Therma Bright (TBRIF) Gains 29% Amidst Breaking News

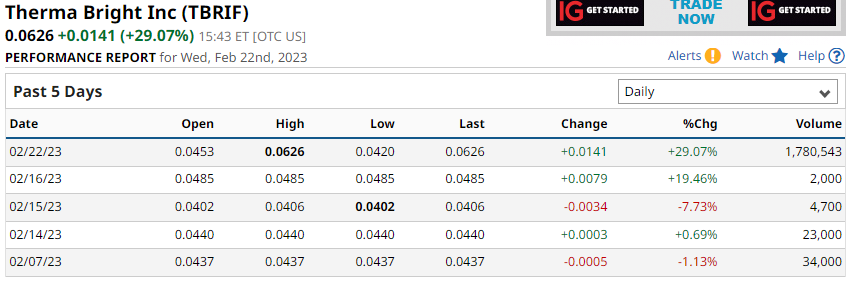

Since Therma Bright TBRIF announced they secured the license for Digital Cough Technology, the stock has been on a steady climb up.

Here are the Top 3 catalysts that could send TBRIF up 200%++ in the next 3 months:

- Technologies are disruptive in a $21 billion market

- Multi-channel market penetration strategy

- Chart is bullish

History of Massive Runs

Where did we come up with 200%?

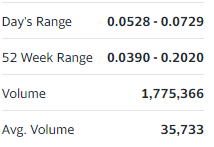

The 52 week high is $.21 and at the current prices that would represent 200% gains.

Check Out This Run

Date: October 24th 2022

PPS: $.039

PPS on 11/7: $.101

Gains: 159%

Small Cap Exclusive has built a reputation of uncovering stocks with massive upside potential. Our research reports have uncovered some of the largest breakout stock alerts year after year.

We stand by our alerts, our 2023 alert tracker providing transparency. Click Here

Small Cap Exclusive’s much anticipated research report on Therma Bright is found below.

[clickfunnels_embed height=”320″ url=”https://chrisputnam1229.clickfunnels.com/optin1677276397943″ scroll=”yes”]

(OTC:TBRIF) Therma Bright has so many catalysts that could send it parabolic it was difficult to finalize the top 3 catalysts found above, so we will open this research report with the honorable mention!

Therma Bright’s Other Explosive Catalysts

- Recent news has has created massive increases in share volume in the US market.

- TSX, Canadian exchange, is also having the same changes in trends, volume and PPS.

- This is a classic momentum play, all the indicators are pointing to it.

- The chart looks like Warren Buffet grabbed chalk, went to the chalk board, turned to the class and said, “this is a bullish trend line, this is breakout pattern, this is a momentum play and a possible short squeeze catalyst.” all in one chart!

]Why is Therma Bright trading at 49X trading volume?

News below is a game changer:

Therma Bright announced that it has finalized and signed the exclusive worldwide licensing rights to market and sell AI4LYF’s Digital Cough Technology (DCT). DCT can accurately and almost instantaneously detect multiple respiratory diseases, including COVID-19, simply and efficiently through a smartphone app, anytime, anywhere.

Pay attention!

Therma Bright is methodically releasing incredible press releases possibly setting up a massive run similar to the last bullish move from $.039 to .1010 representing a 159% increase in share price.

Notice a trend in the news cycle below?

March 1st – Announced The Appointment of Dr. John Patton as Chairman, most notably he was the co-founder of Inhale/Nektar (NKTR) achieved a US $2.1bn valuation on NASDAQ. link

Feb 23 – TBRIF Reports on Progress of Inretio’s Novel Clot Removal Device for Stroke Treatment link

Feb 16 – Therma Bright Secures Exclusive License Agreement for AI4LYF’s Patent-Pending Digital Cough Technology (DCT) to Detect Respiratory Diseases Link

Jan 19 – Therma Bright to invest up to US$2.5M in developer of a groundbreaking ischemic stroke treatment Link

Dec 1, 2022 – TBRIF invests in novel treatment using inhaled statins to treat respiratory conditions Link

Let’s do a quick summary on TBRIF before we jump into the catalysts.

Therma Bright Company Summary

Company Name: Therma Bright, Inc.

Ticker: TBRIF

Exchange: OTC

Website: https://www.thermabright.com/

Therma Bright Company Summary:

Therma Bright, developer of the smart-enabled AcuVid™ COVID-19 Rapid Antigen Saliva Test, is a progressive medical diagnostic and device technology company focused on providing consumers and medical professionals with quality, innovative solutions that address some of today’s most important medical and healthcare challenges.

During the research process many investing principles that are a hallmark of a an explosive trade became clear in regards to Therma Bright.

