TC BioPharm TCBP Stock Price broke out, the set up is AMAZING! Pay ATTENTION!

TC BioPharm TCBP stock price is up today & volume is up 8%, this appears to be the bottom I have been waiting for. I am consequently, placing an immediate and elusive 4🔥 official heat level for TC BioPharm TCBP is, that is a 🔥🔥🔥 4 out of 4!

There is an old adage, “two heads are better than one”, so let’s collaborate on TCBP and compare notes.

In this in depth report, I look at 5 KPIs: Technical Analysis, Volume, News Cycle, Fundamentals & awareness campaigns. I believe the stock market is not gambling, it is also not fool proof, but I have developed a dependable system. I have found some critical components to success for TCBP, tell me what you think.

Before we get started, I like being methodical and easy to understand so I have developed a ranking system for my stocks. I call it, Alexander Goldman’s “HOT Stock Ranking!”

The official heat level for TCBP is, a 🔥🔥🔥🔥 4 out of 4

Before I get ahead of myself and just jump right into this exciting breakout stock, I wanted to introduce myself.

Hello 🙋♂️ My name is Alexander Goldman. I have been trading small cap stocks, breakout stocks and trending stocks for 20 years now. I’m accredited for establishing the coveted HOT Stock Reporting system for breakout stocks.

To find out more about my story, CLICK HERE

[thrive_leads id=’28419′]

TC BioPharm Company Information

Company Name: TC BioPharm Inc.

Ticker: TCBP

Exchange: NASDAQ

Website: https://www.tcbiopharm.com/

TC BioPharm Company Summary:

TC Biopharm (Holdings) Plc is a clinical-stage biopharmaceutical company, which engages in the development of novel immunotherapy products based on its proprietary allogeneic gamma delta T cell platform. The company was founded by Michael Leek and Angela Scott in 2013 and is headquartered in Motherwell, the United Kingdom.

TCBP stock price is due to News?

April 6, 2022

Announced that it has successfully registered the UK trademark “CryoTC®”, for the Company’s proprietary process for freezing and thawing of its lead oncology product, OmnImmune®.

CryoTR® is TC BioPharm’s unique process of cryopreservation, which is performed in a controlled rate freezer using an optimized protocol. OmnImmune® is an allogeneic unmodified cell therapy consisting of activated and expanded gamma delta T cells. OmnImmune® comprises GDT cells sourced from healthy donors, activated and expanded in large numbers before being purified formulated, and cryopreserved for subsequent thawing and infusion into patients.

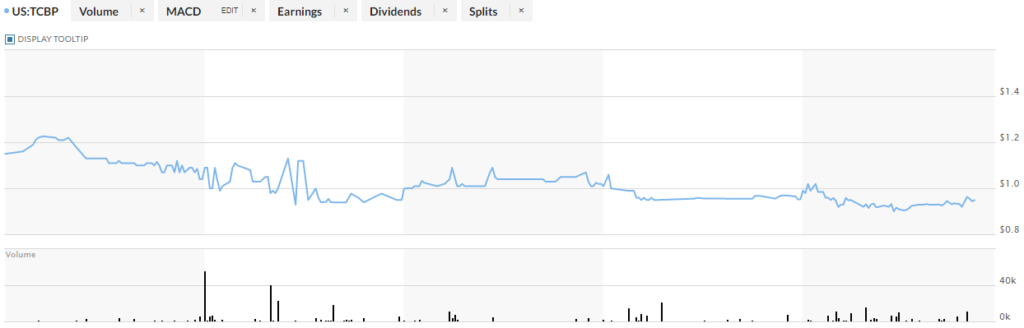

Trending Stock TCBP 5 Day Chart

TCBP Stock Price HOT Stock Grade:

The official heat level for ECTM is, a 🔥🔥🔥🔥 4 out of 4 . Here are my takeaways on it and why it is just a 3 out of 4. Do you agree?

TCBP Trading Volume

The volume, is trading at an increase of 8% over the average which indicates a higher demand in the stock. This is a great sign that trading activity is picking up, but we also don’t want to see 100%, 200% or even 400% increases in volume because that would mean the short term move is over.

I pride myself in determining moves before they happen! I believe, this may be the very situation wee are witnessing right now with TC BioPharm NASDAQ:TCBP. Pay attention!

Trading 101: volume is measured in the number of shares traded. Traders look to volume to determine liquidity and combine changes in volume with technical indicators to make trading decisions. So, let’s take a look at the technical indicators.

TCBP Technicals

The technical analysis “chart reading”, it is consolidated after a bearish move and now has broken out of the consolidation as you can see from the chart below.

