Celgene Switzerland Llc. Picked Juno Therapeutics Inc. (NASDAQ:JUNO) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Juno Therapeutics Inc. (NASDAQ:JUNO) reported that has picked up 10,350,833 of common stock as of 2017-03-27.

The acquisition brings the aggregate amount owned by Celgene Switzerland Llc. to a total of 10,350,833 representing a 9.7% stake in the company.

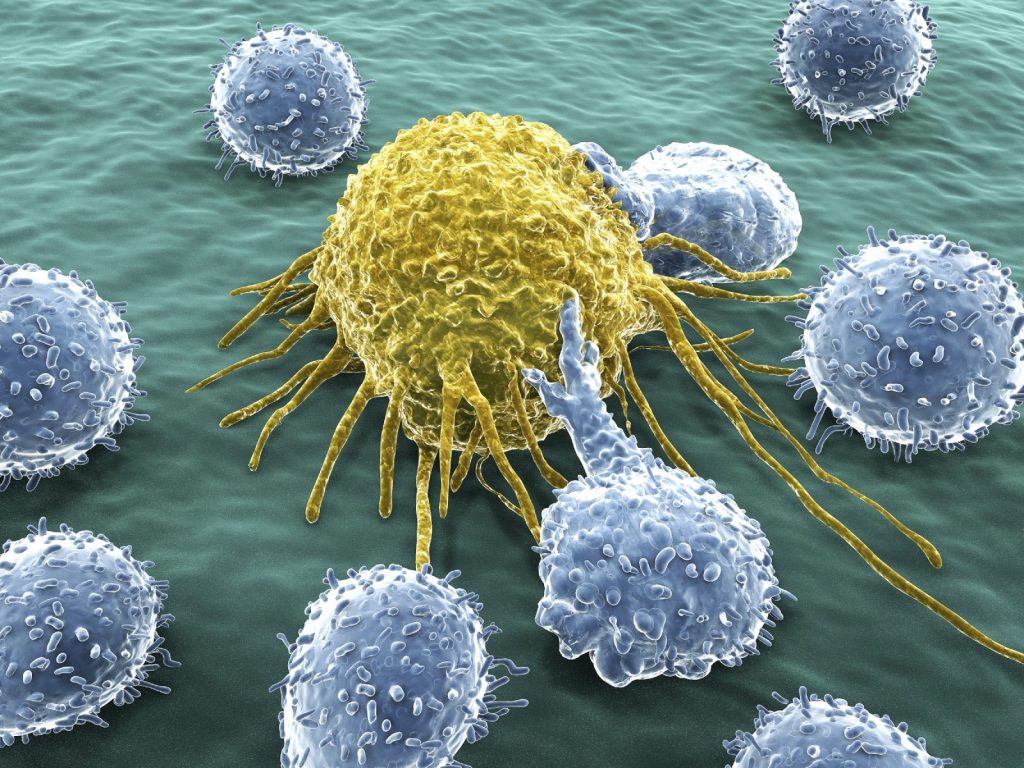

For those not familiar with the company, Juno Therapeutics, Inc. (Juno) is a biopharmaceutical company focused on re-engaging the body’s immune system to revolutionize the treatment of cancer. The Company is developing cell-based cancer immunotherapies based on its chimeric antigen receptor (CAR) and T cell receptor (TCR) technologies to genetically engineer T cells to recognize and kill cancer cells. Juno’s product candidates, JCAR015, JCAR017 and JCAR014, utilize CAR technology to target CD19, a protein expressed on the surface of various B cell leukemias and lymphomas. Its other product candidates include JCAR018: CD22, JCAR023: L1CAM (CD171) and JCAR020: MUC-16/IL-12. The Company’s CAR and TCR technologies alter T cells ex vivo, or outside the body. In addition, the Company holds license to vipadenant, a small molecule adenosine A2a (A2a) receptor antagonist that has the potential to disrupt important immunosuppressive pathways in the tumor microenvironment in certain cancers.

A glance at Juno Therapeutics Inc. (NASDAQ:JUNO)’s key stats reveals a current market capitalization of 2.20 Billion based on 106.02 Million shares outstanding and a price at last close of $20.85 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2017-03-10, Evnin picked up 8,000 at a purchase price of $22.11. This brings their total holding to 56,990 as of the date of the filing.

