Wynn Macau WYNMF explode Friday!

Wynn Macau WYNMF is up big after positive news in regard to Covid that has been making the stock crashing for over the last 12 months. I have written a full report on on WYNMF that you can read below.

However, before you read this insightful information, sign up below, let’s stay in contact.

Wynn Macau announced as the government of the world’s largest gambling hub retained the limit on casino licences to six. However, before we get started, let’s review some basic information on this company.

Wynn Macau WYNMF Company Summary

Company Name: Wynn Macau

Ticker: WYNMF

Exchange: OTC

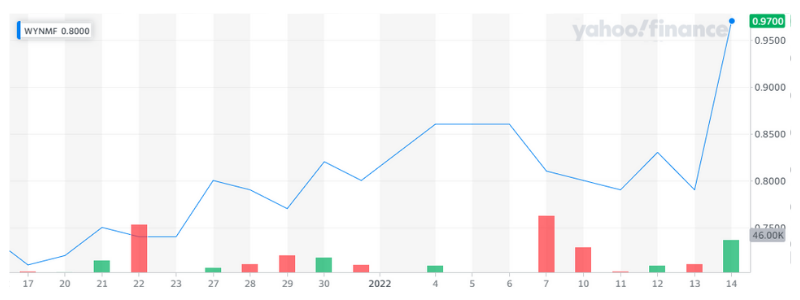

WYNMF 1 Month Chart

Wynn Macau Technical Analysis

Wynn Macau announced as the government of the world’s largest gambling hub retained the limit on casino licences to six. Keeping the market competition exactly where it is so they can continue it’s domination. HERE

The stock has hit a 1 month high and has reversed it’s bearish trend, keep an eye on it.

Remember, to never try and catch a falling safe, or a knife for that matter. Simply let it fall to the ground, walk over, and pick up the money and walk away. If you enjoyed this article, sign up below, I promise I will never spam you and I’m pretty darn good at picking winners. Let’s make some trades together!

Sands China SCHYF had a great month, what’s next?

Sands China SCHYF is up 32% over the last month. I have written a full report on SCHYF that you can read below.

However, before you read this insightful information, sign up below, let’s stay in contact.

Sands China announced last month, “The Venetian® Macao Thursday, where they built 20,000 hygiene kits for Clean the World” However, before we get started, let’s review some basic information on this company.

Sands SCHYF Company Summary

Company Name: Sands China Ltd.

Ticker: SCHYF

Exchange: OTC

Website: www.sandschina.com.

Sands China Company Summary

Sands China Ltd. (Sands China or the Company) is incorporated in the Cayman Islands with limited liability and is listed on The Stock Exchange of Hong Kong Limited (HKEx: 1928).

Sands China is the largest operator of integrated resorts in Macao. The Company’s integrated resorts on the Cotai Strip comprise The Venetian® Macao, The Plaza® Macao, The Parisian Macao and The Londoner® Macao. The Company also owns and operates Sands® Macao on the Macao peninsula.

The Company’s portfolio features a diversified mix of leisure and business attractions and transportation operations, including large meeting and convention facilities; a wide range of restaurants; shopping malls; world-class entertainment at the Cotai Arena, The Venetian Theatre, The Parisian Theatre, the Londoner Theatre and the Sands Theatre; and a high-speed Cotai Water Jet ferry service between Hong Kong and Macao.

The Company’s Cotai Strip portfolio has the goal of contributing to Macao’s transformation into a world centre of tourism and leisure. Sands China is a subsidiary of global resort developer Las Vegas Sands Corp. (NYSE: LVS).

SCHYF News

Dec. 16, 2021

Got together with volunteers from two local community groups at The Venetian® Macao Thursday, where they built 20,000 hygiene kits for Clean the World, an international social enterprise that provides hygiene supplies essential for good health to populations in need around the globe, helping prevent the spread of disease.

