DOCU DocuSign, Inc Stock Price Is Undervalued!

DocuSign DOCU was trading at almost $400 a year ago, now it’s at $56. This is an incredible value and we love it!

Before we do, remember to stop what you are doing and 👇 Sign up for our newsletter to get the latest breakout stocks and trending stocks!

[thrive_leads id=’14274′]

DocuSign Inc. Company Information

Company Name: DocuSign

Ticker: DOCU

Exchange: NASDAQ

Website: www.docusign.com

DOCUSIGN Company Summary:

DocuSign helps organizations connect and automate how they prepare, sign, act on, and manage agreements. As part of the DocuSign Agreement Cloud, DocuSign offers eSignature, the world’s #1 way to sign electronically on practically any device, from almost anywhere, at any time. Today, over 1.2 million customers and more than a billion users in over 180 countries use the DocuSign Agreement Cloud to accelerate the process of doing business and simplify people’s lives.

DocuSign stock price is due to News?

Sept. 8, 2022 /PRNewswire/ — DocuSign, Inc. (NASDAQ: DOCU), which offers the world’s #1 e-signature solution as part of the DocuSign agreement platform, today announced results for its fiscal quarter ended July 31, 2022.

“We delivered solid Q2 results, with a strong finish to the first half of the year. These results reflect the focus and dedication of our team on execution during this transition period, with a stronger foundation in place to deliver in the second half of the year. We enter this next phase with a clear set of vital few deliverables for our people initiatives and product roadmap, while driving sustainable and profitable growth at scale,” said Maggie Wilderotter, DocuSign’s Interim CEO and Board Chair. “We have a $50 billion market opportunity, an industry leading digital agreement platform, strong market position, and an experienced leadership team. I have total confidence our team will successfully deliver for all stakeholders.”

Second Quarter Financial Highlights

- Total revenue was $622.2 million, an increase of 22% year-over-year. Subscription revenue was $605.2 million, an increase of 23% year-over-year. Professional services and other revenue was $17.0 million, a decrease of 11% year-over-year.

- Billings were $647.7 million, an increase of 9% year-over-year.

- GAAP gross margin was 78% for both periods. Non-GAAP gross margin was 82% for both periods.

- GAAP net loss per basic and diluted share was $0.22 on 201 million shares outstanding compared to $0.13 on 196 million shares outstanding in the same period last year.

- Non-GAAP net income per diluted share was $0.44 on 206 million shares outstanding compared to $0.47 on 208 million shares outstanding in the same period last year.

- Net cash provided by operating activities was $120.9 million compared to $177.7 million in the same period last year.

- Free cash flow was $105.5 million compared to $161.7 million in the same period last year.

- Cash, cash equivalents, restricted cash and investments were $1,129.6 million at the end of the quarter.

A reconciliation of GAAP to non-GAAP financial measures has been provided in the tables included in this press release. An explanation of these measures is also included below under the heading “Non-GAAP Financial Measures and Other Key Metrics.”

Operational and Other Financial Highlights

DocuSign Agreement Cloud 2022 Product Release 2. DocuSign announced new product capabilities, including:

- DocuSign eSignature. Introduced Shared Access, which allows a user to be granted permission to send or manage envelopes on another user’s behalf, and announced enhancements to Bulk Send and Agreement Actions.

- DocuSign eSignature App for Stripe. A new integration that allows account, finance and support teams to view eSignature agreements and Stripe payments side-by-side and launch new agreements right from their Stripe dashboards. Stripe users no longer need to go between the two platforms to complete transactions, support customers, or review transactions.

- DocuSign CLM. Introduced a new CLM Integration within Slack that enables customers to collaborate and move their agreements forward in a more streamlined way. CLM for Slack allows users to navigate the full agreement processes from redlining, to reviews and approvals, using our leading CLM solution without ever leaving the Slack platform. Other CLM enhancements include CLM AI-assisted data capture and a new integration with DocuSign CLM Connector for Coupa.

- DocuSign Notary. Introduced support for notaries seated in two additional U.S. states, New Jersey and Oregon, bringing the total number of states supported by DocuSign Notary to 25.

