-reports-fy-2022-results-130000549.html

Now, I know what you’re thinking. The past is the past. What is AMPG going to do for me in the future?… Well, let’s see what the analyst’s forecast for the future of AMPG.

Stock Price Forecast

As if that’s not a good enough projection, according to 7 stock analysts, the average 12-month stock price forecast for AMPG stock is $8.16, which predicts an increase of 155.80%. The lowest target is $8.08 and the highest is $8.4. On average, analysts rate AMPG stock as a buy. In fact, a couple of firms have already initiated coverage of AMPG with more expected to do so as this one continues to move higher.

Analyst Forecast

The consensus rating for AMPG from stock analysts is “Buy.” This means that analysts believe this stock is likely to outperform the market over the next twelve months.

The average analyst rating for AMPG stock from 7 stock analysts is “Buy”. This means that analysts believe this stock is likely to outperform the market over the next twelve months.

February 2, 2022

Analyst Firm: Small Cap Consumer Research

Rating: Buy

Target: $5.00

July 7, 2021

Analyst Firm: Maxim Group

Rating: Buy

Target: $10

If the forecasters think AMPG is worth adding to their watchlist then we should too, right? But, what about actually buying the stock for themselves? Let’s take a look…

Insider Holdings

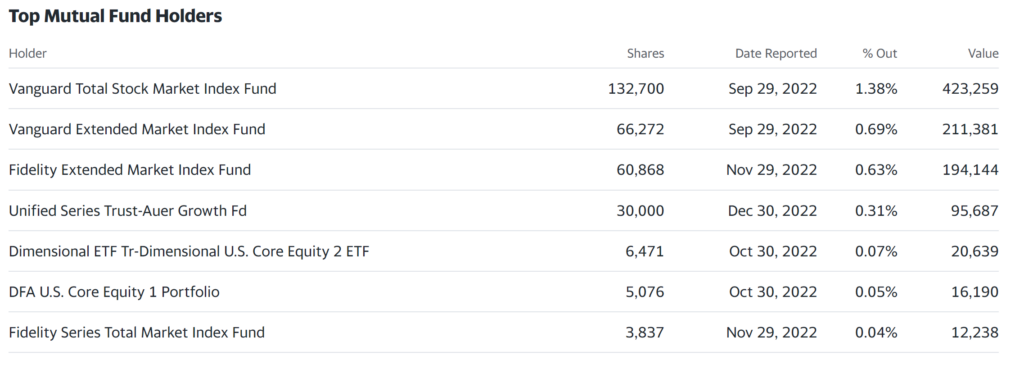

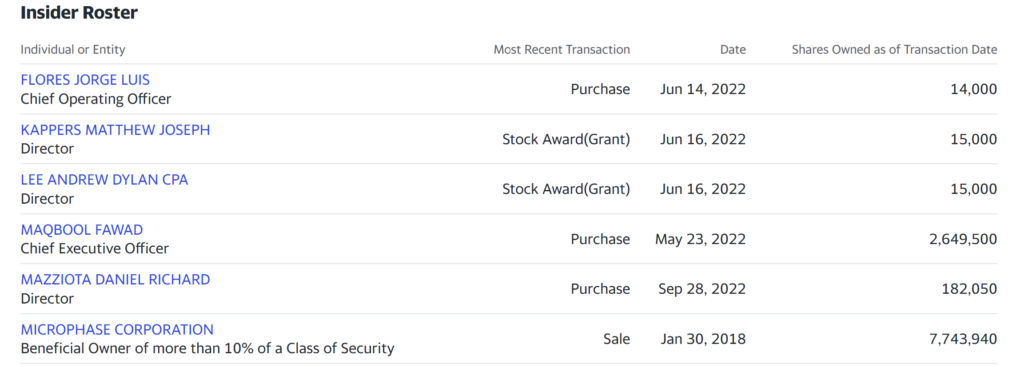

AMPG has 9.63 million shares outstanding with a low float of only 6.75 million shares with a meager short interest of less than 1% sold short. Of their shares, 32.99% are held by insiders, 8.68% is held by 16 different institutional investors, totalling to a little under 13% of the float.

Recent News

April 17, 2023

AmpliTech Group’s Division, Spectrum Semiconductor Materials, Inks Distribution Deal with NGK Electronic Devices, a Leading Global Semiconductor Manufacturer

AmpliTech to Become NGK’s First US Distributor of Their RF Microwave Package Products

McapMediaWire – AmpliTech Group, Inc. (NASDAQ: AMPG) a designer, developer, and manufacturer of state-of-the-art signal-processing components for satellite, 5G, and other communications networks, and a worldwide distributor of packages and lids for integrated circuit assembly, as well as a designer of complete 5G/6G systems, is proud to announce its partnership with NGK Electronic Devices, a powerhouse in the semiconductor packaging industry, to become their US distributor for NGK’s state-of-the-art RF Microwave products. This partnership marks NGK’s first distribution agreement with a US partner, presenting a significant opportunity for both parties.

Full Article: https://finance.yahoo.com/news/amplitech-group-division-spectrum-semiconductor-133000902.html

March 30, 2023

AmpliTech Records a New Benchmark at Satellite 2023 Show in Washington, D.C.

