CYBIN (CYBN) ISSUED A BUY RATING WITH A 1,539% UPSIDE!

Good Morning Traders, Cybin CYBN issued blockbuster news this morning that the FDA has cleared their proprietary molecule for the phase 2a study. Take a look at the news below and get ready for a big day. Cybin Inc. (NYSE American: CYBN) today announced that the U.S. Food and Drug Administration (“FDA”) has cleared its […]

Coeptis Therapeutics Could Revolutionize The Treatment of Cancer

Small Cap Exclusive is proud to present our research report on Coeptis Therapeutics a NASDAQ biopharmaceutical company trading under the ticker (COEP) that is developing innovative treatments in the field of cancer. Take a look at this chart below! There is very little resistance in L2 with market makers and the slightest bit of volume […]

Why NASDAQ: AMPG Is An ‘Under The Radar’ Juggernaut You NEED To Know About

After combing the NASDAQ exchange for weeks, we think we found a true juggernaut in the Communication Equipment Industry. The kicker… As of April 20, 2023, it’s trading at around the low low price $3.20 per share. The Company is Amplitech Group Inc. (NASDAQ: AMPG) and we think you NEED to know about this one BEFORE it becomes a household name.

Alright, without further adieu, let’s get started.

Company Details

- Stock Details

- Ticker Symbol: AMPG

- Exchange: NASDAQ

- Location: United States

- Founded: 2002

- Industry: Communication Equipment

- Sector: Technology

- Employees: 34

- CEO Mr. Fawad A. Maqbool

- Website: https://www.amplitechinc.com/

AmpliTech designs, develops, and manufactures custom and standard state‐of‐the‐art RF components for the Commercial, SATCOM, Space, and Military markets. These designs cover the frequency range from 50 kHz to 40 GHz Eventually, offering designs up to 100 GHz. AmpliTech also provides consulting services to help with any microwave components or systems design problems.Our growth has come about because we can provide complex, custom solutions. Therefore, AmpliTech is committed to providing immediate responses to any custom requirements that are presented to us. AmpliTech, Inc. has developed and supplied LNAs to Fortune 500 companies, the Military and Government Agencies such as:

- Lockheed Martin

- NASA

- L3 Communications

- Boeing

- Northrop Grumman

- Raytheon

- Government of Israel

Think this sounds like any one of the other hundreds of small-cap companies trying to make a name for themselves without any financial backing, eh?… Well, think again because AMPG has a market cap of $30.72 million. The enterprise value is $21.76 million. In fact, in the last 12 months, AMPG had revenue of $19.39 million and -$677,107 in losses. Meaning, Their FY 2022 results BEAT Revenue Guidance and Reports Record 267% YoY!

BUT THAT’S NOT ALL!

AMPG Highlights

Fundamentals:

- Financial Position: AMPG has a current ratio of 12.08, with a Debt / Equity ratio of 0.16.

- Income Statement: In the last 12 months, AMPG had revenue of $19.39 million

- Balance Sheet: The company has $13.54 million in cash and $4.67 million in debt, giving a net cash position of $8.87 million

2022 Earnings:

- In the last 12 months, AMPG had revenue of $19.39 million and -$677,107 in losses.

- AmpliTech Reports FY 2022 Results; Beats Revenue Guidance and Reports Record 267% YoY Annual Revenue Increase to $19.4 Million

Analyst Forecast:

