Grove Inc. GRVI Stock Price was predicted to “EXPLODE” did it? Explosive RESULTS

UPDATE: Let’s see how GRVI Stock Price Is Doing After My BOLD PREDICTION!

Before We get started here is the original ARTICLE

Grove Inc GRVI stock price is up 22% in the last 1 month since I wrote the article and it appears that it is just the start.

I will go over my perspective in detail in the this article, but don’t take my word for it!

Pull up the chart right now and I think you will agree.

So make sure you continue reading because it is pretty common that I deliver 100%++ gainers to our subscribers!

In this in depth report, I look at 5 KPIs: Technical Analysis, Volume, News Cycle, Fundamentals & Awareness Campaigns. I believe the stock market is not gambling, it is also not fool proof, but I have developed a dependable system.

I have found some critical components to success for GRVI that I will share below, tell me what you think.

Before we get started, I like being methodical and easy to understand so I have developed a ranking system for my stocks. I call it, Alexander Goldman’s “HOT Stock Ranking!”

The official heat level for GRVI is, a 3out of 4

Before I get ahead of myself and just jump right into this exciting breakout stock, I wanted to introduce myself.

Hello 🙋♂️ My name is Alexander Goldman. I have been trading small cap stocks, breakout stocks and trending stocks for 20 years now. I’m accredited for establishing the coveted HOT Stock Reporting system for breakout stocks.

To find out more about my story, CLICK HERE

[thrive_leads id=’28419′]

Grove Inc. Company Information

Company Name: Grove Inc.

Ticker: GRVI

Exchange: NASDAQ

Website: https://groveinc.io/

Grove Inc. Company Summary:

We started as a group of hemp enthusiasts, eager to spread the positive benefits associated with the use of CBD and hemp-based products. But our mission has always been to be innovators in wellness.

Our R&D team works tirelessly to provide people with brands they can trust, putting the customer first during every step of the process. From our stringent testing of each product to our competitive pricing, we believe in plant-based wellness for all and have curated our product line to benefit the needs of each individual person.

GRVI stock price is due to News?

May 18, 2022 (GLOBE NEWSWIRE via COMTEX) — HENDERSON, NV, May 18, 2022 (GLOBE NEWSWIRE) — via NewMediaWire – Grove Inc. (GRVI) SaaS Ad Tech Division, Interactive Offers issued a patent for a proprietary ad tracking system that provides complete transparency for advertisers and publishers.

Digital advertising has skyrocketed over the past couple years. “The average 2021 CPM was $15.30, up from an average 2020 CPM of $9.50, according to Measured. In the second half of 2021, average CPMs shot up to $17.60.” – Business Insider

Trending Stock GRVI 5 Day Chart

GRVI Stock Price HOT Stock Grade:

The official heat level for GRVI is, a 🔥🔥🔥3 out of 4 . My reasons are substantial, take a look below.

GRVI Trading Volume

The volume, is trading at an increase of 33% over the average which indicates a higher demand in the stock. 33% over average is very significant, but not the only KPI to look at when evaluating a small cap stock.

Trading 101: volume is measured in the number of shares traded. Traders look to volume to determine liquidity and combine changes in volume with technical indicators to make trading decisions. So, let’s take a look at the technical indicators.

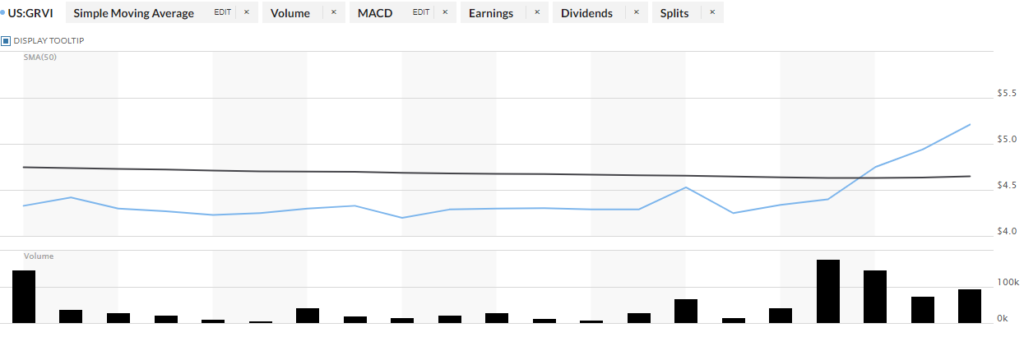

GRVI Technicals

The technical analysis “chart reading”, it is bullish and has been that way all year with a steady ascending channel. When reviewing the news it is not difficult to understand why this stock is such a value. Expect resistance at $5.60, be very careful as it approaches the three month high.

