Periam Ltd. Picked Up Enernoc Inc. (NASDAQ:ENOC) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Enernoc Inc. (NASDAQ:ENOC) reported that Periam Ltd. has picked up 1,525,120 of common stock as of 2017-04-17.

The acquisition brings the aggregate amount owned by Periam Ltd. to a total of 1,525,120 representing a 5.0% stake in the company.

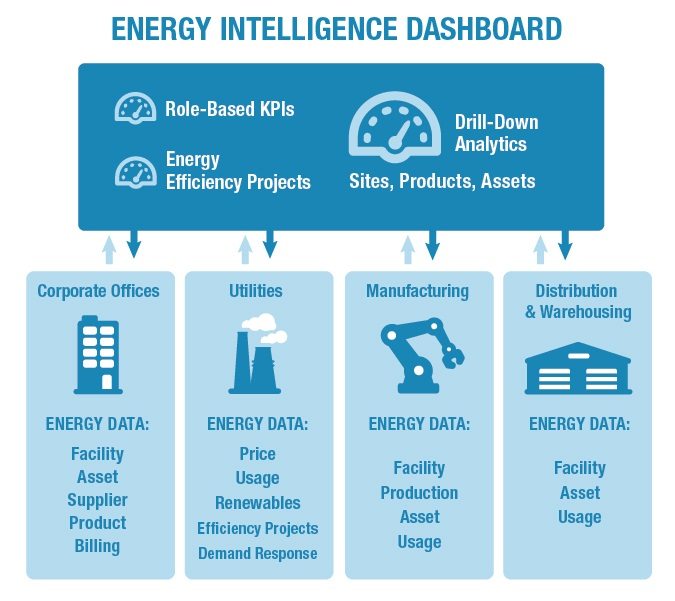

For those not familiar with the company, EnerNOC, Inc. is a provider of energy intelligence software (EIS) and demand response solutions. The Company’s EIS provides enterprise solutions, utility solutions and energy procurement solutions. The Company’s EIS offers enterprise customers with a Software-as-a-Service (SaaS) solutions with various areas of functionalities, including energy cost visualization, budgets, forecasts and accruals; project tracking, and demand management. Its EIS provides its utility customers with a SaaS-based customer engagement platform, which collects and processes data and enables its utility customers to provide personalized communication and recommendations to their customers. Its EIS includes an energy procurement platform that helps its enterprise and utility customers. Its procurement platform offers its enterprise and utility customers with features, such as energy contracts management. Its technology includes over two components: its EIS platform and Network Operations Center (NOC).

A glance at Enernoc Inc. (NASDAQ:ENOC)’s key stats reveals a current market capitalization of 160.04 Million based on 30.43 Million shares outstanding and a price at last close of $5.40 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2016-03-17, Healy picked up 8,170 at a purchase price of $7.36. This brings their total holding to 1,353,907 as of the date of the filing.

On the sell side, the most recent transaction saw Dixon unload 10,000 shares at a sale price of $12.51. This brings their total holding to 231,696.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Enernoc Inc. (NASDAQ:ENOC) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Guess Who Just Picked Up Oci Partners Lp. (NYSE:OCIP) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Oci Partners Lp. (NYSE:OCIP) reported that Oci N.v. has picked up 69,497,590 of common stock as of 2017-04-17.

The acquisition brings the aggregate amount owned by Oci N.v. to a total of 69,497,590 representing a 79.9% stake in the company.

For those not familiar with the company, OCI Partners LP owns and operates an integrated methanol and ammonia production facility that is located on the Texas Gulf Coast near Beaumont. The Company has an annual methanol production capacity of approximately 912,500 metric tons and an annual ammonia production capacity of approximately 331,000 metric tons. It purchases natural gas from third parties and processes the natural gas into synthesis gas, which it then further processes in the production of methanol and ammonia. It stores and sells the processed methanol and ammonia to industrial and commercial customers for further processing or distribution. Its methanol production unit comprises Foster-Wheeler-designed twin steam methane reformers for synthesis gas production, over two Lurgi-designed parallel low-pressure, water-cooled reactors and approximately four distillation columns. The Haldor-Topsoe-designed ammonia synthesis loop at its facility processes hydrogen produced by methanol production process.

A glance at Oci Partners Lp (NYSE:OCIP)’s key stats reveals a current market capitalization of 744.39 Million based on 87.00 Million shares outstanding and a price at last close of $8.65 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2016-11-23, Sawiris picked up 370 at a purchase price of $5.65. This brings their total holding to 868,014 as of the date of the filing.

On the sell side, the most recent transaction saw Gregory unload 4,152 shares at a sale price of $5.35. This brings their total holding to 0.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Oci Partners Lp. (NYSE:OCIP) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Here’s Who Just Picked Up Tesoro Logistics Lp (NYSE:TLLP) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Tesoro Logistics Lp (NYSE:TLLP) reported that Tesoro Corp /new/ has picked up 34,055,042 of common stock as of 2017-04-17.

The acquisition brings the aggregate amount owned by Tesoro Corp /new/ to a total of 34,055,042 representing a 31.5% stake in the company.

For those not familiar with the company, Tesoro Logistics LP is a full-service logistics company operating in the western and mid-continent regions of the United States. The Company operates through three segments. Its Gathering segment consists of crude oil, natural gas and produced water gathering systems in the Bakken Region and Rockies Region. Its Processing segment consists of the Vermillion processing complex, the Uinta Basin processing complex, the Blacks Fork processing complex and the Emigrant Trail processing complex. Its Terminalling and Transportation segment consists of the Northwest Products Pipeline, which includes a regulated common carrier products, a regulated common carrier refined products pipeline system connecting Tesoro Corporation’s Kenai refinery to Anchorage, Alaska, and crude oil and refined products terminals and storage facilities in the western and midwestern United States; marine terminals in California; a petroleum coke handling and storage facility in Los Angeles, and other pipelines.

A glance at Tesoro Logistics Lp (NYSE:TLLP)’s key stats reveals a current market capitalization of 5.76 Billion based on 103.00 Million shares outstanding and a price at last close of $53.94 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2016-08-26, Sterin picked up 1,300 at a purchase price of $47.34. This brings their total holding to 3,814 as of the date of the filing.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Tesoro Logistics Lp (NYSE:TLLP) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.