However, we are going to focus on just three of the numerous unique investing propositions.

So, without further delay, here are the top 3 catalysts that could ignite parabolic growth with TBRIF.

Before we review #1 Catalyst, their technology suite, let’s review how the catalysts above could generate parabolic growth.

As mentioned above, Therma Bright trades on the OTC market which indicates the incredible upside potential if just one of their revolutionary products captures the market share warranted.

It gets better, they have strategically created two paths to revenue, institutional focus and direct to consumer.

More on that later, then to top it off the chart just broke through resistance and is appearing to be setting up for another massive run.

ADD UP ALL THE POSITIVES then add in that their technologies are innovative, have massive demand in the marketplace and are disruptive in a $21 billion market.

Digital Cough Technology (DCT)

Artificial intelligence, smart phones, algorithms, we live in an amazing time and Therma Bright very well could become a household name with their Digital Cough Technology.

In lay terms, imagine an application that has thousand of recorded coughs on a server. Next, those coughs are denoted and attributed to a certain illness or disease. Third step, develop a mobile app utilizing your microphone to record your cough. Finally, the application performs a search query to detect an illness or disease in the library of coughs.

Wow, just wow the times we live in! The icing on the cake is, you have an opportunity to take advantage of this amazing technology if you choose to invest in Therma Bright (OTC:TBRIF). Look at the amazing press on DCT below:

Press Announcing DCT Licensing

February 16th

Therma Bright announced that it has finalized and signed the exclusive worldwide licensing rights to market and sell AI4LYF’s Digital Cough Technology (DCT). DCT can accurately and almost instantaneously detect multiple respiratory diseases, including COVID-19, simply and efficiently through a smartphone app, anytime, anywhere. The exclusive license agreement also will allow Therma Bright to develop the DCT solution for other respiratory diseases, such as asthma, pneumonia, bronchiolitis, and chronic obstructive pulmonary disease.

Statins

Statins traditionally have been used to treat cholesterol but there has been significant studies in the efficacy in treating treat respiratory conditions, including asthma and chronic obstructive pulmonary disease (COPD), and acute lung inflammatory diseases, including those caused by COVID-19. Please review this study to gather a better insight in the incredible novel technology Therma Bright just acquired. https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7836012/

In December Therma Bright announced that it has entered into an agreement to acquire an interest in a novel technology utilizing inhaled statins to treat respiratory conditions, including asthma and chronic obstructive pulmonary disease (COPD), and acute lung inflammatory diseases, including those caused by COVID-19.

Research from the University of California Davis School of Medicine on “inhaled statins” to treat the acute and chronic respiratory inflammatory mechanisms associated with asthma, COVID-19, and other respiratory conditions has yielded promising results, according to Therma.

Inretio

It keeps getting better, they announced a SPA (Share Purchase Agreement) with Inretio Ltd. (“Inretio”) for its innovative protective blood clot retriever technology.

Therma Bright has the right to invest up to USD $2,000,000 in cash and USD $500,000 in Therma Bright shares to earn up to 25% in Inretio Inc., subject to TSX Venture Exchange approval.

Inretio is developing a medical device called PREVA™ to treat ischemic stroke.

The PREVA™ clot retriever is a groundbreaking medical device that will change the way ischemic strokes are treated.

It is the first and only protective clot retriever that uses a distal basket. The device’s unique PREVA™ basket “ensnares” the clot, encapsulating it and protecting the brain from any sub-clots breaking off during the thrombectomy procedure.

This ensures the complete removal of the clot and its fragments, leading to more successful revascularization of the brain which can prevent further damage and complications. The PREVA™ clot retriever is a game-changing technology that has the potential to significantly improve outcomes of clot removal procedures for stroke patients.

Venowave

The Venowave is a circulation booster designed to improve circulation in the lower extremities.

The Venowave is a medical compression pump that is lightweight, compact, battery operated, designed to treat and alleviate the symptoms associated with poor circulation. When worn firmly on the calf, the Venowave produces a wave form motion forcing blood from the feet and legs back to the heart. This increase in blood flow draws oxygen to wound and ulcer sites, prevents blood pooling and clotting, and alleviates symptoms of Post Thrombotic Syndrome and other Chronic Venous Insufficiencies.

Therma Bright has implemented a multi-channel market penetration strategy that doubles their opportunity at success and can double their revenue.

You might be asking right now, what is a multi-channel market penetration strategy? In lay terms, Therma Bright is institutionally focused while consumer driven, a rare double threat that is similar to a unicorn when referencing international commerce.