Look at the 3 Month Chart for GRVI!

Trading 101: Technical indicators are technical tools that help in analyzing the movement in the stock prices whether the ongoing trend is going to continue or reverse. It helps the traders to make entry and exit decisions of a particular stock. Technical indicators can be leading or lagging indicators.

GRVI News Cycle

The news, there is significant news, for example the “launch of a billboard campaign in 3 major cities throughout the nation aimed at driving submission traffic and awareness for Upexi, the company’s Amazon Brand Aggregator.”

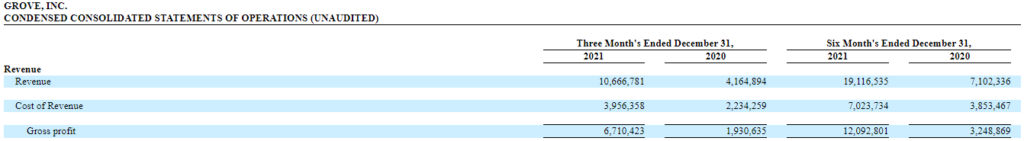

This news coupled with “Revenues rose to $19.1 million from $7.1 million, a 167% increase.”

All of the incredible news lately is playing a part in the spikes in volume and I believe the PPS price per share is in a trailing pattern and it will follow soon. If you think the technicals, news and volume looks good, it gets BETTER! Look at the financials on this Cinderella story!

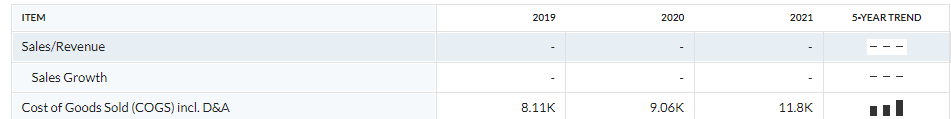

GRVI Fundamentals

The fundamentals, there is exciting financial filings associated with this stock, they are profitable, buying back shares and revenue is up over 160%!

Trading 101: Fundamental trading is a method where a trader focuses on company-specific events to determine which stock to buy and when to buy it. Trading on fundamentals is more closely associated with a buy-and-hold strategy rather than short-term trading.

GRVI Awareness, GRVI stock price is related to it!

Marketing efforts “Awareness Campaigns”, I have found significant marketing efforts around the investor awareness of this company. Hence the 4 out of 4. Do you agree? Write me a line at [email protected]

Again, two heads are better than one, let’s work together to have the best trading year of our lives! Do you believe GRVI stock price could go up?

To receive one more 🔥🔥🔥🔥 HOT stock as a thank you for joining our FREE newsletter, sign up today.

To find out more about my story, CLICK HERE

👇 Sign up for our newsletter to get the latest 🔥🔥🔥🔥 HOT stocks and we can compare notes!👇

[thrive_leads id=’28419′]

Alexander Goldman’s Disclaimer

I am not a certified financial consultant and have no license to give financial advice. The information found in this article is purely my opinion. Do not take my opinion as trading advice.

Small Cap Exclusive’s Disclaimer

Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation. We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).

We publish the Information on our website, smallcapexclusive.com and in newsletters, text message alerts, audio services, live interviews, featured “research” reports, on message boards and in email communications for specific time periods that are agreed upon between us and the Profiled Issuer and / or third party paying us. Our publication of the Information is known as a “Campaign”.

This information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart. Typically, the trading volume and PPS of a Profiled Issuer’s securities increases after the information is provided to the first group of investors. Therefore, the later an investor receives the Information, the more likely it is that he will suffer trading losses if they invest in the securities of a Profiled Issuer late in a Campaign. We are paid to advertise the Profiled Issuers, MIGI. Small Cap Exclusive has been hired by Awareness Consulting for a period beginning on April 7th, 2022 to publicly disseminate information about (MIGI) via website and email. We have been compensated $4,450 USD. We will update any changes to our compensation. Read FULL DISCLAIMER

AGRI Stock Price is on FIRE, can it go higher? Explosive Report

AgriFORCE Growing Systems AGRI stock price is up 89% in the last 5 days & volume is up 425%, but is it over for this breakout stock?