On the sell side, the most recent transaction saw Azelby unload 12,921 shares at a sale price of $24.14. This brings their total holding to 35,719.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Juno Therapeutics Inc. (NASDAQ:JUNO) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Here’s Who Just Picked Up Power Solutions International Inc. (NASDAQ:PSIX) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Power Solutions International Inc. (NASDAQ:PSIX) reported that Frontline Ltd has picked up 9,607,972 of common stock as of 2017-03-27.

The acquisition brings the aggregate amount owned by Frontline Ltd to a total of 9,607,972 representing a 10.2% stake in the company.

For those not familiar with the company, Power Solutions International, Inc. is a producer and distributor of a range of low-emission power systems that run on non-diesel fuels, such as natural gas, propane and gasoline. The Company’s industrial power systems are used by original equipment manufacturers (OEMs) in a range of industries with a diversified set of applications, including stationary electricity generators, oil and gas equipment, forklifts, aerial work platforms, industrial sweepers, arbor equipment, agricultural and turf equipment, aircraft ground support equipment, construction and irrigation equipment, and other industrial equipment. The Company provides alternative fuel power systems for OEMs of off-highway industrial equipment and on-road medium trucks and busses. In addition to its emission-certified power systems, the Company produces and distributes non-emission-certified power systems for industrial OEMs for particular applications in markets without emission standards.

A glance at Power Solutions International Inc. (NASDAQ:PSIX)’s key stats reveals a current market capitalization of 68.02 Million based on 10.88 Million shares outstanding and a price at last close of $6.40 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2016-03-04, Lewis picked up 1,000 at a purchase price of $11.24. This brings their total holding to 1,000 as of the date of the filing.

On the sell side, the most recent transaction saw Cohen unload 6,000 shares at a sale price of $73.78. This brings their total holding to 0.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Power Solutions International Inc. (NASDAQ:PSIX) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Bullish Pullback on Friendable Inc (OTCMKTS:FDBL) Shares

Friendable Inc (OTCMKTS:FDBL) shares dipped 7.69% on Friday to $0.00120 and an additional 1.50% to $0.00118 in after-hours trading. Share prices have been trading in a 52-week range of $0.00 to $0.03. The company has a market cap of $882K at 869 million shares outstanding.

Formerly iHookUp Social, Friendable Inc is engaged in the development and dissemination of a proximity-based mobile social media application that facilitates connections between people, utilizing global positioning system (GPS) and localized recommendations.

It offers Friendable, which is a location specific social platform, as well as a discovery application that facilitates communication between two or more users on a one to one meeting or group style event-based meet ups for concerts, sporting events, coffee, movies and night out, among others. Friendable bridges its mobile community of users with the meeting of new friends, building relationships and connecting them with local venues or events tied to their interests. Its application is available on the Apple iOS platform and in iTunes stores, where Friendable offers a free version and a paid version of the application. Its application is also available on the Android platform and in the Google Play Store.

Last week, Friendable Inc announced that its mobile app, a location and events based social platform, was the number one social media app in Canada for a day in March while reaching the top 50 apps in China. This supports the company’s update last month that the most significant spikes in Friendable App rankings, downloads, and user engagement were realized during concerted marketing initiatives.

We have not implemented any proactive marketing initiatives since completing our strategic investment in Hang W/, Inc. in October 2016 and embarking on a relationship designed to bring new opportunity for Friendable and our product offerings,” remarked Friendable Inc CEO, Robert A. Rositano Jr. “Periodically, we pause all marketing to evaluate the marketplace’s organic trends so we can generate a new baseline against which to measure the ROI on our various marketing programs. We expect our metrics to go flat from time to time, which is typically a function of marketing initiatives or not. We were pleasantly surprised to see our rankings spike in China and Canada — two diverse markets.”

The company also recently filed a Securities Purchase Agreementwith EMA Financial, LLC to issue and sell a 8% Convertible Note in the principal amount of $96,000 with a maturity date of March 15, 2018. This was funded in March 15, 2017. The next day, the company entered into a Securities Purchase Agreement, dated March 13, 2017 with Coventry Enterprises, LLC to issue and sell a 8% Convertible Redeemable Note in the principal amount of $32,000 with a maturity date of March 13, 2018.

DISCLAIMER: There is a substantial risk of loss with any speculative asset, especially small cap stocks. The opinions expressed are those of the author, and do not constitute recommendations to buy or sell a stock. Do your own research before committing capital.