Let us explain this concept in greater detail, because it is important. You don’t buy Tylenol from McNeil Consumer Healthcare you purchase it from CVS, their distributor. Similarly, you don’t buy Nyquil from Proctor & Gamble, you pick it up Harris Teeter. Therma Bright is making a massive commitment to operate in both models, intuitional and dtc. For a brief description of both models, look below.

Institutional: Hospitals, pharmacies, HMOs and the VA to mention a few. The pros with this model is massive sales, streamline logistics, reduction in customer service, reduction in marketing, reduction in employees and reduced accounting expenses. The cons are, thinner margins and the tail wags the dog, meaning, if you lose a massive account that is 23% of your business, heads will roll and revenue comes crashing down.

Direct to Consumer: Otherwise known as DTC, is any company that penetrates a market with directly to the consumer rather than through a wholesale distributor, HMO as an example. The advantage with DTC is you have the ultimate control. You are fishing for yourself rather than depending on a sales agency essentially. Furthermore, your profit margins are higher as well. The cons are higher overhead and the pain of managing all the employees who oversee the customers you created through your direct marketing efforts. https://www.benepod.com/

Breakout Pattern Detected

The 3rd catalyst has so many facets, such as: breakout confirmation, Canadian volume skyrocketing, momentum and it’s consolidated and ready for it’s next move!

Breakout confirmation is clear as day in the chart below. There was resistance and consolidation from $.0425 to $.05, then boom, it catapulted through resistance reaching it’s 60 day high. More importantly, it has retraced, pulled back, and consolidating creating a bullish trend! The chart looks spectacular!

Canadian Volume – Therma Bright trades under the ticker (TSXV: THRM) on the TSX, mirroring the US market, volume is skyrocketing due to the news and the possible short squeeze. The short squeeze aspect of Therma Bright is the gasoline that the catalysts spark and then it may go parabolic, more on this later. If you look below, you will see the TSX chart with a similar bullish trend and volume spikes.

New Momentum – As seen in both charts above, volume has increased 4,900%, that is worth repeating, 4,900% increase in demand for this stock! Look at the screenshot below.

Worth noting, with all of this demand TBRIF still has almost 200% to get to their 52 week high and all signs point to the possibility of meeting and exceeding those numbers with the catalysts and the possible short squeeze that we will discuss shortly.

Consolidated under current prices – the last 70 days have been trading in a consolidation pattern creating a base then the move it made a few days creates a situation where there are modest gains and sustainable gains without creating a mass sell off. This action creates a bullish pattern and incredible stability in the trading activities.

In closing, look at these record breaking volume spikes, turn your attention to Therma Bright (OTC:TBRIF) right now, regret can be demoralizing and always remember, to the victor belongs the spoils.

[clickfunnels_embed height=”320″ url=”https://chrisputnam1229.clickfunnels.com/optin1677276397943″ scroll=”yes”]

Condensed Disclaimer

Small Cap Exclusive is owned and operated by King Tide Media, LLC, which is a US based corporation & has been compensated $60,000 from Therma Bright Inc. for profiling TBRIF. We own ZERO shares in TBRIF.

Massive IPO Stock Alert: Lucy Scientific (NASDAQ:LSDI) Announces It’s $7.5M IPO

Lucy Scientific manufactures therapeutic psychedelics and made a huge announcement, we will get to that soon.