There is an old adage, “two heads are better than one”, so let’s collaborate on ECTM and compare notes.

In this in depth report, I look at 5 KPIs: Technical Analysis, Volume, News Cycle, Fundamentals & awareness campaigns. I believe the stock market is not gambling, it is also not fool proof, but I have developed a dependable system. I have found some critical components to success for AGRI, tell me what you think.

Before we get started, I like being methodical and easy to understand so I have developed a ranking system for my stocks. I call it, Alexander Goldman’s “HOT Stock Ranking!”

The official heat level for AGRI is, a 🔥🔥🔥 3 out of 4

Before I get ahead of myself and just jump right into this exciting breakout stock, I wanted to introduce myself.

Hello 🙋♂️ My name is Alexander Goldman. I have been trading small cap stocks, breakout stocks and trending stocks for 20 years now. I’m accredited for establishing the coveted HOT Stock Reporting system for breakout stocks.

To find out more about my story, CLICK HERE

[thrive_leads id=’28419′]

AgriFORCE Growing Systems Company Information

Company Name: AgriFORCE Growing Systems

Ticker: AGRI

Exchange: NASDAQ

Website: https://agriforcegs.com/

AgriFORCE Growing Systems Company Summary:

AgriFORCE Growing Systems Ltd. is an intellectual property and technology company. It sets to disrupt the horticultural facility and hydroponics industry. The company was founded on December 22, 2017 and is headquartered in Vancouver, Canada.

AGRI stock price is due to News?

May 18, 2022

Announced acquisition of the intellectual property of Manna Nutritional Group (MNG). The IP encompasses patent-pending technologies to naturally process and convert grain, pulses and root vegetables, resulting in low-starch, low-sugar, high-protein, fiber-rich baking flour products, as well as a wide range of breakfast cereals, juices, natural sweeteners and baking enhancers. The core process is covered under a pending patent application in the U.S. and key international markets.

Trending Stock AGRI 5 Day Chart

AGRI Stock Price HOT Stock Grade:

The official heat level for AGRI is, a 🔥🔥🔥 3 out of 4 . Here are my takeaways on it and why it is just a 3 out of 4. Do you agree?

AGRI Trading Volume

The volume, is trading at an increase of 425% over the average which indicates a higher demand in the stock.

Trading 101: volume is measured in the number of shares traded. Traders look to volume to determine liquidity and combine changes in volume with technical indicators to make trading decisions. So, let’s take a look at the technical indicators.

AGRI Technicals

The technical analysis “chart reading”, it is bullish and has been that way since the early part of this month with a steady ascending channel.

Trading 101: Technical indicators are technical tools that help in analyzing the movement in the stock prices whether the ongoing trend is going to continue or reverse. It helps the traders to make entry and exit decisions of a particular stock. Technical indicators can be leading or lagging indicators.

AGRI News Cycle

The news, there is significant news with the acquisition that is posted above. So far this company is doing everything right! The chart looks steady and not over bought, love it.!

AGRI

AGRI Fundamentals

The fundamentals, there is exciting financial filings associated with this stock, “265% growth”!

Trading 101: Fundamental trading is a method where a trader focuses on company-specific events to determine which stock to buy and when to buy it. Trading on fundamentals is more closely associated with a buy-and-hold strategy rather than short-term trading.

AGRI Awareness

Marketing efforts “Awareness Campaigns”, I have not found marketing efforts around the investor awareness of this company. Hence the 3 out of 4. Do you agree? Write me a line at [email protected]

Again, two heads are better than one, let’s work together to have the best trading year of our lives!

To receive my 🔥🔥🔥🔥 HOT stock as a thank you for joining our FREE newsletter, sign up today.

To find out more about my story, CLICK HERE

👇 Sign up for our newsletter to get the latest 🔥🔥🔥🔥 HOT stocks and we can compare notes!👇

[thrive_leads id=’28419′]