That tap at $1.00 was significant as well as the resistance point at $.95 that was broken and is holding. Hence I am placing TCBP on an immediate 4 out 4 alert!

Trading 101: Technical indicators are technical tools that help in analyzing the movement in the stock prices whether the ongoing trend is going to continue or reverse. It helps the traders to make entry and exit decisions of a particular stock. Technical indicators can be leading or lagging indicators.

TCBP News Cycle

The news, there is significant news. The news, “Announced that it has successfully registered the UK trademark “CryoTC®”, for the Company’s proprietary process for freezing and thawing of its lead oncology product, OmnImmune®.” is huge! Cancer will be a $268 BILLION dollar industry by 2026. HERE

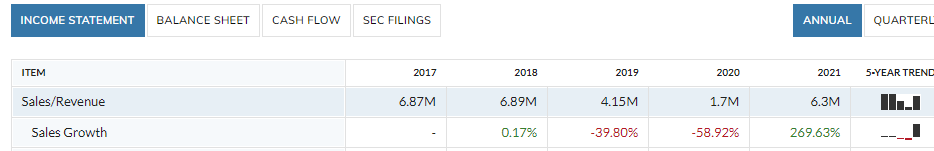

TCBP Fundamentals

The fundamentals, there is exciting financial filings associated with this stock, “265% growth”!

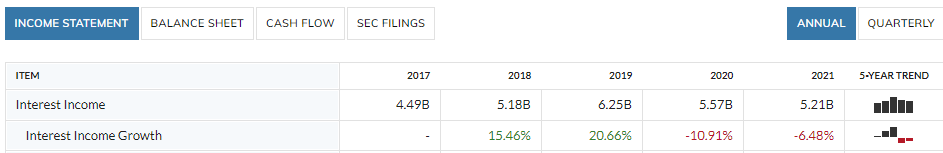

As you can see from the above screen shot from Market Watch HERE

The EBITDA has grown at 18%, that is STRONG!

Trading 101: Fundamental trading is a method where a trader focuses on company-specific events to determine which stock to buy and when to buy it. Trading on fundamentals is more closely associated with a buy-and-hold strategy rather than short-term trading.

TCBP Awareness

Marketing efforts “Awareness Campaigns”, I have found marketing efforts around the investor awareness of this company. Hence the 4 out of 4. Do you agree? Write me a line at [email protected]

Again, two heads are better than one, let’s work together to have the best trading year of our lives!

To receive my 🔥🔥🔥🔥 HOT stock as a thank you for joining our FREE newsletter, sign up today.

To find out more about my story, CLICK HERE

👇 Sign up for our newsletter to get the latest 🔥🔥🔥🔥 HOT stocks and we can compare notes!👇

[thrive_leads id=’28419′]

Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation. We have been compensated $4,000 for profiling TCBP. We own ZERO shares in TCBP. We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).

ECTM Stock Price is so consistent, can it go higher? Looks GREAT!

ECA Marcellus Trust ECTM stock price is up 17% in the last 5 days & volume is up 60%, but is it over for this breakout stock?

There is an old adage, “two heads are better than one”, so let’s collaborate on ECTM and compare notes.

In this in depth report, I look at 5 KPIs: Technical Analysis, Volume, News Cycle, Fundamentals & awareness campaigns. I believe the stock market is not gambling, it is also not fool proof, but I have developed a dependable system. I have found some critical components to success for ECTM, tell me what you think.

Before we get started, I like being methodical and easy to understand so I have developed a ranking system for my stocks. I call it, Alexander Goldman’s “HOT Stock Ranking!”

The official heat level for ECTM is, a 🔥🔥🔥 3 out of 4

Before I get ahead of myself and just jump right into this exciting breakout stock, I wanted to introduce myself.

Hello 🙋♂️ My name is Alexander Goldman. I have been trading small cap stocks, breakout stocks and trending stocks for 20 years now. I’m accredited for establishing the coveted HOT Stock Reporting system for breakout stocks.

To find out more about my story, CLICK HERE

[thrive_leads id=’28419′]

ECA Marcellus Trust Company Information

Company Name: ECA Marcellus Trust

Ticker: ECTM

Exchange: OTC

Website: http://ect.q4web.com/home/default.aspx

ECA Marcellus Trust Company Summary:

ECA Marcellus Trust I is a statutory trust. It owns royalty interest in producing wells and development wells. It also acquires horizontal natural gas development wells to be drilled to the Marcellus Shale formation. The company was founded in March 2010 and is headquartered in Houston, TX.

ECTM stock price is due to News?

