Here’s Who Just Picked Up Turkish Investment Fund Inc. (NYSE:TKF) Shares

Diversification is more than just a buzz word in the finance space, and especially right now, when geopolitical uncertainty hangs over the major markets in nearly every developed nation, it’s a must. One way to gain easy access to diversity is through a closed end fund like Turkish Investment Fund Inc.

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Turkish Investment Fund Inc. (NYSE:TKF) reported that Deschutes Portfolio Strategy, Llc. has picked up 253,339 of common stock as of 2017-01-20.

The acquisition brings the aggregate amount owned by Deschutes Portfolio Strategy, Llc. to a total of 253,339 representing a 5.4% stake in the company.

For those not familiar with the company, The Turkish Investment Fund, Inc. is a non-diversified, closed-end management investment company. The Fund’s investment objective is long-term capital appreciation through investments primarily in equity securities of Turkish corporations. The Fund invests in the Institutional Class of the Morgan Stanley Institutional Liquidity Funds. The Fund invests in various sectors, such as airlines, auto components, automobiles, banks, beverages, building products, commercial services and supplies, construction materials, diversified financial services, food products, household durables, industrial conglomerates, insurance, machinery, oil, gas and consumable fuels, textiles, apparel and luxury goods, and wireless telecommunication services.

A glance at Turkish Investment Fund Inc. (NYSE:TKF)’s key stats reveals a current market capitalization of 30.24 million based on 4.66 million shares outstanding and a price at last close of $6.60 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2013-05-02, Advance picked up 35,000 at a purchase price of $19.01. This brings their total holding to 858,919 as of the date of the filing.

On the sell side, the most recent transaction saw Advance unload 50,000 shares at a sale price of $7.96. This brings their total holding to 447,626.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Turkish Investment Fund Inc. (NYSE:TKF) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Here’s Who Just Picked Up Vycor Medical Inc. (OTCMKTS:VYCO) Shares

January has been a big month for biotech, with the JP Morgan conference dominating the start of the year. The conference traditionally brings about a host of deals and new buys, and this latest Vycor pick up suggests there’s plenty more to come before the end of the month.

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Vycor Medical Inc. (OTCMKTS:VYCO) reported that Fountainhead Capital Management Ltd. has picked up 9,733,832 of common stock as of 2017-01-20.

The acquisition brings the aggregate amount owned by Fountainhead Capital Management Ltd. to a total of 9,733,832 representing a 55.74% stake in the company.

For those not familiar with the company, Vycor Medical, Inc. provides surgical and therapeutic solutions. The Company operates through two segments: Vycor Medical, which focuses on brain and cervical surgical access systems for sale to hospitals and medical professionals, and NovaVision, which focuses on neuro-stimulation therapies and diagnostic devices for the treatment and screening of vision field loss resulting from neurological damage. The Company designs, develops and markets neurological medical devices and therapies. The Company operates in the United States and Europe. Vycor Medical’s product Vycor Medical’s ViewSite Brain Access System (VBAS) is a next generation retraction and access system. VBAS is a disposable product that can be used with microscopic, endoscopic and neuro-navigation systems.

A glance at Vycor Medical Inc. (OTCMKTS:VYCO)’s key stats reveals a current market capitalization of 2.82 million based on 11.22 million shares outstanding and a price at last close of $0.250 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2014-12-31, Fountainhead picked up 8,380 at a purchase price of $1.79. This brings their total holding to 4,366,844 as of the date of the filing.

On the sell side, the most recent transaction saw Bronsther unload 6,241 shares at a sale price of $2.75. This brings their total holding to 18,216.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Vycor Medical Inc. (OTCMKTS:VYCO) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

