Eastman Kodak Company NYSE: KODK outlook

Eastman Kodak Company NYSE: KODK is a stallworth in American business but lately they have been struggling mightily. Could this be a reversal?

Company Name: Eastman Kodak Company

Ticker: NYSE: KODK

Exchange: NYSE

Website: https://www.kodak.com/en

Company Summary:

Kodak is a global technology company focused on print and advanced materials & chemicals. We provide industry-leading hardware, software, consumables and services primarily to customers in commercial print, packaging, publishing, manufacturing and entertainment.

We are committed to environmental stewardship and ongoing leadership in developing sustainable solutions. Our broad portfolio of superior products, responsive support and world-class R&D make Kodak solutions a smart investment for customers looking to improve their profitability and drive growth.

Why has it gone down?

Marketwatch recently wrote the following, “Some business executives have profited handsomely from the practice of earning “spring-loaded” stock options that take advantage of information not available to the public, but U.S. regulators on Monday announced plans to put a stop to it.

The Securities and Exchange Commission issued new guidance for companies on how to reflect the potential value of spring-loaded options when they disclose how much top executives actually earn.

Spring-loaded awards are a type of compensation in which a company grants stock options shortly before it announces market-moving information, such as an stronger-than-expected earnings release or disclosure of important transactions. The options have the potential to soar in value once the news is made public.”

6 month Chart

5 Day Chart

Eastman Kodak Company NYSE: KODK Technical Analysis:

Can KODK stay above $4.80, and perhaps consolidate there after it’s little run and reversal? If so, that would be a decent signal. The other option is that it continues the slide it did at the end of today and trades in between $4.70 and $4.85 and consolidates there.

The other two options are: Bullish move or a continued bearish trend. A double confirmation of a reversal would be the stock sliding past $5.00 PPS. That would be a buy signal in my opinion.

Falling below $4.55 is a clear sign that KODK is continuing a bearish trend.

AMMO Incorporated POWW bottom play?

AMMO Incorporated POWW could be entering into a bottom but there is no definitive reversal yet. Let’s take a closer look at this ammunition manufacturer.

Let’s look at the general information AMMO Incorporated POWW

Company Name: AMMO, Inc.

Ticker: POWW

Exchange: NASDAQ

Website: www.ammo-inc.com & www.gunbroker.com.

AMMO Incorporated POWW Summary:

With its corporate offices headquartered in Scottsdale, Arizona. AMMO designs and manufactures products for a variety of aptitudes, including law enforcement, military, sport shooting and self-defense. The Company was founded in 2016 with a vision to change, innovate and invigorate the complacent munitions industry. AMMO promotes branded munitions as well as its patented STREAK™ Visual Ammunition, /stelTH/™ subsonic munitions, and armor piercing rounds for military use.

GunBroker.com is the largest online marketplace dedicated to firearms, hunting, shooting and related products. Aside from merchandise bearing its logo, GunBroker.com currently sells none of the items listed on its website. Third-party sellers list items on the site and Federal and state laws govern the sale of firearms and other restricted items. Ownership policies and regulations are followed using licensed firearms dealers as transfer agents. Launched in 1999, GunBroker.com is an informative, secure and safe way to buy and sell firearms, ammunition, air guns, archery equipment, knives and swords, firearms accessories and hunting/shooting gear online.

What is the news lately?

Dec. 21, 2021 They announced the manufacturing of a new plant with some drone footage HERE

Nov. 19, 2021 AMMO, Inc. is pleased to announce that the holders of record of the Company’s 8.75% Series A Cumulative Redeemable Perpetual Preferred Stock (the “Series A Preferred Stock”) as of the close of business on November 30, 2021 will receive a cash dividend equal to $1.01475694444444 per Series A Preferred Stock share. The cash dividend will be paid on December 15, 2021.

3 Month Chart for AMMO Incorporated POWW

1 Day Chart for POWW

POWW Technical Analysis:

POWW is 100% BEARISH in the 3 month chart with nothing really good to say. In regards to the 1 day chart it isn’t looking much better. It fell below support and revealed a reversal from bullish to bearish.

