Exicure XCUR has been on fire lately, up almost 50% in 5 days after a massive amount of volume being injected into this little well known stock. The stock has been crashing for the last 6 months. I have written a full report on XCUR that you can read below.

However, before you read this insightful information, sign up below, let’s stay in contact.

Exicure XCUR has some very bad press, check it out “UPCOMING DEADLINE ALERT: The Schall Law Firm Encourages Investors in Exicure, Inc. with Losses of $100,000 to Contact the Firm” Before we get started, let’s review some basic information on this company.

Exicure XCUR Company Summary

Company Name: LimitExicure

Ticker: XCUR

Exchange: NASDAQ

Exicure, Inc. Company Summary

Exicure, Inc. is a development-stage biotechnology company developing therapeutics for neurology and rare genetic disorders based on its proprietary spherical nucleic acid (SNA™) technology. Exicure’s proprietary SNA architecture is designed to unlock the potential of therapeutic oligonucleotides in a wide range of cells and tissues. Exicure’s lead programs address neuroscience diseases and genetic disorders. Exicure is based in Chicago, IL.

SNA constructs overcome one of the most difficult obstacles to nucleic acid therapeutics: safe and effective delivery into cells and tissues. SNA constructs exhibit unparalleled transfection efficiency into numerous cell and tissue types, including the skin, without carriers or transfection agents.

SNA™ technology originated in the lab of Professor Chad A. Mirkin at the Northwestern University International Institute for Nanotechnology.

XCUR News

NEW YORK, NY / ACCESSWIRE / December 16, 2021 / Bronstein, Gewirtz & Grossman, LLC notifies investors that a class action lawsuit has been filed against Exicure, Inc. (“Exicure” or the “Company”) (NASDAQ:XCUR) and certain of its officers, on behalf of shareholders who purchased or otherwise acquired Exicure securities between March 11, 2021 and November 15, 2021, inclusive (the “Class Period”).

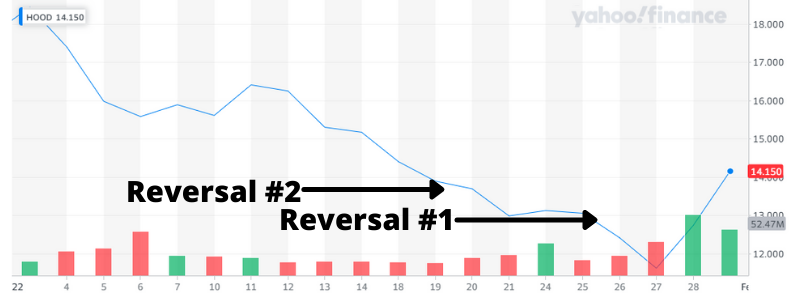

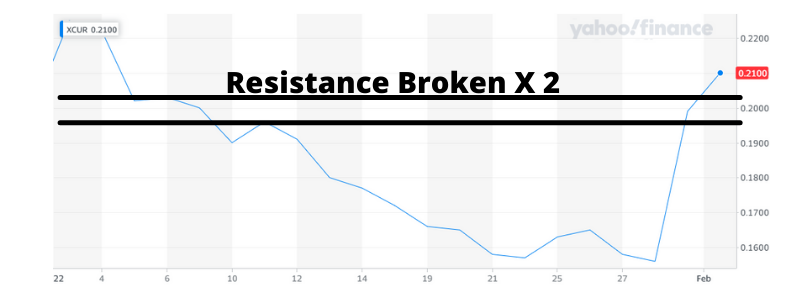

XCUR 1 Month Chart

XCUR Technical Analysis

Why stocks go up baffles me, but this one has broken two resistance points and looks strong and BULLISH. I think its worth putting on your watchlist.

Remember, to never try and catch a falling safe, or a knife for that matter. Simply let it fall to the ground, walk over, and pick up the money and walk away. If you enjoyed this article, sign up below, I promise I will never spam you and I’m pretty darn good at picking winners. Let’s make some trades together!