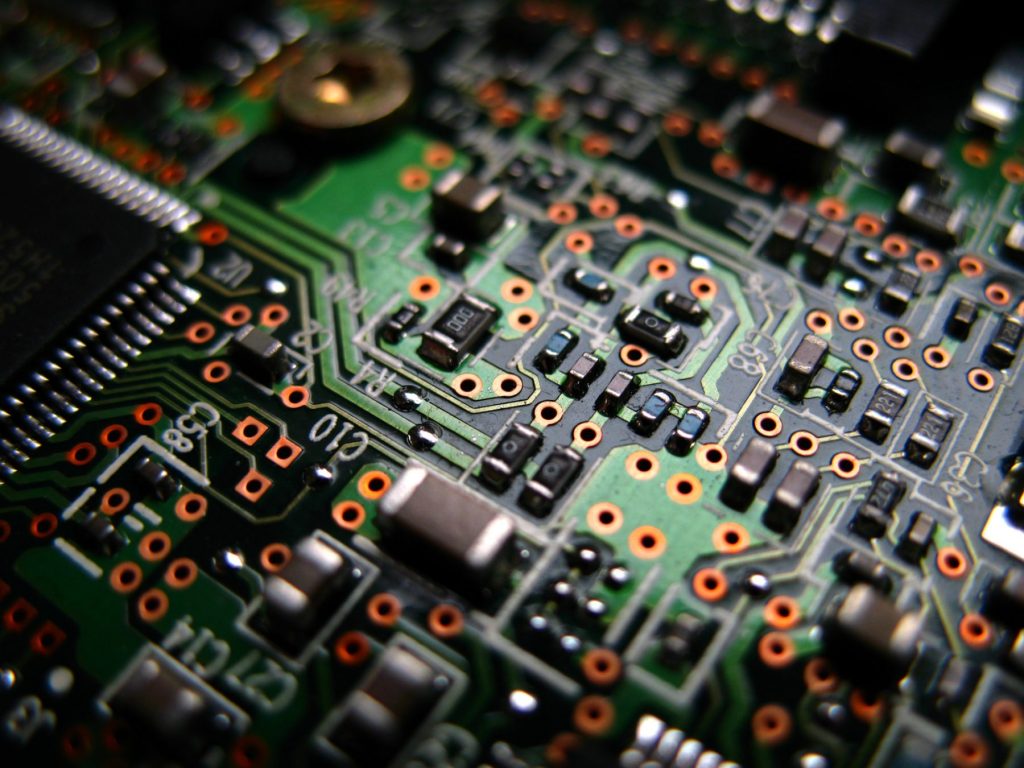

Kemet Corp. (NYSE:KEM) Is Bringing In The Smart Money

We’re heading into what could be a second golden age of technology, as the quantum becomes reality. Whereas the semiconductor behemoths ruled the 80s and 90s, a number of funds are looking for a bit of diversification in the space. Kemet offers said diversification. Here’s a look at the company’s latest institutional buyer, and what it means for the company

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Kemet Corp (NYSE:KEM) reported that Marda Rama S. has picked up 335 of common stock as of 2017-01-20.

The acquisition brings the aggregate amount owned by Marda Rama S. to a total of 335 representing a 7.26% stake in the company.

For those not familiar with the company, KEMET Corporation (KEMET) is a manufacturer of passive electronic components. The Company operates in two segments: Solid Capacitors, and Film and Electrolytic. The Solid Capacitors segment primarily produces tantalum, aluminum, polymer and ceramic capacitors. Solid Capacitors also produces tantalum powder used in the production of tantalum capacitors. The Film and Electrolytic Business Group produces film, paper and wet aluminum electrolytic capacitors. It also designs and produces EMI Filters. The Company’s product offerings include surface mount, which are attached directly to the circuit board; leaded capacitors, which are attached to the circuit board using lead wires, and chassis-mount and other pin-through-hole board-mount capacitors, which utilize attachment methods, such as screw terminal and snap-in.

A glance at Kemet Corp. (NYSE:KEM)’s key stats reveals a current market capitalization of 325.84 million based on 46.28 million shares outstanding and a price at last close of $7.07 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2016-02-01, Lowe picked up 10,000 at a purchase price of $1.51. This brings their total holding to 525,264 as of the date of the filing.

On the sell side, the most recent transaction saw Mcadams unload 1,446 shares at a sale price of $8.82. This brings their total holding to 24,957.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Kemet Corp. (NYSE:KEM) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Chemours Co. (NYSE:CC) Scores Big With Latest Filing

Chemicals are always going to be hot, and as we move forward into a renewable focus world, things are only going to get hotter in the space. The latest Norges bank transaction highlights this fact.

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Chemours Co. (NYSE:CC) reported that Norges Bank has picked up 8,911,449 of common stock as of 2017-01-20.

The acquisition brings the aggregate amount owned by Norges Bank to a total of 8,911,449 representing a 4.90% stake in the company.

For those not familiar with the company, The Chemours Company is a provider of performance chemicals. The Company operates through three segments: Titanium Technologies, Fluoroproducts and Chemical Solutions. The Company’s Titanium Technologies segment manufactures titanium dioxide (TiO2), which is a pigment used to deliver whiteness, opacity, brightness and protection from sunlight in applications, such as architectural and industrial coatings, plastic packaging, polyvinyl chloride (PVC) window profiles, laminate papers, coated paper and coated paperboard used for packaging. Its Fluoroproducts segment provides fluoroproducts, such as refrigerants and industrial fluoropolymer resins. Its Chemical Solutions segment provides industrial and specialty chemicals used in gold production, oil refining, agriculture, industrial polymers and other industries.

A glance at Chemours Co. (NYSE:CC)’s key stats reveals a current market capitalization of 4.35 billion based on 181.83 million shares outstanding and a price at last close of $24.78 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2016-05-13, Newman picked up 1,300 at a purchase price of $9.70. This brings their total holding to 2,800 as of the date of the filing.

On the sell side, the most recent transaction saw Newman unload 16 shares at a sale price of $9.37. This brings their total holding to 121,178.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Chemours Co. (NYSE:CC) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.