March 24th

The Trust is a statutory trust created under the Delaware Statutory Trust Act. The Bank of New York Mellon Trust Company, N.A. serves as Trustee. The Trust does not conduct any operations or activities. The Trust’s purpose is, in general, to hold the Royalty Interests, to distribute to the Trust unitholders cash that the Trust receives in respect of the Royalty Interests after payment of Trust expenses, and to perform certain administrative functions in respect of the Royalty Interests and the Trust units. The Trustee has no authority or responsibility for, and no involvement with, any aspect of the oil and gas operations on the properties to which the Royalty Interests relate. The Trust derives all or substantially all of its income and cash flows from the Royalty Interests. The Trust is treated as a partnership for federal and state income tax purposes.

The Trust’s reserves and quarterly cash distributions are highly dependent upon the prices realized from the sale of natural gas. The markets for these commodities are volatile, as demonstrated by significant price swings experienced during 2020 and 2021, which were attributable primarily to the economic effects of the global outbreak of the novel form of coronavirus known as COVID-19.

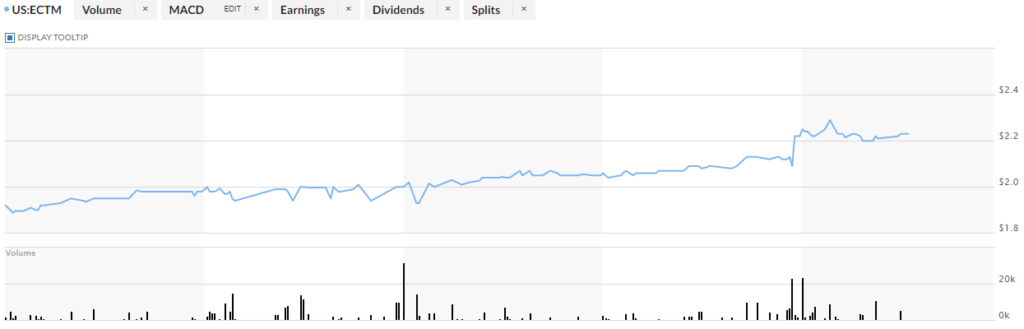

Trending Stock ECTM 5 Day Chart

ECTM Stock Price HOT Stock Grade:

The official heat level for ECTM is, a 🔥🔥🔥 3 out of 4 . Here are my takeaways on it and why it is just a 3 out of 4. Do you agree?

ECTM Trading Volume

The volume, is trading at an increase of 60% over the average which indicates a higher demand in the stock.

Trading 101: volume is measured in the number of shares traded. Traders look to volume to determine liquidity and combine changes in volume with technical indicators to make trading decisions. So, let’s take a look at the technical indicators.

ECTM Technicals

The technical analysis “chart reading”, it is bullish and has been that way since the early part of this month with a steady ascending channel. It looks fabulous still since my last article.

Trading 101: Technical indicators are technical tools that help in analyzing the movement in the stock prices whether the ongoing trend is going to continue or reverse. It helps the traders to make entry and exit decisions of a particular stock. Technical indicators can be leading or lagging indicators.

ECTM News Cycle

The news, there is no significant news.

ECTM Fundamentals

The fundamentals, there is exciting financial filings associated with this stock, “265% growth”!

Trading 101: Fundamental trading is a method where a trader focuses on company-specific events to determine which stock to buy and when to buy it. Trading on fundamentals is more closely associated with a buy-and-hold strategy rather than short-term trading.

ECTM Awareness

Marketing efforts “Awareness Campaigns”, I have not found marketing efforts around the investor awareness of this company. Hence the 3 out of 4. Do you agree? Write me a line at [email protected]

Again, two heads are better than one, let’s work together to have the best trading year of our lives!

To receive my 🔥🔥🔥🔥 HOT stock as a thank you for joining our FREE newsletter, sign up today.

To find out more about my story, CLICK HERE

👇 Sign up for our newsletter to get the latest 🔥🔥🔥🔥 HOT stocks and we can compare notes!👇

[thrive_leads id=’28419′]

PTPI Stock Price has plummeted, is it ready to bounce? URGENT

Petros Pharmaceuticals PTPI stock price is down –4% in the last 5 days & volume is up 7%, but is it over for this breakout stock?

In this in depth report, I look at 5 KPIs: Technical Analysis, Volume, News Cycle, Fundamentals & awareness campaigns.

Before we get started, I like being methodical and easy to understand so I have developed a ranking system for my stocks. I call it, Alexander Goldman’s “HOT Stock Ranking!”

The official heat level for PTPI is, a 🔥🔥2 out of 4

Before I get ahead of myself and just jump right into this exciting breakout stock, I wanted to introduce myself.