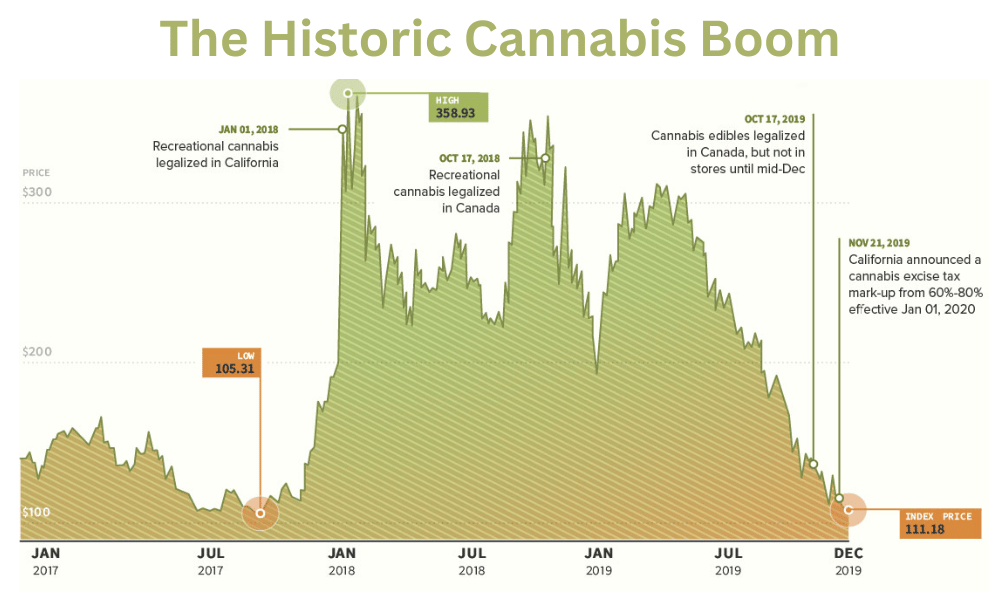

The Global Psychedelics Market Is Expected To Reach almost $100 BN By 2029 Full Article

That is larger than the cannabis market segment, without a market leader.

Lucy Scientific has made some serious steps toward possibly dominating the market.

This is exciting investors, it is a second chance at the cannabis boom but bigger.

In case, you need a reminder of how crazy that ride was, the market grew by 250% in less than a year.

UPDATE:

Breaking News:

March 21, 2023 (GLOBE NEWSWIRE) — Lucy Scientific Discovery Inc. (“Lucy” or “The Company”) [NASDAQ:LSDI], an early-stage psychedelics manufacturing company, announced that it has entered into a definitive asset purchase agreement with Wesana Health Holdings Inc. (“Wesana”).

Lucy has agreed to acquire intellectual property and related assets for Wesana’s psilocybin and cannabidiol (CBD) combination investigational therapy, SANA-013, and Wesana’s supply of psilocybin which is sufficient to complete all near-term clinical studies. The aggregate consideration comprises 1,000,000 shares of common stock and $570,000 in cash. The shares will be subject to a lock-up agreement whereby half of the shares will be released 9 months from closing, and other half will be released 14 months from closing. The transaction is also subject to Wesana’s shareholder approval and is expected to close in Q2 2023.

Small Cap Exclusive has built a reputation of uncovering stocks with massive upside potential, concentrating on IPOs and we have uncovered some interesting data on LSDI.

Our research reports have uncovered some of the largest breakout stock alerts year after year.

LSDI may even be the best yet. So put us to the test and put it on your watchlist.

We stand by our alerts, our 2023 alert tracker provides transparency. Click HERE

Small Cap Exclusive’s much anticipated research report on Lucy Scientific (NASDAQ:LSDI) is found below.

Top 3 catalysts that could send LSDI up 127%++ in the next month:

#1 The Chart

#2 IPOs Offer A Significant Upside Potential

#3 The Market Could Be As Big As Coffee

Lucy’s Other Explosive Catalysts

- Recent news has has not been covered by major financial news outlets, creating a unique opportunity.

- Lucy Scientific Discovery Announces First Commercial Sale of Psilocybin. Press Release

- Files Amendment with Health Canada to Expand its List of Controlled Substances to Include Cocaine and Heroin Press Release

Why do we consider Lucy Scientific as a contender for the best stock of 2023?

Large announcements in the drug world is turning heads on Wall Street and it feels like 2017’s green boom with cannabis.

Wait until you see what we have uncovered!

Major Psychedelic Announcements:

2019: May 9th

Denver, Colorado became the first city in the United States to decriminalize the cultivation, possession and use of psilocybin mushrooms.

2019: June 5th

Oakland California decriminalized the cultivation, possession and use of plants or fungi containing psychedelic compounds including DMT, ibogaine, mescaline and psilocybin.

2019: September 4th

Johns Hopkins launched the Center for Psychedelic and Consciousness Research. The center’s director, Roland Griffiths, said that researchers will focus on how psychedelics affect behavior, mood, cognition, brain function, learning, memory, and biological markers of health.

2019: November 22nd

The Food and Drug Administration granted Breakthrough Therapy designation to the Usona Institute for its psilocybin therapy for major depressive disorder. Usona’s phase 2 clinical trials will include 80 volunteers at seven sites around the U.S.

2020: October 22nd

In Vancouver, Canada Numinus Wellness Inc. harvested the first legal flush of psilocybin mushrooms by a public company under its Health Canada-issued Controlled Drugs and Substances Dealer’s License.

2021: October 18th

Johns Hopkins Medicine was awarded a $3.9 million grant by the National Institutes of Health (NIH) for clinical research on psilocybin-assisted psychotherapy to treat tobacco addiction.

Let’s take a closer look at Lucy LSDI.

2023: March 23

Announced today the launch of a new line of unscheduled psychoactive compounds that will be available for sale throughout the United States, and where permitted throughout the rest of the world.