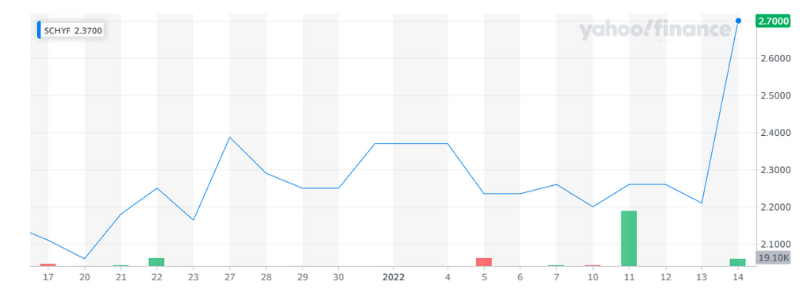

SCHYF 1 Month Chart

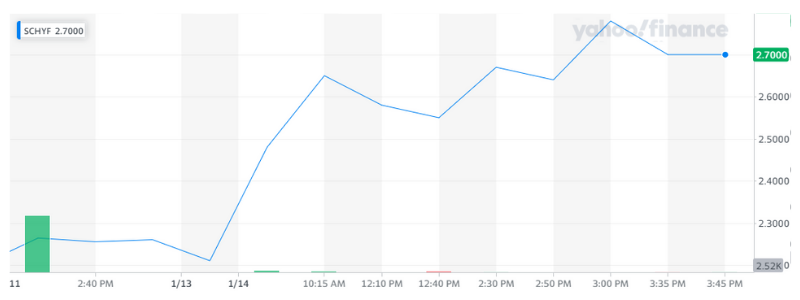

Sands China 5 Day Chart

SCHYF Technical Analysis

Remember, to never try and catch a falling safe, or a knife for that matter. Simply let it fall to the ground, walk over, and pick up the money and walk away. If you enjoyed this article, sign up below, I promise I will never spam you and I’m pretty darn good at picking winners. Let’s make some trades together!

Canada Cannabis Stocks

Canada Cannabis Stocks could take off with the news that marijuana could protect humans from Covid-19. Let’s take a look at 3 Canadian stocks that should be on every traders radar.

Aurora Cannabis (NASDAQ: ACB)

The $2 billion Aurora Cannabis ACB in recent quarters it has been putting up attractive growth numbers with medical cannabis. In its last fiscal quarter medical cannabis revenue rose 42% year over year, as its international medical cannabis sales boosted growth, soaring 562%.

Aurora’s consumer division is growing too, rising 25% last quarter compared to the same period in the previous year. That division is responsible for things like vapes, edibles and concentrates directly to the customer.

Canada Cannabis Stocks such as ACB are really looking good.

Canopy Growth Corporation (NASDAQ:CGC)

The largest of the Canadian cannabis stocks, Canopy Growth CGC is worth more than $12 billion.

CGC owns several different brands, and it doesn’t just sell marijuana: the company sells CBD, oil, concentrates and capsules.

CGC established operations and distribution network could serve them well upon a move intothe US market. CGC is just waiting for more favorable regulations.

Canada Cannabis Stocks such as Canopy Growth Corporation should be placed on your watchlist.

Cronos Group (NASDAQ:CRON)

Cronos Group CRON reported the highest revenue growth of any major Canadian cannabis stock last quarter, 133% in the fourth quarter of 2020.

Growth was driven by blockbuster expansion in non-U.S. markets, where sales nearly tripled, going from $4.6 million to $13.5 million year over year.

While growth rates this high are certainly hard to find, CRON stock is by no means priced cheaply, with its $3.65 billion market cap representing a price-sales ratio of about 75.

Canada Cannabis Stocks are on the rise, make sure you follow Cronos Group CRON, Canopy Growth CGC & Aurora Cannabis ACB.

DatChat DATS is About to Breakout?

DatChat DATS is at a 52 week low and it could be ready to explode! I have written a full report on DATS that you can read below.

However, before you read this insightful information, sign up below, let’s stay in contact.

[thrive_leads id=’9979′]

DATS announced this month, “the appointment of Mark Mathis as its first Chief Blockchain Architect” However, before we get started, let’s review some basic information on this company.

DatChat, Inc. Company Summary

Company Name: DatChat, Inc.