Outlook

The company currently expects the following guidance:

| • Quarter ending October 31, 2022 (in millions, except percentages): | |||

| Total revenue | $624 | to | $628 |

| Subscription revenue | $609 | to | $613 |

| Billings | $584 | to | $594 |

| Non-GAAP gross margin | 79 % | to | 81 % |

| Non-GAAP operating margin | 16 % | to | 18 % |

| Non-GAAP diluted weighted-average shares outstanding | 205 | to | 210 |

| • Year ending January 31, 2023 (in millions, except percentages): | |||

| Total revenue | $2,470 | to | $2,482 |

| Subscription revenue | $2,405 | to | $2,417 |

| Billings | $2,550 | to | $2,570 |

| Non-GAAP gross margin | 79 % | to | 81 % |

| Non-GAAP operating margin | 16 % | to | 18 % |

| Non-GAAP diluted weighted-average shares outstanding | 205 | to | 210 |

The company has not reconciled its guidance of non-GAAP financial measures to the corresponding GAAP measures because stock-based compensation expense cannot be reasonably calculated or predicted at this time. Accordingly, a reconciliation has not been provided.

DOCU 5 Day Chart

Breakout Alert!

Docusign is the 500LB gorilla in the electronic document signing vertical and that is not changing anytime soon. The stock is undervalued and took a beating with all other stocks in the massive sell off of 2022. Look for a massive bounce!

[thrive_leads id=’14274′]

(NASDAQ-SNDL) A Cannabis Stock Announces Intl Export!

On Wednesday September 14th SNDL Inc. (SNDL) a Cannabis Stock went Up due to the announcement of an in international export deal with Israel. However, it quickly fell through support. Was it a head fake? Is it the bottom and it’s ready to bounce? Keep reading to find out.

Before we do, remember to stop what you are doing and 👇 Sign up for our newsletter to get the latest breakout stocks and trending stocks!

[thrive_leads id=’14274′]

SNDL Inc. Company Information

Company Name: SNDL Inc.

Ticker: SNDL

Exchange: NASDAQ

Website: https://www.sndl.com/

Sundial Company Summary:

SNDL is the largest private sector liquor and cannabis retailer in Canada with retail banners that include Ace Liquor, Wine and Beyond, Liquor Depot, Value Buds, and Spiritleaf. SNDL is a licensed cannabis producer that uses state-of-the-art indoor facilities to supply wholesale and retail customers under a cannabis brand portfolio that includes Top Leaf, Sundial Cannabis, Palmetto, Spiritleaf Selects, and Grasslands. SNDL’s investment portfolio seeks to deploy strategic capital through direct and indirect investments and partnerships throughout the global cannabis industry.

Sundial stock price is due to News?

Sept. 15, 2022

Today announced that SNDL has completed its initial international export of approximately 167 kilograms of premium dried flower from Canada to Israel as part of its total commitment with IMC. SNDL and IMC have agreed to the aggregate export of 1,000 kilograms of high-quality dried flower products for processing and distribution in the Israeli medical cannabis market.

The expansion marks a significant milestone for SNDL as it enters the global market. “We are pleased with our partnership with IMC, one of Europe’s most established and trusted medical cannabis companies,” said Andrew Stordeur, President and Chief Operating Officer of SNDL. “SNDL plans to opportunistically expand the Company’s premium inhalables footprint to international cannabis markets, and this initial endeavour strengthens our pursuits in both established medical markets and emerging global recreational markets.”

For IMC, the completed export marks another major step forward in streamlining its expansive global operations that include Israel, Canada, and Germany. “The medical cannabis market in Israel has shifted towards premium and ultra-premium cannabis products. By forming an international partnership with SNDL, we are improving our global supply chain and enhancing our ability to provide the Israeli market with the high-quality products it has come to expect,” said Oren Shuster, Chief Executive Officer of IM Cannabis.

SNDL views the international market as an emerging opportunity to increase revenue from its cannabis operations. The Company is optimistic that an increasing number of global markets will refine regulations, allowing for lower-barrier access to high-quality cannabis products produced by trusted suppliers from Canada.

SNDL 5 Day Chart

#1 Cannabis PLAY!

The announcement Todaythat SNDL has completed its initial international export of approximately 167 kilograms of premium dried flower from Canada to Israel as part of its total commitment with IMC is a groundbreaking deal for the cannabis industry and for SNDL.

[thrive_leads id=’14274′]

(NASDAQ-OPEN) Stock Price Is Ready To Bounce?

On Monday September 12th Ilustrato Open Door Technologies (NASDAQ-OPEN) Stock Price went Up BIG and broke through a serious resistance point. However, it quickly fell through support. Was it a head fake? Is it the bottom and it’s ready to bounce? Keep reading to find out.

Before we do, remember to stop what you are doing and 👇 Sign up for our newsletter to get the latest breakout stocks and trending stocks!

[thrive_leads id=’14274′]

Open Door Technologies Company Information

Company Name: Open Door Technologies

Ticker: OPEN

Exchange: NASDAQ

Website: https://investor.opendoor.com.