The first line in the new family of brands contains Amanita Muscaria mushrooms, a psychoactive adaptogen. The product leverages the compounds of these mushrooms, and a proprietary blend of other natural functional ingredients, to create a transformative experience for consumers worldwide. This product line is named ‘Mindful by Lucy’.

Lucy Scientific Discovery Company Summary

Company Name: Lucy Scientific Discovery

Ticker: LSDI

Exchange: NASDAQ

Website: https://www.lucyscientific.com/

Lucy’s Company Summary:

Lucy Scientific Discovery Inc. [NASDAQ:LSDI] an early-stage psychedelics manufacturing company that is focused on becoming the premier research, development, and manufacturing organization for the emerging psychedelics-based medicines industry.

Lucy maintains a Controlled Drugs and Substances Dealer’s License under Part J of the Food and Drug Regulations promulgated under the Food and Drugs Act (Canada), more commonly known as a Dealer’s License, that was issued to Lucy by Health Canada’s Office of Controlled Substances.

This Dealer’s License authorizes the Company to develop, sell, deliver, and manufacture (through extraction or synthesis) certain pharmaceutical-grade active pharmaceutical ingredients, or APIs, used in controlled substances and their raw material precursors.

Before we review #1 Catalyst, their technology suite, let’s review how the catalysts above could generate parabolic growth.

As mentioned above, Lucy Scientific Discovery trades on the NASDAQ as an IPO, which indicates the incredible upside potential.

#1 The Chart

The chart has clearly broken out and is creating a bullish trend line. Start your research now before it is too late, just like the green boom.

#2 IPOs Offer A Significant Upside Potential

Facebook META acted the same way as most IPOs with hype. They get overbought, they pull back and then run like mad!

Lucy is following that same pattern and we believe it has created a bottom and has broken out clearly in the above image.

Look at what Motley Fool wrote about the massive opportunity FB provided, “The stock was offered at $38 per share via the IPO. Let’s assume you bought 132 shares for a total of $5,016 on May 18, 2012, and held all the way through to today. At today’s price of around $191 per share, those 132 shares would be worth $25,212, resulting in a market-beating five-bagger.”

Just like the cannabis boom, and Facebooks IPO, traders are being handed another possible monumental opportunity.

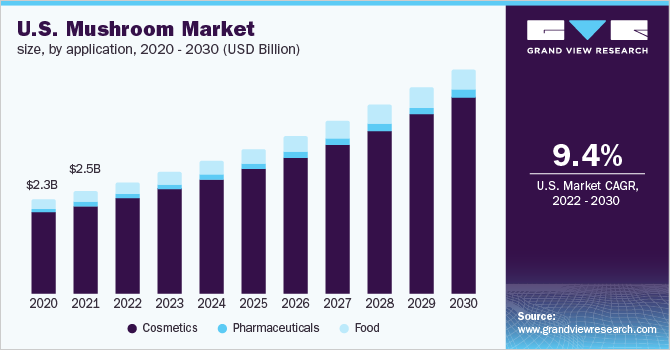

#3 The Market Could Be As Big As Coffee

The global mushroom market size was valued at USD 50.3 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 9.7% from 2022 to 2030. The increasing vegan population demanding a protein-rich diet around the globe is expected to be a key driver for the market over the forecast period. Mushrooms are considered a superfood owing to their nutritional contents. Mushrooms are packed with four key nutrients namely selenium, vitamin D, glutathione, and ergothioneine. These nutrients help mitigate oxidative stress and prevent or decrease the risk of chronic conditions such as cancer, heart disease, and dementia. Moreover, it offers a strong natural umami flavor, allowing consumers to reduce salt proportion in mushroom meals by 30-40%, thereby benefitting health.

The U.S. was the second-largest producer accounting for approximately 375 million kg in the year 2019. The production in the country is declining since 2017 and has declined by 11% from 2017 to 2019. Whereas the demand from end-users is growing, which has resulted in an increase in the prices by 6% in 2017-18 and by 3% in 2018-19. The U.S. government is continuously increasing import duties, which is also contributing to the higher prices of mushrooms. Mushroom is one of the protein-rich vegan sources as it offers nearly 3.3 g of protein per 100 g of serving. Meat has been a key source of protein in the western diet; thus, the population adopting a vegan diet is anticipated to prefer protein-rich vegan products to fulfill their daily protein requirements.

Condensed Disclaimer

Small Cap Exclusive is owned and operated by King Tide Media, LLC, which is a US based corporation & has been compensated $350,000 from Lucy Scientific Discovery Inc. for profiling LSDI. We own ZERO shares in LSDI.