McapMediaWire – AmpliTech Group, Inc. (NASDAQ: AMPG), a designer, developer, and manufacturer of state-of-the-art signal-processing components for satellite, 5G, and other communications networks, as well as a worldwide distributor of packages and lids for integrated circuit assembly, is excited to announce an unprecedented achievement at the Satellite 2023 show held in Washington, D.C. The company recorded more than 100 meetings with executives in the satellite communications (Satcom) space – a new record for the prestigious event. Among the attendees were multiple Fortune 100 companies, top-tier research institutions, and exciting startups driving the next generation of connectivity.

Full News Article: https://finance.yahoo.com/news/amplitech-records-benchmark-satellite-2023-130000747.html

February 27, 2023

AmpliTech Group, Inc. Discusses Significance of Its State-of-the-Art Radio Frequency Components with The Stock Day Podcast

AmpliTech Group, Inc. (NASDAQ: AMPG),a designer, developer, and manufacturer of state-of-the-art signal-processing components for satellite, 5G, and other communications networks and a worldwide distributor of packages and lids for integrated circuit assembly, is pleased to announce its participation in three upcoming shows, where it will exhibit its latest technological advancements at the Satellite Show in Washington DC, at Booth #2092. AmpliTech Group is also attending the Mobile World Congress (MWC) Show in Barcelona, and the American Physical Society (APS) show in Las Vegas, to participate with key players in the 5G and Quantum Computing industries.

Full News Article: https://finance.yahoo.com/news/amplitech-showcase-latest-product-wins-141500565.html

November 7, 2023

AmpliTech Recognized by Inc. Magazine as Top 10 Most Innovative Telecom Solution to Watch

AmpliTech Group, Inc. (Nasdaq: AMPG) announced that it was recognized by Inc. magazine in its list of “Top 10 Most Innovative Telecom Solution to Watch”

Founder and CEO Fawad Maqbool stated, “It was an honor to work with Inc. Magazine on this article to discuss Amplitech Group and how we currently offer a wide range of products for 5G, Telecom, quantum computing, airline Wi-Fi, and all things wireless, starting from connectorized modules, discrete transistors, MMICs, and packages, to multi-chip modules (MCMs) and systems using multiple disciplines and processes that we see a lack of in the market. All of these products directly enable technologies such as Virtual Reality (VR), Augmented reality (AR), Telemedicine, fully autonomous vehicles, Satellite-to-phone connectivity, the Internet of Things (IoT), Internet in the sky, and much more. AmpliTech is committed to connecting humans like never before in the 21st century.”

Full News Article: https://finance.yahoo.com/news/amplitech-recognized-inc-magazine-top-210000268.html

AMPG Company Background

Developing the communication systems of tomorrow, today.

AmpliTech was founded to address the industry gap for high-performance, ultra-reliable, and extremely efficient radio frequency (RF) devices to power the communication ecosystem of tomorrow. We obsess over pushing boundaries of what can be done to increase connectivity in the sky, in space, and in your homes. The devices AmpliTech designs boast the lowest noise figures and power dissipation across all usage frequencies to offer customers in the military, Satcom, aviation, automotive, and computing industry unparalleled product specifications and user experience. As industry requirements for communication throughput, speed, and endurance grow exponentially, we strive to develop the technologies necessary to power the future of communication.

AmpliTech designs, develops, and manufactures custom leading-edge RF components for the Commercial, SATCOM, Space, and Military markets. These designs cover frequencies from 50 kHz to 44 GHz. AmpliTech also has developed new products for the 5G/6G wireless ecosystem and infrastructure with unparalleled performance. In addition to this rapidly emerging market, AMPG has also developed solutions for Quantum Computing, with cutting edge technology. We continue to blaze trails in our commitment to enable and accelerate the arrival of true 5G/6G architecture and contribute to the U.S. being the leader and first to reach the coveted position of Quantum Supremacy. Our growth has come about because we provide complex, custom solutions that our competitors shy away from. We have consistently provided the industry-leading SATCOM Low Noise Amplifier Solutions for the past 18 years and our new website showcases these products below, with its advanced search engine and listing of stock items. This allows us to provide immediate response to custom requirements, unwavering technical support and timely delivery. We will be continuing our R&D efforts to always be at the forefront of emerging technologies and using our advanced techniques and IP to provide tomorrow’s technology today, and improve everyone’s quality of life. In addition, we have the best assemblers, wirers, and technicians in the industry and can provide contract assembly of customers’ own designs. AmpliTech is in the process of scaling up its proprietary technology and design its own MMICs, subsystems, and other products to address the rapidly emerging, large volume commercial applications in the communications technology space.

AmpliTech, Inc. has a rich history in the design of microwave amplifiers and components, including a wide variety of product lines, from LNA’s (Low Noise Amplifiers) and MPA’s (Medium Power Amplifiers), to broadband telecom amplifiers for the microwave and fiber optic communications firms.