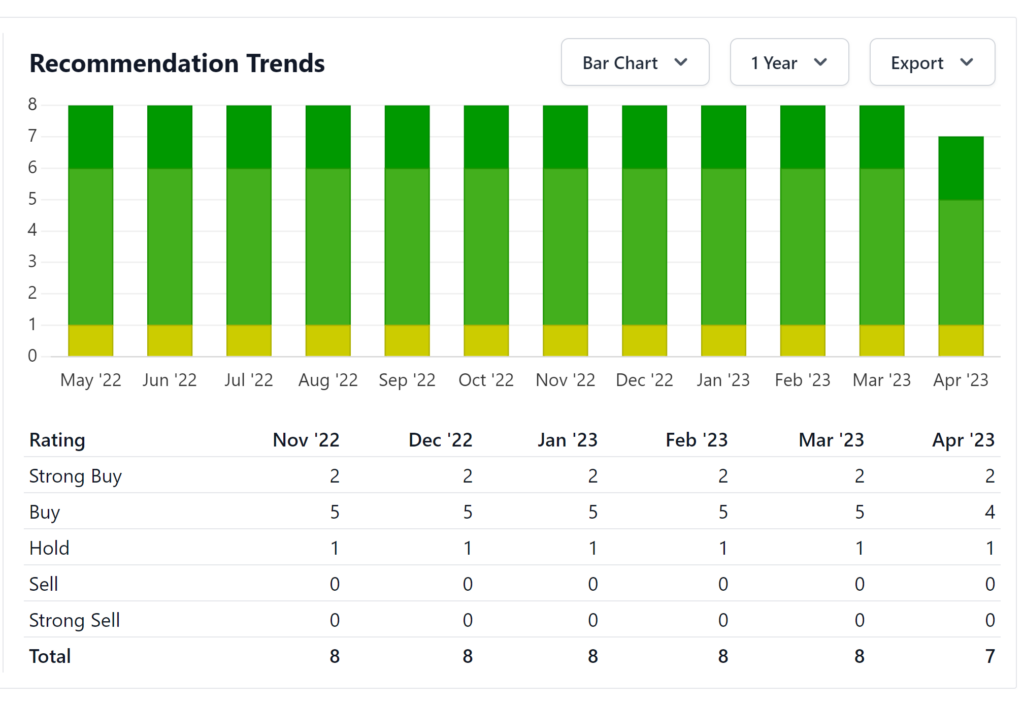

- The consensus rating for AMPG from 7 stock analysts is “Buy”.

- This means that analysts believe this stock is likely to outperform the market over the next twelve months.

Stock Price Forecast:

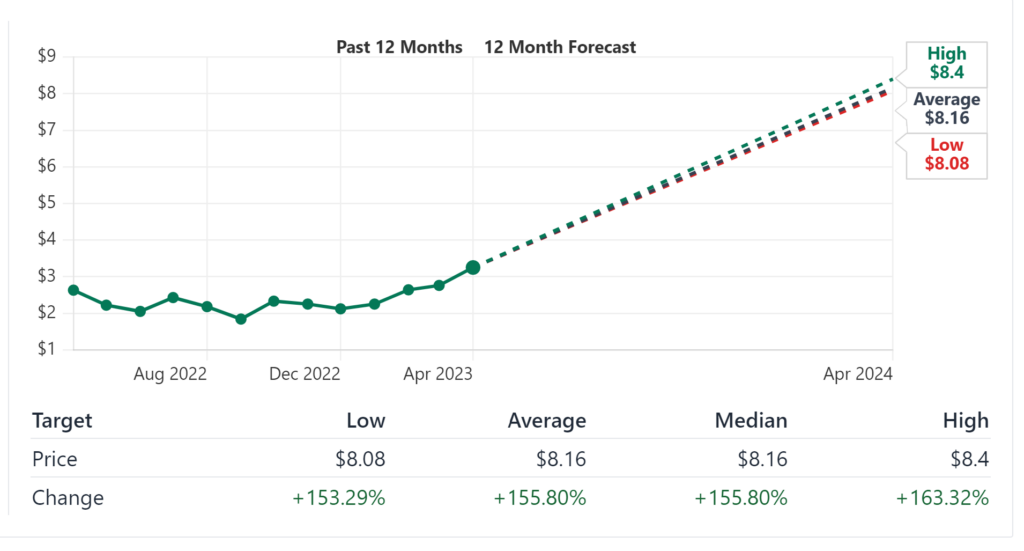

- According to 7 stock analysts, the average 12-month stock price forecast for AMPG stock is $8.16, which predicts an increase of 155.80%.