Ticker: DATS

Exchange: NASDAQ

Website: https://www.datchat.com/

DatChat, Inc. Company Summary

DatChat Inc. is a blockchain, cybersecurity, and social media Company that not only focuses on protecting privacy on personal devices, but also protects user information after it is shared with others.

The DatChat Messenger & Private Social Network presents technology that allows users to change how long their messages can be viewed before or after users send them, prevents screenshots, and hides encrypted photos in plain sight on camera rolls.

DatChat’s patented technology offers users a traditional texting experience while providing control and security for their messages. With DatChat Messenger, a user can decide how long their messages last on a recipient’s device, while feeling secure that, at any time, they can delete individual messages or entire message threads, making it like the conversation never happened.

DATS News

Jan. 03, 2022

Announced the appointment of Mark Mathis as its first Chief Blockchain Architect. The Chief Blockchain Architect position will focus on aligning the Company’s strategic initiatives with the increasing adoption of blockchain technology primarily through development and integration within the DatChat ecosystem. HERE

Nov. 30, 2021

Announced the release of the Nirad Points Rewards Program (NRD), with the first 1 million users receiving 10,000 NRD Points. HERE

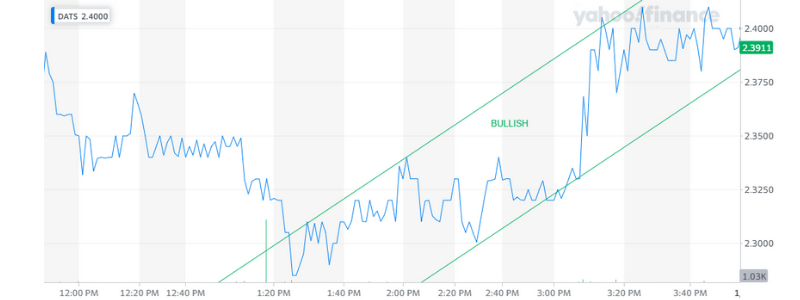

DATS 1 Day Chart

DatChat Technical Analysis

| Good Afternoon Investors,

DatChat DATS has reversed trend and is looking great! (DATS) trades on the NASDAQ, so there may be some pre-market activity which could possibly create a potential buying frenzy at the opening bell.You see, a NASDAQ alert provides investors and traders with the added benefit of being able to trade even before the bell rings. Some traders are in and out pre-market, and go back to sleep before everyone else even wakes up. Like last weeks NASDAQ alert “Mainz Biomed (MYNZ)”… When I alerted (MYNZ) after hours on Tuesday Jan 4th, it was trading at approx. $10.39… The following morning, shortly after 7AM ET, (MYNZ) started to gain some serious momentum, running and hitting a pre-market high of $21.41 showing early traders a quick +106.00% in gains… Basically, a quick double. All before the opening bell even rang… But this next pick (DATS) could potentially be even bigger than (MYNZ)A lot bigger… Now, we are turning our full attention to DatChat Inc. (DATS) and like (MYNZ)…DatChat Inc. (DATS) is also listed on the NASDAQ. However, there is something a little different about this one…Something “Special” if you will…And this is what I was alluding to earlier in this report.You see… we could be looking at a “Special Situation” with (DATS).And more specifically, what I mean is, we could be looking at the beginning of a “Short Squeeze.” Keep reading to see exactly what I mean. |

| Now according to MarketWatch.com, there are only 13.82M shares available in the public float for DatChat, Inc. (DATS)….with a market cap of less than $53M…Yahoo Finance reports that Company Insiders still own 25.53% of (DATS) shares… with another 4.79% owned by Institutions including Wall Street powerhouses like Morgan Stanley, Blackrock, and UBS…

Combine this with the big spike in “Short-Interest” this week and we could be looking at the makings of a massive potential “Short Squeeze” that potentially could send shares of (DATS) soaring to higher levels. Remember, to never try and catch a falling safe, or a knife for that matter. Simply let it fall to the ground, walk over, and pick up the money and walk away. If you enjoyed this article, sign up below, I promise I will never spam you and I’m pretty darn good at picking winners. Let’s make some trades together! [thrive_leads id=’9979′] |