Hello 🙋♂️ My name is Alexander Goldman. I have been trading small cap stocks, breakout stocks and trending stocks for 20 years now. I established the coveted HOT Stock Reporting system.

To find out more about my story, CLICK HERE

[thrive_leads id=’28419′]

Petros Pharmaceuticals Company Information

Company Name: Petros Pharmaceuticals Inc

Ticker: PTPI

Exchange: NASDAQ

Website: https://www.petrospharma.com/

Petros Pharmaceuticals Company Summary:

Petros Pharmaceuticals, Inc. engages in men’s health therapeutics. It is involved in sales, marketing, regulatory and medical affairs, finance, trade relations, pharmacovigilance, market access relations, manufacturing, and distribution. It operates through the Prescription Medications and Medical Devices segments. The Prescription Medications segment handles Stendra, a FDA approved PDE-5 inhibitor prescription medication for the treatment of erectile dysfunction, and H100, a topical formulation candidate for the treatment of acute Peyronie’s disease. The Medical Devices segment consists of vacuum erection devices. The company was founded on May 14, 2020 and is headquartered in New York, NY.EBML stock price is due to News?

PTPI stock price is due to News?

- Announced the pursuit of the 505(b)(2) pathway for early stage asset, H-100 for the treatment of Peyronie’s Disease

- Initiated sponsored research agreement with Massachusetts General Hospital to evaluate incorporating the use of a tissue-specific oxygenation sensor with the goal of monitoring and understanding the success of Erectile Device Therapy.

- Reported positive results of a Phase 2 label comprehension study to initiate process for STENDRA(R) prescription erectile dysfunction medication to support the process for designation as over -the-counter treatment

- Engaged with celebrity physician, Dr. Drew Pinsky to provide patient education about erectile dysfunction and branded STENDRA messaging

- Announced an agreement with a leading U.S. based global contract manufacturer for STENDRA

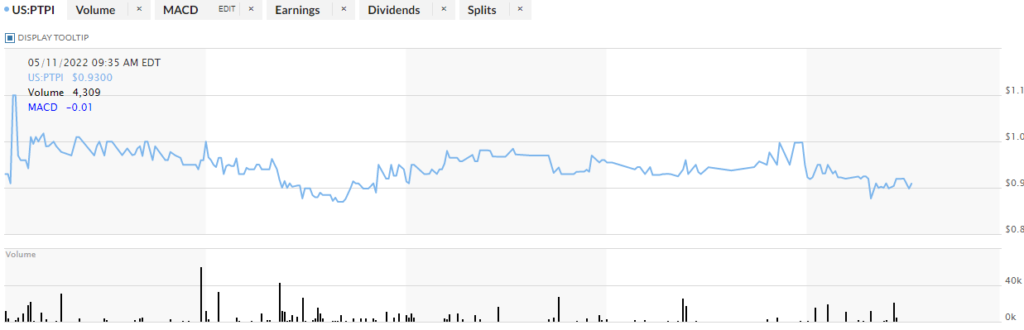

Trending Stock PTPI 5 Day Chart

PTPI Stock Price HOT Stock Grade:

PTPI is, a 🔥🔥2 out of 4 . Here are my takeaways on it and why it is just a 3 out of 4.

PTPI Trading Volume

The volume, the normal trading volume is established by the previous 30 days of trading and this stock is trading at an increase of 7% over the average. Normally, this indicates a higher demand in the stock or a sell off (selling pressure).

Trading 101: volume is measured in the number of shares traded. Traders look to volume to determine liquidity and combine changes in volume with technical indicators to make trading decisions. So, let’s take a look at the technical indicators.

PTPI Technicals

The technical analysis “chart reading”, this stock is down -3% on the 5 day chart and the overall trend for the long term chart, the 1 month, is down -31%. We are still waiting for the bottom. I imagine good news should be coming soon, pay attention and bookmark it.

Trading 101: Technical indicators are technical tools that help in analyzing the movement in the stock prices whether the ongoing trend is going to continue or reverse. It helps the traders to make entry and exit decisions of a particular stock. Technical indicators can be leading or lagging indicators.

PTPI News Cycle

The news, there is no significant news.

PTPI Fundamentals

The fundamentals, how a company is doing financially can be a serious KPI and there is no exciting financial filings associated with this stock.

Trading 101: Fundamental trading is a method where a trader focuses on company-specific events to determine which stock to buy and when to buy it. Trading on fundamentals is more closely associated with a buy-and-hold strategy rather than short-term trading.