- The lowest target is $8.08 and the highest is $8.4.

- On average, analysts rate AMPG stock as a buy.

Share Statistics:

- Float: AMPG has 9.63 million shares outstanding with a low float of only 6.75 million shares

- Short Interest: The latest short interest is 89,377, so 0.93% of the outstanding shares have been sold short.

Continue reading to get our FULL BREAKDOWN of AMPG’s Highlights.

AMPG Fundamentals

- Financial Position: AMPG has a current ratio of 12.08, with a Debt / Equity ratio of 0.16.

- Balance Sheet: The company has $13.54 million in cash and $4.67 million in debt, giving a net cash position of $8.87 million

- Income Statement: In the last 12 months, AMPG had revenue of $19.39 million

The current ratio, also known as the working capital ratio, measures the capability of a business to meet its short-term obligations that are due within a year. The ratio considers the weight of total current assets versus total current liabilities. It indicates the financial health of a company and how it can maximize the liquidity of its current assets to settle debt and payables. The current ratio formula (below) can be used to easily measure a company’s liquidity.

So, if a currently has a current ratio of 2, then it can easily settle each dollar on loan or accounts payable twice. A rate of more than 1 suggests financial well-being for the company. Well, Financial Position: AMPG has a current ratio of 12.08. Meaning, it can easily settle each dollar on loan or accounts payable 12 times over.

That said, a very high current ratio may indicate that a company has excess cash in hand. Well, after looking into it, AMPG does have cash in hand… A lot of cash in hand… $13.54 MILLION to be exact.

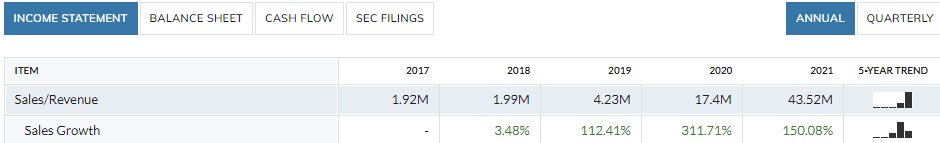

Saving the best for last, In the last 12 months, AMPG had revenue of $19.39 MILLION. Let’s take a closer look at how great a year it’s been for this company.

2022 Earnings

In the last 12 months, AMPG had revenue of $19.39 million and -$677,107 in losses.