Ilustrato Pictures Company Summary:

Selling a home can be full of uncertainty for many consumers who would rather focus on their next chapter than on the stresses of moving. Potential sellers on Zillow apps and sites may request and view an offer directly from Opendoor and easily compare it to an open-market sale using a real estate agent.

OPEN stock price is due to News?

Aug. 4, 2022

Zillow, Inc. (Nasdaq: Z and ZG) and Opendoor Technologies Inc. (Nasdaq: OPEN) have announced a multi-year partnership that combines two category leaders to transform how people start their move. The partnership will allow home sellers on the Zillow platform to seamlessly request an Opendoor offer to sell their home.

Selling a home can be full of uncertainty for many consumers who would rather focus on their next chapter than on the stresses of moving. Potential sellers on Zillow apps and sites may request and view an offer directly from Opendoor and easily compare it to an open-market sale using a real estate agent. Opendoor offers will be available on Zillow, and customers will be able to use the service as a standalone offering or package it with other Zillow home shopping services such as financing, closing and agent selection. Additionally, Zillow customers will be able to work with a licensed Zillow advisor who will serve as a helpful guide in understanding these options.

“Zillow is the most visited brand in online real estate. As we bring the housing super app to life, we’re empowering our millions of visitors to understand all their options and transact in the way that best meets their housing needs,” said Zillow Chief Operating Officer, Jeremy Wacksman. “We know choice is important for customers and they can make the best decision when they see all of their selling options up front — including selling on the open market with a Zillow Premier Agent partner and getting a cash offer from Opendoor. This exclusive partnership will pair Zillow’s audience and brand power with Opendoor’s selling solution in one easy place, so customers can evaluate their selling options and easily package it with other Zillow services to buy and finance their next home.”

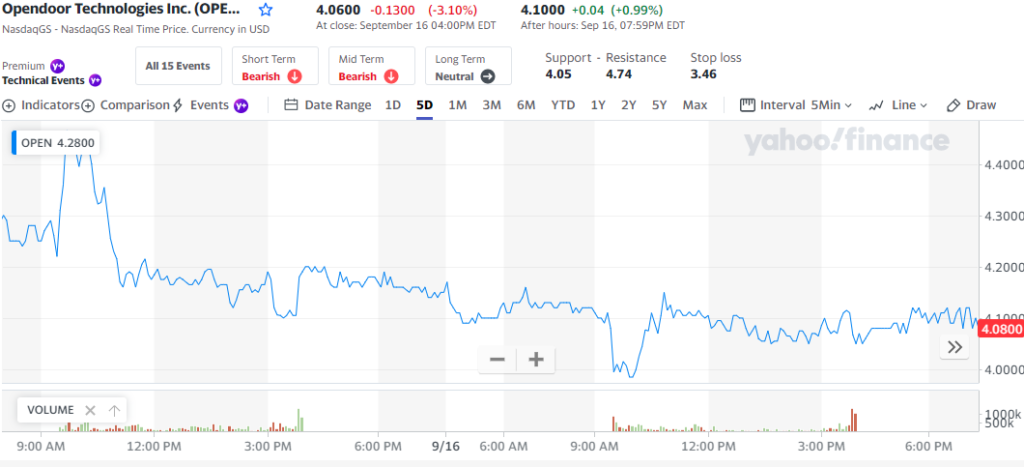

OPEN 5 Day Chart

Bounce Play, I think so, here is why!

OPEN is the amazon for real estate tech companies and it has been oversold and is greatly undervalued! I am excited for the future of this real estate darling and you should be too!

[thrive_leads id=’14274′]

Ilustrato Pictures ILUS Stock Price went Up BIG Monday but WHY?

On Monday September 12th Ilustrato Pictures ILUS Stock Price went Up BIG and in this article I am going to explain why!

Before we do, remember to stop what you are doing and 👇 Sign up for our newsletter to get the latest breakout stocks and trending stocks!

[thrive_leads id=’14274′]

Ilustrato Pictures Company Information

Company Name: Ilustrato Pictures International INc.

Ticker: ILUS

Exchange: OTC

Website: https://ilus-group.com/

Ilustrato Pictures Company Summary:

Ilustrato Pictures International, Inc. is an investment company, which focuses on acquiring businesses in the technology, engineering & manufacturing sector. The company was founded on April 27, 2010 and is headquartered in New York, NY.

ILUS stock price is due to News?

Sept. 15, 2022

With signed Letters of Intent to acquire two wildfire equipment manufacturers, and in line with upcoming subsidiary up list plans, the company is gearing up extensive manufacturing facilities for wildland firefighting equipment and specialist vehicles in Serbia.