PTPI Awareness

Marketing efforts “Awareness Campaigns” Just like advertising a prroduct is important, advertising a publicly traded company during a news cycle is critical for the stock price of a company.

I have found marketing efforts around the investor awareness of this company. So, I have awarded this stock a 2 out of 4. Do you agree? Write me a line at [email protected]

Again, two heads are better than one, let’s work together to have the best trading year of our lives!

To receive my 🔥🔥🔥🔥 HOT stock as a thank you for joining our FREE newsletter, sign up today.

To find out more about my story, CLICK HERE

👇 Sign up for our newsletter to get the latest 🔥🔥🔥🔥 HOT stocks and we can compare notes!👇

[thrive_leads id=’28419′]

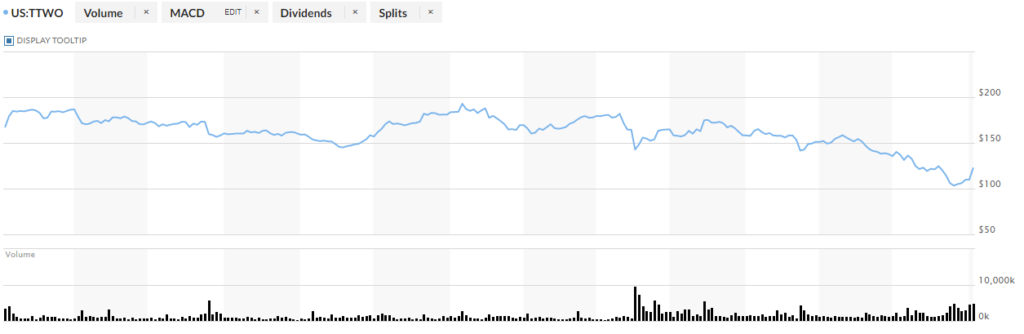

TTWO Stock Price is liquid, can it go higher? TIME-SENSITIVE ARTICLE

Take-Two Interactive Software TTWO stock price is up 18% in the last 5 days & volume is up 236%, but is it over for this breakout stock?

In this in depth report, I look at 5 KPIs: Technical Analysis, Volume, News Cycle, Fundamentals & awareness campaigns.

Before we get started, I like being methodical and easy to understand so I have developed a ranking system for my stocks. I call it, Alexander Goldman’s “HOT Stock Ranking!”

The official heat level for TTWO is, a 🔥🔥🔥 3 out of 4

Before I get ahead of myself and just jump right into this exciting breakout stock, I wanted to introduce myself.

Hello 🙋♂️ My name is Alexander Goldman. I have been trading small cap stocks, breakout stocks and trending stocks for 20 years now. I established the coveted HOT Stock Reporting system.

To find out more about my story, CLICK HERE

[thrive_leads id=’28419′]

Take-Two Interactive Software Company Information

Company Name: Take-Two Interactive Software

Ticker: TTWO

Exchange: NASDAQ

Website: https://www.take2games.com/

Take-Two Interactive Software Company Summary:

Take-Two Interactive Software, Inc. engages in the development, publishing, and marketing of interactive software games. Its products are designed for console systems, handheld gaming systems, and personal computers, including smart phones and tablets, and are delivered through physical retail, digital download, online platforms, and cloud streaming services. The company was founded by Ryan A. Brant in 1993 and is headquartered in New York, NY.

TTWO stock price is due to News?

May 16, 2022 at 4:05 p.m. ET0

GAAP net revenue increased 4% to $3.50 billion

GAAP net income per diluted share was $3.58

GAAP net cash provided by operating activities for the twelve-months ended March 31, 2022 was $258.0 million

Adjusted Unrestricted Operating Cash Flow (Non-GAAP) for the twelve-months ended March 31, 2022 was $424.9 million

Net Bookings were $3.41 billion

Trending Stock TTWO 5 Day Chart

TTWO Stock Price HOT Stock Grade:

TTWO is, a 🔥🔥🔥 3 out of 4 . Here are my takeaways on it and why it is just a 3 out of 4.

TTWO Trading Volume

The volume, the normal trading volume is established by the previous 30 days of trading and this stock is trading at an increase of 241% over the average. Normally, this indicates a higher demand in the stock or a sell off (selling pressure).

Trading 101: volume is measured in the number of shares traded. Traders look to volume to determine liquidity and combine changes in volume with technical indicators to make trading decisions. So, let’s take a look at the technical indicators.

TTWO Technicals

The technical analysis “chart reading”, this stock is up 18% on the 5 day chart and the overall trend for the long term chart, the 1 month, is down -12%. The great financial news is causing this stock to boounce!