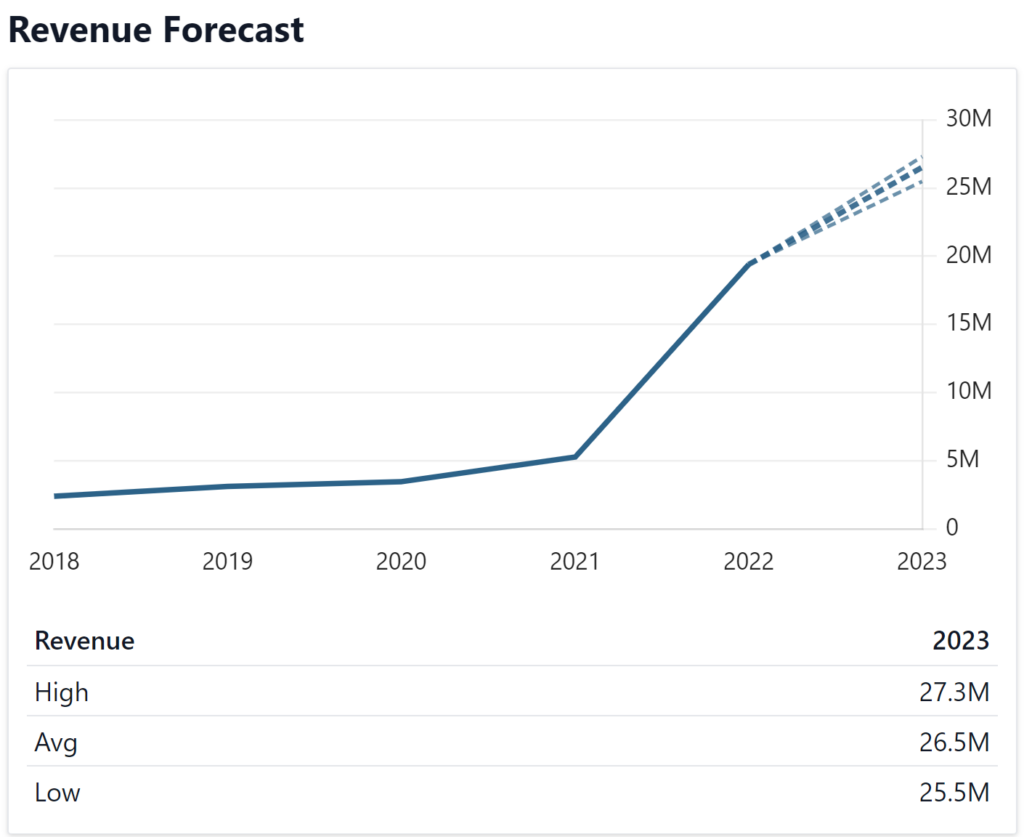

AmpliTech Reports FY 2022 Results; Beats Revenue Guidance and Reports Record 267% YoY Annual Revenue Increase to $19.4 Million

March 31, 2023:

2022 Annual Revenue increases nearly 3x to $19.4M, Gross Profit increases nearly 7-fold, Gross Margin almost doubles

AmpliTech Reports FY 2022 Results; Beats Revenue Guidance and Reports Record 267% YoY Annual Revenue Increase to $19.4 Million

- Gross Profit Increases nearly 7-fold, Gross Margin Expands 2,150 basis points to 46.0%

- 2022 Annual Revenue increases nearly 3x to $19.4M, Gross Profit increases nearly 7-fold, Gross Margin almost doubles

Full Year 2022 Highlights

- Revenue increased 267% to $19,394,000 in FY’22 compared to $5,275,000 in FY’21.

- FY’ 22 gross profit grew to $8,925,000, an almost 7-fold increase from FY’ 21 gross profit of $1,293,000. The gross profit margin increased by 2150 basis points to 46.0% compared to 24.5% a year ago.

- FY’22 net loss was $677,000 compared to a FY’21 net loss of $4,759,000, a positive swing of approximately $4.1 million. The net loss includes a one-time revenue earnout of approximately $816,000 as a result of Spectrum’s beating sales expectations for the years 2021 and 2022. It is important to note that without this earnout payment, the Company would have been profitable.

- As of December 31, 2022, cash and equivalents totaled $13,290,000 and working capital was $20,331,000, which is sufficient capital for AmpliTech to fund all of its strategic growth initiatives.

- AmpliTech experienced great success at trade shows such as Satellite 2022, IMS 2022, the AOC 2022, and the APS March Meeting 2022 , achieving positive customer engagement and setting company records at each event for the number of meetings with new and existing customers.

- Customers have begun to sample AGMDC’s new MMIC chip products which have received very positive praise and feedback.

Forward-Looking Update

- MMIC chips, or ICs, have been released to customers for testing and are expected to begin generating revenue in Q2 2023.

- Management expects sustained profitability going into 2023.

- Team is increasing sales exposure through enhanced strategic partnerships with sales representatives and distributors globally.

Full Earnings Report: https://finance.yahoo.com/news/amplitech-reports-fy-2022-results-130000549.html

Now, I know what you’re thinking. The past is the past. What is AMPG going to do for me in the future?… Well, let’s see what the analyst’s forecast for the future of AMPG.

