Asensus Surgical (ASXC) stock Makes A Stunning Comeback: What Now?

When a stock gets a favourable rating from analysts then it almost always leads to gains in the stock and that is what seemed to have happened with the Asensus Surgical (NYSEAMERICAN:ASXC) stock on Wednesday.

The stock is back in favour among many penny stocks investors and yesterday it clocked gains of as much as 23%. The firm H.C. Wainwright started covering the stock and gave the stock a buy rating. In this regard, it should be noted that the latest rating was done not even two weeks after the company announced its financial results for the first quarter.

In the three month period ended on March 31, 2021, Asensus managed to generate revenues of as much as $2.1 million, which was a considerable jump from the $600000 it generated in revenues in the prior year period.

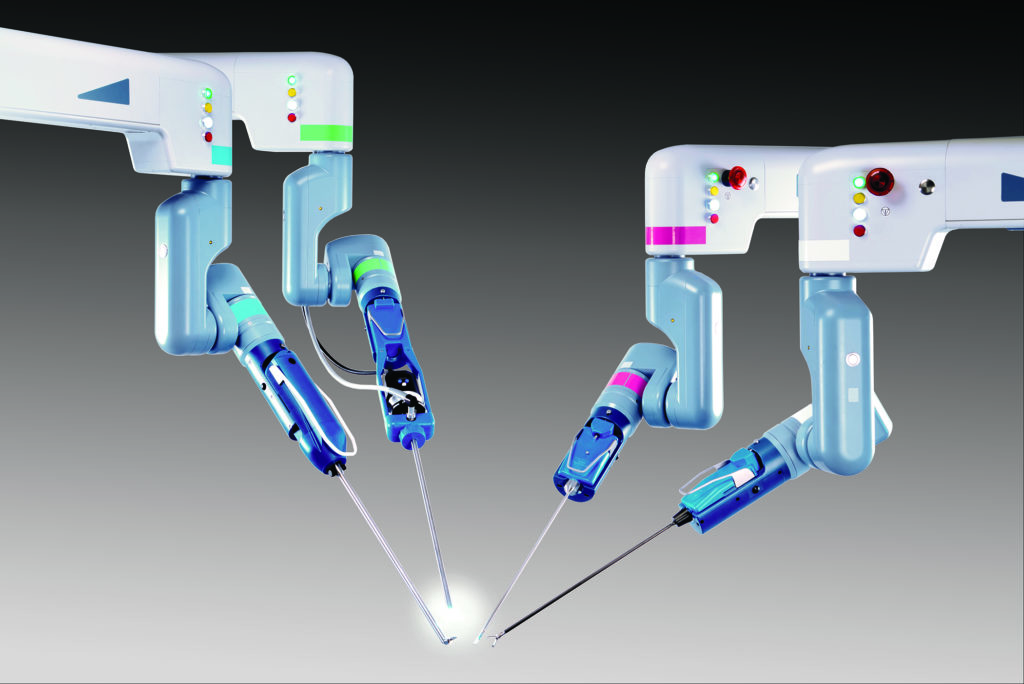

It should also be noted that as much as $1.3 million out of the total revenue was generated through the sales of Asensus Surgical’s Senhance Surgical System. Hence, the latest bullish sentiment from the analysts at H.C. Wainwright has not come as a complete surprise. It is now going to be interesting to see if the Asensus stock can continue to hold on to the momentum that it has managed to gain this week.

The company has become an important player in surgical instruments space and has developed devices that provide greater control as well as minimum variability. Asensus aims to combine the powers of machine learning and automated intelligence in order to improve the outcomes from surgeries.

Moreover, it is also necessary to point out that for more than a year, the stock has had a remarkable run. After hovering around the 33 cents market around a year ago, the stock soared to 63 cents by the end of 2020. At the beginning of 2021, the Asensus stock had another remarkable rally and touched $6.95 in February. It corrected after that but now the stock seems to be readying for another run.

88 Energy (EEENF) Stock Moves Closer To 2 cents: How To Trade Now?

Back in April the stock of the oil and natural gas company 88 Energy Limited (OTCMKTS:EEENF) had displayed considerable volatility owing to certain developments. However, over the course of the past few weeks the stock has been in the middle of a phase of consolidation.

When that happens, then there is a possibility of the stock breaking out and hence, it might be a good idea for investors to take a closer look at the 88 Energy stock. The 88 Energy came into focus in March this year, when it soared to 20 cents a share, however, an update from the company back in April rocked and sent the shares tumbling.

In April, the company announced that equipment failure had led to a power outage at two of its highest prospect zone. It disrupted the sampling work at those two properties that are part of 88 Energy’s Alaskan Peregrine project.

That proved to be a major blow for the stock as a major selloff ensured amidst panic from customers and the stock crashed. However, the stock recovered some days later on April 27 after the company provided another operational update in relation to its drilling activities in Alaska.

88 Energy announced that it started the testing on the sidewell cores, fluid samples, mud gas and cuttings at the property in question. At the time, the company revealed that the results from the testing are going to be revealed in 10 weeks.

It goes without saying that many investors are going to be eagerly waiting for the results from the tests and it remains to be seen if the publication leads to any rally or not. That might actually be one of the major reasons why the stock is currently trading flat. Once the results are declared, there might be considerable movement in the stock either way depending on the nature of the findings.