As such. we are defined by our expertise in custom designed amplifiers with special requirements such as military screening and space qualification. To provide for customers dealing with extremely low noise figure applications, we have excelled in the ever-growing cryogenic market as well. In short, all our customers agree that we provide simply the best product and services available in the industry while maintaining lower prices than most of our competitors and we do so in the most emergent of technologies on the industry landscape today. Our success is marked not only by our technical achievements, but also by an extremely respectable customer base which includes giants in the industry such as Motorola, ITT, Harris, Northrop Grumman, Raytheon, L3 Communications, Aeroflex, NASA, NIST and TRW (to name a few). Due to the achievements of its talented staff, AmpliTech has also received numerous Supplier Quality awards, including a Best Technology Award from one of the industry’s leading trade magazines. AmpliTech now trades on the NASDAQ public stock exchange under the ticker symbol AMPG which will help take our products to a broader and more global customer base, bringing cutting-edge technology to the masses and improving everyday quality of life for us all. The following are some of the many advantages that set us apart from our competition:

- Skilled and experienced Management Team

- Proven track record of performance and quality products

- Quantified IP and pending patents

- Virtual sole-source current supplier positions in various areas such as Quantum Computing, Military Avionics Equipment, High-speed SATCOM equipment, Telemetry applications

- Government GSA Award

- Strategic alignment with key vendors and customers to provide next generation products for 5G/6G. Quantum Cloud, High-speed Satellite Internet, IoT commercial markets

- Integration of Microwaves and Life Sciences to provide diagnostic and non-invasive detection systems and treatments for medical applications

- Much more!

Core Competencies

AmpliTech, Inc. offers:

- Standard state-of-the-art RF/Microwave components for the Commercial, SATCOM, Space, & Military

- markets.

- Highly customized RF/Microwave amplifiers that cover frequency ranges from 50 kHz to 100 GHz.

- Cryogenically cooled LNAs that achieve the lowest Noise Figures in the industry.

- High reliability Space-Qualified components that meet standards of excellence that no other

- manufacturer in the industry can match.

- Consulting services to provide technical support for any microwave components or systems design issues, even from other manufacturers.

Differentiator

AmpliTech, Inc. provides tangible advantages

over our competitors because:

- Superior product -even standard commercial

- units are built to MIL-883 guidelines.

- Most competitive pricing in the industry.

- Timely delivery.

- The highest possible level of customer service

- and technical support.

- We’ve developed designs for hundreds of

- customers who couldn’t find manufacturers to

- meet their stringent specs.

Key Executives

Fawad Maqbool (President and CEO (Founder) / CTO)

Mr. Maqbool has been in the microwave business for 30 years. He has a B.S.E.E. in microwave engineering and a B.S.E.E in Bio-Medical Engineering from CUNY and an M.S.E.E from Polytechnic University of New York. He founded AmpliTech in 2002 to fill the need for affordable, high quality, custom, state-of-the-art amplifiers and components. For almost 14 years as Department Head, he designed and developed state of the art amplifiers and components for MITEQ Inc., a leading supplier of microwave components and communications equipment. He then founded AmpliComm (acquired by Aeroflex, Inc. (ARXX) in 2000 to develop custom cryogenic and fiber optic amplifiers and components). Mr. Maqbool’s innovative management and design experience continues to push AmpliTech’s boundaries in microwave technology both in commercial and military markets. Mr. Maqbool has received various awards for innovative design and quality from suppliers such as Motorola, and publications such as Wireless Design and Technology magazine. AmpliTech continues to surpass it’s peers in performance, value, service, and innovation, and is poised to become the leading supplier of amplifiers and related components in the coming years.

Louisa Sanfratello (Chief Financial Officer)

Louisa Sanfratello, a CPA (Certified Public Accountant), has been a Certified Public Accountant working in numerous organizations in various industries since 1998. Her duties throughout this time and her time as an accountant for various charities and schools consisted of preparation of official financial documents as well as day-to-day financial management. Also tapped were her skills in the area of projection of cash flow and consequent requirements. Her professional career began in 1987 with the public accounting firm of Holtz, Rubinstein & CO., where she gathered two years of invaluable experience before earning her CPA and moving on to more challenging things.

Jorge Flores Chief Operating Officer

Having joined AmpliTech at the end of March in 2021, Mr. Flores brings with him over 30 years of combined Operations and Program Management experience. Prior to joining Amplitech’s executive leadership team, Mr. Flores held various leadership roles at Comtech Telecommunications, a Nasdaq listed corporation with over 2K employees and revenues of over $600M. Previous management roles included Director of Program Management Office, Business Unit Manager and Supply Line Management. Mr. Flores holds an MBA with concentration in Operations Management and Leadership from Dowling NY and, a BS in Business Administration, Major in Operations Management from NYIT.

John P. Pastore Director of Sales

Mr. Pastore has been in the microwave industry for 40 years. He has a B.S. in Business Management and has worked for many of the leaders in the RF/Microwave industry. Mr. Pastore is a hands-on professional whose experience spans over 20 years of progressive roles through which he has gained a rare blend of technical, manufacturing, customer service, and management skills and capabilities. His business savvy and deep understanding of the industry make him an extremely valuable asset to the company and an integral part of the AmpliTech team.