Trading 101: Technical indicators are technical tools that help in analyzing the movement in the stock prices whether the ongoing trend is going to continue or reverse. It helps the traders to make entry and exit decisions of a particular stock. Technical indicators can be leading or lagging indicators.

TTWO News Cycle

The news, GAAP net revenue increased 4% to $3.50 billion is HUGE like Donald Trump would say!

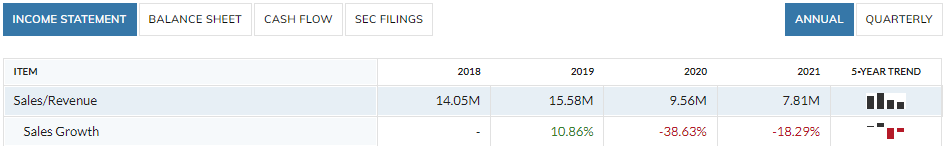

TTWO Fundamentals

The fundamentals, how a company is doing financially can be a serious KPI and there is no exciting financial filings associated with this stock.

Trading 101: Fundamental trading is a method where a trader focuses on company-specific events to determine which stock to buy and when to buy it. Trading on fundamentals is more closely associated with a buy-and-hold strategy rather than short-term trading.

TTWO Awareness

Marketing efforts “Awareness Campaigns” Just like advertising a prroduct is important, advertising a publicly traded company during a news cycle is critical for the stock price of a company.

I have found marketing efforts around the investor awareness of this company. So, I have awarded this stock a 3 out of 4. Do you agree? Write me a line at [email protected]

Again, two heads are better than one, let’s work together to have the best trading year of our lives!

To receive my 🔥🔥🔥🔥 HOT stock as a thank you for joining our FREE newsletter, sign up today.

To find out more about my story, CLICK HERE

👇 Sign up for our newsletter to get the latest 🔥🔥🔥🔥 HOT stocks and we can compare notes!👇

[thrive_leads id=’28419′]

GLBE Stock Price is bouncing, can it go higher? Exclusive Report

Global-E Online GLBE stock price is up 5% in the last 5 days & volume is up 861%, but is it over for this breakout stock?

In this in depth report, I look at 5 KPIs: Technical Analysis, Volume, News Cycle, Fundamentals & awareness campaigns.

Before we get started, I like being methodical and easy to understand so I have developed a ranking system for my stocks. I call it, Alexander Goldman’s “HOT Stock Ranking!”

The official heat level for GLBE is, a 🔥🔥🔥 3 out of 4

Before I get ahead of myself and just jump right into this exciting breakout stock, I wanted to introduce myself.

Hello 🙋♂️ My name is Alexander Goldman. I have been trading small cap stocks, breakout stocks and trending stocks for 20 years now. I established the coveted HOT Stock Reporting system.

To find out more about my story, CLICK HERE

[thrive_leads id=’28419′]

Global-E Online Company Information

Company Name: Global-E Online

Ticker: GLBE

Exchange: NASDAQ

Website: https://www.global-e.com/about/

Global-E Online Company Summary:

Global-e envisions a world where international ecommerce growth is both simple and profitable for retailers. By making selling globally as simple as selling locally, Global-e seeks to create a borderless ecommerce world, connecting shoppers and brands all over the world.

We pave the way for brands to expand globally with simplicity, breaking through the cross-border barriers that prevent international shoppers from purchasing, enabling retailers to sell to and from anywhere in the world, and global consumers to buy online seamlessly.

GLBE stock price is due to News?

- GMV1 in the first quarter of 2022 was $455 million, an increase of 71% year over year

- Revenue in the first quarter of 2022 was $76.3 million, an increase of 65% year over year, of which service fees revenue was $31.9 million and fulfillment services revenue was $44.4 million

- Non-GAAP gross profit2 in the first quarter of 2022 was $29.9 million, an increase of 94% year over year. GAAP gross profit in the first quarter of 2022 was $27.2 million

- Non-GAAP gross margin2 in the first quarter of 2022 was 39.1%, an increase of 580 basis points from 33.3% in the first quarter of 2021. GAAP gross margin in the first quarter of 2022 was 35.6%

- Adjusted EBITDA3 in the first quarter of 2022 was $3.3 million compared to $5.2 million in the first quarter of 2021

- Net loss in the first quarter of 2022 was $53.6 million

Trending Stock GLBE 5 Day Chart

GLBE Stock Price HOT Stock Grade:

GLBE is, a 🔥🔥🔥 3 out of 4 . Here are my takeaways on it and why it is just a 3 out of 4.

GLBE Trading Volume

The volume, the normal trading volume is established by the previous 30 days of trading and this stock is trading at an increase of 861% over the average. Normally, this indicates a higher demand in the stock or a sell off (selling pressure).