My opinion is that this stock will continue for a while in this bearish trend until we have good news. By the way, more news is coming tomorrow for the end of the year Q4 financials.

Therefore, if the news is positive, then I would wait for a confirmation of a reversal at the $5.50 PPS.

TAL Education Group Analysis

TAL Education Group bounces from here? Let’s take a close look.

Company Name: TAL Education Group TAL

Ticker: TAL

Exchange: NYSE

Website: https://en.100tal.com/

Company Summary:

Tomorrow Advancing Life (NYSE: TAL) is an educational technology company dedicated to supporting public and private education across the world and exploring new education models for the future with smart education tools and open platforms featuring well-rounded development and extracurricular learning.

Tal News

Bloomberg states, “Chinese companies listed in the U.S. rebounded Thursday after a five-day slump as investors piled back into stocks hurt by Beijing’s crackdown this year.

The Nasdaq Golden Dragon China Index jumped as much as 10%, its biggest intraday gain since at least 2012, putting the gauge on pace for its largest climb since 2008. Alibaba Group Holding, Tal Education Group and Vipshop Holdings Ltd. were among some of the best performers Thursday with each rallying at least 9.7%. The article can be found HERE

Also, Investors Observer released news two days ago in regards to “TAL Education Group (TAL) is around the top of the Education & Training Services industry according to InvestorsObserver. TAL received an overall rating of 42, which means that it scores higher than 42 percent of all stocks.

TAL Education Group also achieved a score of 73 in the Education & Training Services industry, putting it above 73 percent of Education & Training Services stocks. Education & Training Services is ranked 125 out of the 148 industries.” The article can be found HERE

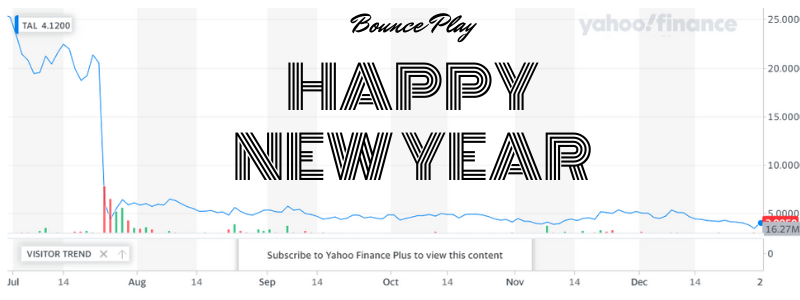

TAL 6 month chart

TAL Education Group TAL 5 day chart

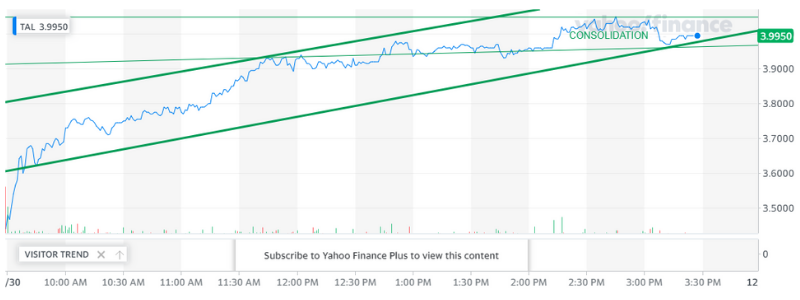

Tomorrow Advancing Life (NYSE: TAL) 1 day chart

Tomorrow Advancing Life (NYSE: TAL) Technical Analysis:

TAL is a very interesting play. If you look at the overall Chinese sector it is a very good time to invest in Chinese stocks. The government announced tax incentives that should bolster the strength of the publicly traded companies.

A technical analysis in the 6 month chart shows that this is most definitely a bottom play.

The 5 day chart reveals that the trend has reversed but is showing difficulty with a double confirmation at the $4.00 PPS. The 1 day chart shows a strong bullish move and then consolidation with an end of the day slight bearish move to be watched.

Overall, I like the stock! My only concern in the short term is a bearish break from the consolidation pattern. If I was to invest in this company, I would once it breaks $4.00 with ease.