Stock Price Forecast

As if that’s not a good enough projection, according to 7 stock analysts, the average 12-month stock price forecast for AMPG stock is $8.16, which predicts an increase of 155.80%. The lowest target is $8.08 and the highest is $8.4. On average, analysts rate AMPG stock as a buy. In fact, a couple of firms have already initiated coverage of AMPG with more expected to do so as this one continues to move higher.

Analyst Forecast

The consensus rating for AMPG from stock analysts is “Buy.” This means that analysts believe this stock is likely to outperform the market over the next twelve months.

The average analyst rating for AMPG stock from 7 stock analysts is “Buy”. This means that analysts believe this stock is likely to outperform the market over the next twelve months.

February 2, 2022

Analyst Firm: Small Cap Consumer Research

Rating: Buy

Target: $5.00

July 7, 2021

Analyst Firm: Maxim Group

Rating: Buy

Target: $10

If the forecasters think AMPG is worth adding to their watchlist then we should too, right? But, what about actually buying the stock for themselves? Let’s take a look…

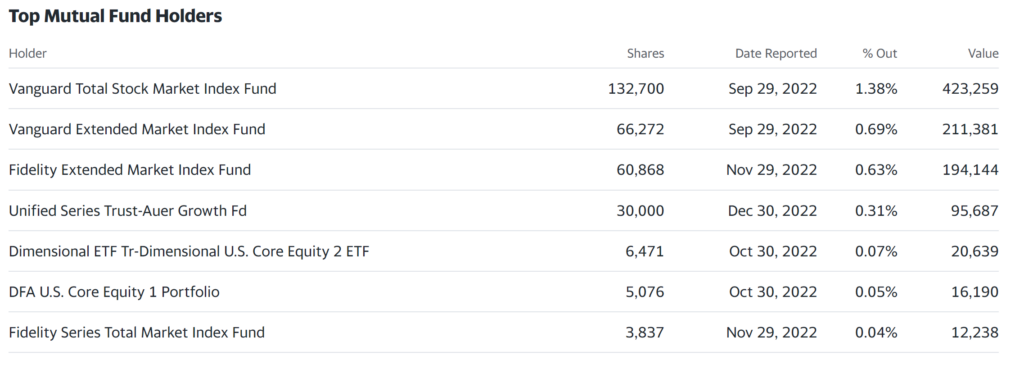

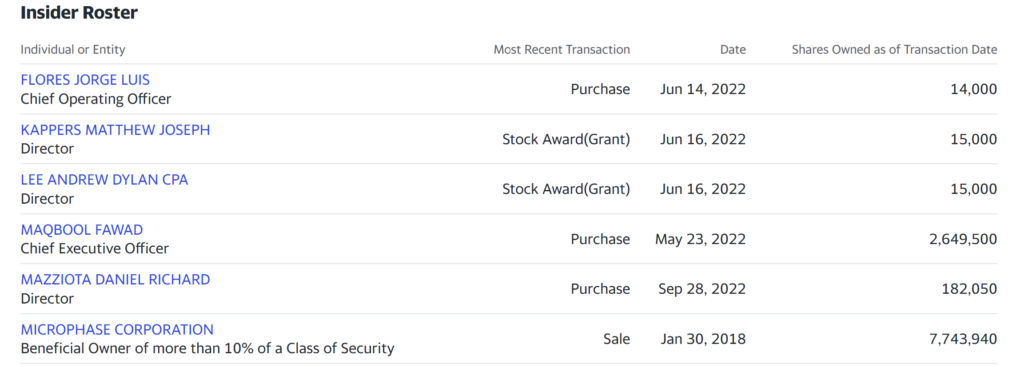

Insider Holdings

AMPG has 9.63 million shares outstanding with a low float of only 6.75 million shares with a meager short interest of less than 1% sold short. Of their shares, 32.99% are held by insiders, 8.68% is held by 16 different institutional investors, totalling to a little under 13% of the float.