Trading 101: volume is measured in the number of shares traded. Traders look to volume to determine liquidity and combine changes in volume with technical indicators to make trading decisions. So, let’s take a look at the technical indicators.

GLBE Technicals

The technical analysis “chart reading”, this stock is up 5% on the 5 day chart and the overall trend for the long term chart, the 1 month, is up -32%. There has been a reversal but it has now been met with selling pressure at $20. If GLBE can not clear $20 easily, then I will avoid it.

Trading 101: Technical indicators are technical tools that help in analyzing the movement in the stock prices whether the ongoing trend is going to continue or reverse. It helps the traders to make entry and exit decisions of a particular stock. Technical indicators can be leading or lagging indicators.

GLBE News Cycle

The news, the revenue increase is amazing.

GLBE Fundamentals

The fundamentals, how a company is doing financially can be a serious KPI and there is no exciting financial filings associated with this stock.

GMV1 in the first quarter of 2022 was $455 million, an increase of 71% year over year

Revenue in the first quarter of 2022 was $76.3 million, an increase of 65% year over year, of which service fees revenue was $31.9 million and fulfillment services revenue was $44.4 million

Non-GAAP gross profit2 in the first quarter of 2022 was $29.9 million, an increase of 94% year over year. GAAP gross profit in the first quarter of 2022 was $27.2 million

Non-GAAP gross margin2 in the first quarter of 2022 was 39.1%, an increase of 580 basis points from 33.3% in the first quarter of 2021. GAAP gross margin in the first quarter of 2022 was 35.6%

Adjusted EBITDA3 in the first quarter of 2022 was $3.3 million compared to $5.2 million in the first quarter of 2021

Net loss in the first quarter of 2022 was $53.6 million

Trading 101: Fundamental trading is a method where a trader focuses on company-specific events to determine which stock to buy and when to buy it. Trading on fundamentals is more closely associated with a buy-and-hold strategy rather than short-term trading.

GLBE Awareness

Marketing efforts “Awareness Campaigns” Just like advertising a prroduct is important, advertising a publicly traded company during a news cycle is critical for the stock price of a company.

I have found marketing efforts around the investor awareness of this company. So, I have awarded this stock a 3 out of 4. Do you agree? Write me a line at [email protected]

Again, two heads are better than one, let’s work together to have the best trading year of our lives!

To receive my 🔥🔥🔥🔥 HOT stock as a thank you for joining our FREE newsletter, sign up today.

To find out more about my story, CLICK HERE

👇 Sign up for our newsletter to get the latest 🔥🔥🔥🔥 HOT stocks and we can compare notes!👇

[thrive_leads id=’28419′]

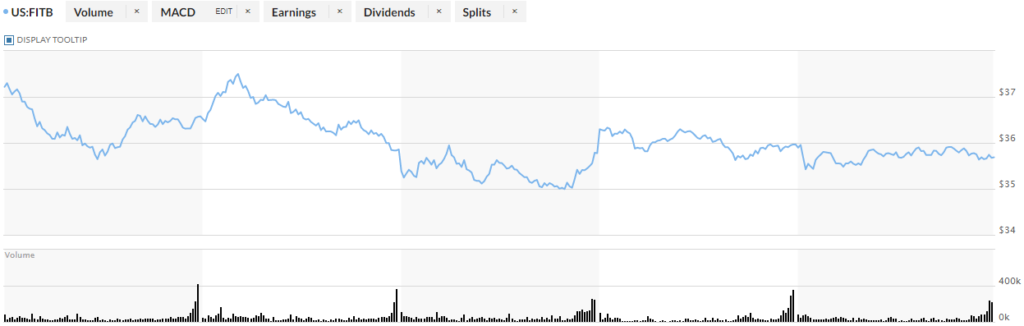

FITB Stock Price is liquid, can it go higher? URGENT ARTICLE

Fifth Third Bancorp FITB stock price is down -3% in the last 5 days & volume is up 81%, but is it over for this breakout stock?

In this in depth report, I look at 5 KPIs: Technical Analysis, Volume, News Cycle, Fundamentals & awareness campaigns.

Before we get started, I like being methodical and easy to understand so I have developed a ranking system for my stocks. I call it, Alexander Goldman’s “HOT Stock Ranking!”

The official heat level for FITB is, a 🔥🔥🔥 3 out of 4

Before I get ahead of myself and just jump right into this exciting breakout stock, I wanted to introduce myself.

Hello 🙋♂️ My name is Alexander Goldman. I have been trading small cap stocks, breakout stocks and trending stocks for 20 years now. I established the coveted HOT Stock Reporting system.