In 2022, extreme wildfires have swept across huge swathes of land all over the world, destroying homes and threatening livelihoods. The frequency and severity of wildfires has increased and with globally increasing temperatures and an increased onslaught of droughts; the momentum is showing no signs of slowing. Some reports show that annually, wildfires cause as many as 400,000 global deaths, millions of injuries and billions in property and business costs. It is estimated that the cost of damage from wildfires is as much as 1-2% of GDP in some high-income countries.

ILUS’ emergency response subsidiary, Emergency Response Technologies (ERT), is rolling out acquisition and manufacturing plans which will soon make it the leading global wildland firefighting technology manufacturer and solution provider. As part of several acquisitions which are underway for the subsidiary, the company is in the process of completing the acquisition of two companies which specialize in the manufacture of wildland firefighting equipment. Both companies are already prominent wildfire equipment manufacturers and together, they hold the most extensive global distribution network.

Sept. 09, 2022

Given the substantial progress that has been made by the company in the third quarter, it recently confirmed that it will be making important announcements on the following milestones during the month of September 2022:

- Filing of its Form 10-12G Registration Statement with the U.S. Securities and Exchange Commission (the “SEC”)

- Investment Bank which the company is working with to complete its first planned subsidiary up list to a major stock exchange

- Announcement regarding planned Share lock-up and Share buy-back

- First site which the company is acquiring in Serbia and details on the Investment Project and its incentives

- $100m Revenue acquisition by the company’s industrial subsidiary, Quality Industrial Corp. (OTCQB: QIND)

- Further acquisitions which are in their final stages

In order to become fully reporting, change its name, and up list to the OTCQB, ILUS underwent the audit of its 2020 and 2021 financials, the completion of which was announced on the 30th of August 2022. ILUS is now in the final stages of preparing its Form 10-12G Registration Statement, which it expects to file during September 2022.

ILUS has been in talks with a major investment bank regarding the planned up-list of a subsidiary to a major stock exchange. During this month, the company will make an announcement confirming the investment bank and its associated plans. Linked to the investment bank confirmation, ILUS will make an announcement regarding its planned Share lock-up and Share buy-back.

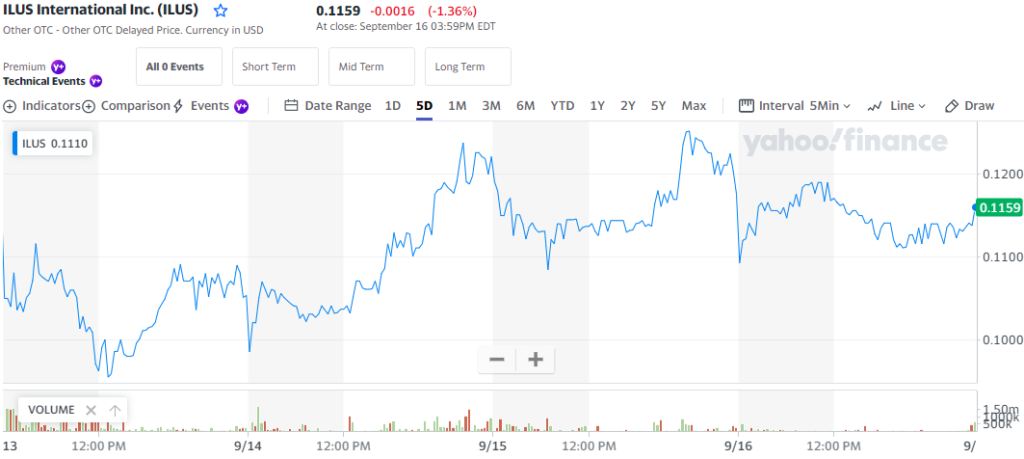

ILUS 5 Day Chart

6 Reasons Why ILUS Stock Price skyrocketed Monday, here is why!

- The Filing of its Form 10-12G Registration Statement with the U.S. Securities and Exchange Commission (the “SEC”) is a huge announcement and a key contributor to Mondays explosion and subsequent rally.

2. The up list to a major stock exchange is exciting and noteworthy.

3. Announcement regarding planned Share lock-up and Share buy-back is another planned objective which historically reaps PPS increases.

4. First site which the company is acquiring in Serbia and details on the Investment Project and its incentives is driving demand for the stock.

5. $100m Revenue acquisition by the company’s industrial subsidiary, Quality Industrial Corp. (OTCQB: QIND) never hurts!

6. Moreover, ILUS has further acquisitions which are in their final stages

[thrive_leads id=’14274′]