Recent News

April 17, 2023

AmpliTech Group’s Division, Spectrum Semiconductor Materials, Inks Distribution Deal with NGK Electronic Devices, a Leading Global Semiconductor Manufacturer

AmpliTech to Become NGK’s First US Distributor of Their RF Microwave Package Products

McapMediaWire – AmpliTech Group, Inc. (NASDAQ: AMPG) a designer, developer, and manufacturer of state-of-the-art signal-processing components for satellite, 5G, and other communications networks, and a worldwide distributor of packages and lids for integrated circuit assembly, as well as a designer of complete 5G/6G systems, is proud to announce its partnership with NGK Electronic Devices, a powerhouse in the semiconductor packaging industry, to become their US distributor for NGK’s state-of-the-art RF Microwave products. This partnership marks NGK’s first distribution agreement with a US partner, presenting a significant opportunity for both parties.

Full Article: https://finance.yahoo.com/news/amplitech-group-division-spectrum-semiconductor-133000902.html

March 30, 2023

AmpliTech Records a New Benchmark at Satellite 2023 Show in Washington, D.C.

McapMediaWire – AmpliTech Group, Inc. (NASDAQ: AMPG), a designer, developer, and manufacturer of state-of-the-art signal-processing components for satellite, 5G, and other communications networks, as well as a worldwide distributor of packages and lids for integrated circuit assembly, is excited to announce an unprecedented achievement at the Satellite 2023 show held in Washington, D.C. The company recorded more than 100 meetings with executives in the satellite communications (Satcom) space – a new record for the prestigious event. Among the attendees were multiple Fortune 100 companies, top-tier research institutions, and exciting startups driving the next generation of connectivity.

Full News Article: https://finance.yahoo.com/news/amplitech-records-benchmark-satellite-2023-130000747.html

February 27, 2023

AmpliTech Group, Inc. Discusses Significance of Its State-of-the-Art Radio Frequency Components with The Stock Day Podcast

AmpliTech Group, Inc. (NASDAQ: AMPG),a designer, developer, and manufacturer of state-of-the-art signal-processing components for satellite, 5G, and other communications networks and a worldwide distributor of packages and lids for integrated circuit assembly, is pleased to announce its participation in three upcoming shows, where it will exhibit its latest technological advancements at the Satellite Show in Washington DC, at Booth #2092. AmpliTech Group is also attending the Mobile World Congress (MWC) Show in Barcelona, and the American Physical Society (APS) show in Las Vegas, to participate with key players in the 5G and Quantum Computing industries.

Full News Article: https://finance.yahoo.com/news/amplitech-showcase-latest-product-wins-141500565.html

November 7, 2023

AmpliTech Recognized by Inc. Magazine as Top 10 Most Innovative Telecom Solution to Watch

AmpliTech Group, Inc. (Nasdaq: AMPG) announced that it was recognized by Inc. magazine in its list of “Top 10 Most Innovative Telecom Solution to Watch”

Founder and CEO Fawad Maqbool stated, “It was an honor to work with Inc. Magazine on this article to discuss Amplitech Group and how we currently offer a wide range of products for 5G, Telecom, quantum computing, airline Wi-Fi, and all things wireless, starting from connectorized modules, discrete transistors, MMICs, and packages, to multi-chip modules (MCMs) and systems using multiple disciplines and processes that we see a lack of in the market. All of these products directly enable technologies such as Virtual Reality (VR), Augmented reality (AR), Telemedicine, fully autonomous vehicles, Satellite-to-phone connectivity, the Internet of Things (IoT), Internet in the sky, and much more. AmpliTech is committed to connecting humans like never before in the 21st century.”

Full News Article: https://finance.yahoo.com/news/amplitech-recognized-inc-magazine-top-210000268.html

AMPG Company Background

Developing the communication systems of tomorrow, today.