To find out more about my story, CLICK HERE

[thrive_leads id=’28419′]

Fifth Third Bancorp Company Information

Company Name: Fifth Third Bancorp

Ticker: FITB

Exchange: NASDAQ

Website: https://www.53.com/content/fifth-third/en.html

Fifth Third Bancorp Company Summary:

Fifth Third Bancorp engages in the provision of banking & financial services, retail & commercial banking, consumer lending services, and investment advisory services through its subsidiary Fifth Third Bank. It operates through the following segments: Commercial Banking, Branch Banking, Consumer Lending and Wealth & Asset Management.

The Commercial Banking segment offers credit intermediation, cash management, and financial services to large and middle-market businesses. The Branch Banking segment provides deposit, loan, and lease products to individuals and small businesses.

The Consumer Lending segment includes residential mortgage, home equity, automobile, and indirect lending activities. The Wealth & Asset Management segment provides investment alternatives for individuals, companies, and not-for-profit organizations. The company was founded in 1975 and is headquartered in Cincinnati, OH.

Fifth Third Bancorp FITB stock price is due to News?

May 11, 2022 /3BL Media/ – Fifth Third Bancorp (NASDAQ: FITB) today announced it has closed on the acquisition of Dividend Finance, a leading fintech point-of-sale (POS) lender, providing financing solutions for residential renewable energy and sustainability-focused home improvement.

“The addition of Dividend Finance enhances the scale of our digital service capabilities through its tech-forward platform, provides customers and contractors with a best-in-class experience, and accelerates customer adoption of solar and sustainable home improvements, which are even more compelling given rising energy prices,” said Tim Spence, president of Fifth Third Bancorp. “We expect to grow the Dividend platform significantly and further our ESG leadership position.”

Trending Stock FITB 5 Day Chart

FITB Stock Price HOT Stock Grade:

FITB is, a 🔥🔥🔥 3 out of 4 . Here are my takeaways on it and why it is just a 3 out of 4.

FITB Trading Volume

The volume, the normal trading volume is established by the previous 30 days of trading and this stock is trading at an increase of 946% over the average. Normally, this indicates a higher demand in the stock or a sell off (selling pressure).

Trading 101: volume is measured in the number of shares traded. Traders look to volume to determine liquidity and combine changes in volume with technical indicators to make trading decisions. So, let’s take a look at the technical indicators.

FITB Technicals

The technical analysis “chart reading”, this stock is up 0% on the 5 day chart and the overall trend for the long term chart, the 1 month, is down 10%. Not a lot of volatility with this stock. Overall it has just had a significant bearish move and I believe it will bounce soon.

Trading 101: Technical indicators are technical tools that help in analyzing the movement in the stock prices whether the ongoing trend is going to continue or reverse. It helps the traders to make entry and exit decisions of a particular stock. Technical indicators can be leading or lagging indicators.

FITB News Cycle

The acquisition of Dividend Finance, should bode very well for FITB..

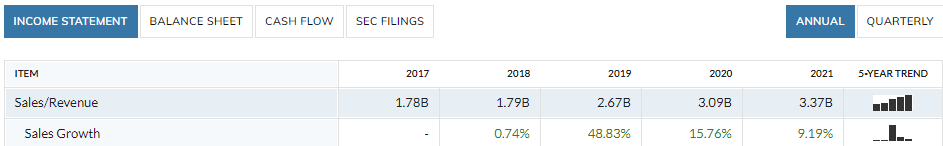

FITB Fundamentals

The fundamentals, how a company is doing financially can be a serious KPI and there no exciting financial filings associated with this stock in fact there has been two years of nominally down revenue years.

Trading 101: Fundamental trading is a method where a trader focuses on company-specific events to determine which stock to buy and when to buy it. Trading on fundamentals is more closely associated with a buy-and-hold strategy rather than short-term trading.

FITB Awareness

Marketing efforts “Awareness Campaigns” Just like advertising a prroduct is important, advertising a publicly traded company during a news cycle is critical for the stock price of a company.

I have found marketing efforts around the investor awareness of this company. So, I have awarded this stock a 3 out of 4. Do you agree? Write me a line at [email protected]

Again, two heads are better than one, let’s work together to have the best trading year of our lives!

To receive my 🔥🔥🔥🔥 HOT stock as a thank you for joining our FREE newsletter, sign up today.

To find out more about my story, CLICK HERE

👇 Sign up for our newsletter to get the latest 🔥🔥🔥🔥 HOT stocks and we can compare notes!👇

[thrive_leads id=’28419′]