AmpliTech was founded to address the industry gap for high-performance, ultra-reliable, and extremely efficient radio frequency (RF) devices to power the communication ecosystem of tomorrow. We obsess over pushing boundaries of what can be done to increase connectivity in the sky, in space, and in your homes. The devices AmpliTech designs boast the lowest noise figures and power dissipation across all usage frequencies to offer customers in the military, Satcom, aviation, automotive, and computing industry unparalleled product specifications and user experience. As industry requirements for communication throughput, speed, and endurance grow exponentially, we strive to develop the technologies necessary to power the future of communication.

AmpliTech designs, develops, and manufactures custom leading-edge RF components for the Commercial, SATCOM, Space, and Military markets. These designs cover frequencies from 50 kHz to 44 GHz. AmpliTech also has developed new products for the 5G/6G wireless ecosystem and infrastructure with unparalleled performance. In addition to this rapidly emerging market, AMPG has also developed solutions for Quantum Computing, with cutting edge technology. We continue to blaze trails in our commitment to enable and accelerate the arrival of true 5G/6G architecture and contribute to the U.S. being the leader and first to reach the coveted position of Quantum Supremacy. Our growth has come about because we provide complex, custom solutions that our competitors shy away from. We have consistently provided the industry-leading SATCOM Low Noise Amplifier Solutions for the past 18 years and our new website showcases these products below, with its advanced search engine and listing of stock items. This allows us to provide immediate response to custom requirements, unwavering technical support and timely delivery. We will be continuing our R&D efforts to always be at the forefront of emerging technologies and using our advanced techniques and IP to provide tomorrow’s technology today, and improve everyone’s quality of life. In addition, we have the best assemblers, wirers, and technicians in the industry and can provide contract assembly of customers’ own designs. AmpliTech is in the process of scaling up its proprietary technology and design its own MMICs, subsystems, and other products to address the rapidly emerging, large volume commercial applications in the communications technology space.

AmpliTech, Inc. has a rich history in the design of microwave amplifiers and components, including a wide variety of product lines, from LNA’s (Low Noise Amplifiers) and MPA’s (Medium Power Amplifiers), to broadband telecom amplifiers for the microwave and fiber optic communications firms.

As such. we are defined by our expertise in custom designed amplifiers with special requirements such as military screening and space qualification. To provide for customers dealing with extremely low noise figure applications, we have excelled in the ever-growing cryogenic market as well. In short, all our customers agree that we provide simply the best product and services available in the industry while maintaining lower prices than most of our competitors and we do so in the most emergent of technologies on the industry landscape today. Our success is marked not only by our technical achievements, but also by an extremely respectable customer base which includes giants in the industry such as Motorola, ITT, Harris, Northrop Grumman, Raytheon, L3 Communications, Aeroflex, NASA, NIST and TRW (to name a few). Due to the achievements of its talented staff, AmpliTech has also received numerous Supplier Quality awards, including a Best Technology Award from one of the industry’s leading trade magazines. AmpliTech now trades on the NASDAQ public stock exchange under the ticker symbol AMPG which will help take our products to a broader and more global customer base, bringing cutting-edge technology to the masses and improving everyday quality of life for us all. The following are some of the many advantages that set us apart from our competition:

- Skilled and experienced Management Team

- Proven track record of performance and quality products

- Quantified IP and pending patents

- Virtual sole-source current supplier positions in various areas such as Quantum Computing, Military Avionics Equipment, High-speed SATCOM equipment, Telemetry applications

- Government GSA Award

- Strategic alignment with key vendors and customers to provide next generation products for 5G/6G. Quantum Cloud, High-speed Satellite Internet, IoT commercial markets

- Integration of Microwaves and Life Sciences to provide diagnostic and non-invasive detection systems and treatments for medical applications

- Much more!

Core Competencies

AmpliTech, Inc. offers:

- Standard state-of-the-art RF/Microwave components for the Commercial, SATCOM, Space, & Military

- markets.

- Highly customized RF/Microwave amplifiers that cover frequency ranges from 50 kHz to 100 GHz.

- Cryogenically cooled LNAs that achieve the lowest Noise Figures in the industry.

- High reliability Space-Qualified components that meet standards of excellence that no other

- manufacturer in the industry can match.

- Consulting services to provide technical support for any microwave components or systems design issues, even from other manufacturers.

Differentiator

AmpliTech, Inc. provides tangible advantages

over our competitors because:

- Superior product -even standard commercial

- units are built to MIL-883 guidelines.

- Most competitive pricing in the industry.

- Timely delivery.

- The highest possible level of customer service

- and technical support.

- We’ve developed designs for hundreds of

- customers who couldn’t find manufacturers to

- meet their stringent specs.

Key Executives

Fawad Maqbool (President and CEO (Founder) / CTO)

Mr. Maqbool has been in the microwave business for 30 years. He has a B.S.E.E. in microwave engineering and a B.S.E.E in Bio-Medical Engineering from CUNY and an M.S.E.E from Polytechnic University of New York. He founded AmpliTech in 2002 to fill the need for affordable, high quality, custom, state-of-the-art amplifiers and components. For almost 14 years as Department Head, he designed and developed state of the art amplifiers and components for MITEQ Inc., a leading supplier of microwave components and communications equipment. He then founded AmpliComm (acquired by Aeroflex, Inc. (ARXX) in 2000 to develop custom cryogenic and fiber optic amplifiers and components). Mr. Maqbool’s innovative management and design experience continues to push AmpliTech’s boundaries in microwave technology both in commercial and military markets. Mr. Maqbool has received various awards for innovative design and quality from suppliers such as Motorola, and publications such as Wireless Design and Technology magazine. AmpliTech continues to surpass it’s peers in performance, value, service, and innovation, and is poised to become the leading supplier of amplifiers and related components in the coming years.

Louisa Sanfratello (Chief Financial Officer)

Louisa Sanfratello, a CPA (Certified Public Accountant), has been a Certified Public Accountant working in numerous organizations in various industries since 1998. Her duties throughout this time and her time as an accountant for various charities and schools consisted of preparation of official financial documents as well as day-to-day financial management. Also tapped were her skills in the area of projection of cash flow and consequent requirements. Her professional career began in 1987 with the public accounting firm of Holtz, Rubinstein & CO., where she gathered two years of invaluable experience before earning her CPA and moving on to more challenging things.

Jorge Flores Chief Operating Officer

Having joined AmpliTech at the end of March in 2021, Mr. Flores brings with him over 30 years of combined Operations and Program Management experience. Prior to joining Amplitech’s executive leadership team, Mr. Flores held various leadership roles at Comtech Telecommunications, a Nasdaq listed corporation with over 2K employees and revenues of over $600M. Previous management roles included Director of Program Management Office, Business Unit Manager and Supply Line Management. Mr. Flores holds an MBA with concentration in Operations Management and Leadership from Dowling NY and, a BS in Business Administration, Major in Operations Management from NYIT.

John P. Pastore Director of Sales

Mr. Pastore has been in the microwave industry for 40 years. He has a B.S. in Business Management and has worked for many of the leaders in the RF/Microwave industry. Mr. Pastore is a hands-on professional whose experience spans over 20 years of progressive roles through which he has gained a rare blend of technical, manufacturing, customer service, and management skills and capabilities. His business savvy and deep understanding of the industry make him an extremely valuable asset to the company and an integral part of the AmpliTech team.

Sharps Technology, Inc. (NASDAQ: STSS) Has An Accelerated Near-Term Path Product For The Commercialization & Accelerated Revenue Growth!

With An Accelerated Near-Term Path For Product Commercialization And Expanded Manufacturing Capacity, Sharps Technology, Inc. (NASDAQ: STSS) Will Have The Ability To Support The Industry With Innovative, Market Leading Injectable Drug Delivery Solutions And Accelerate A Path Towards Revenue Growth.

Newly NASDAQ-traded Sharps Technology, Inc. (NASDAQ: STSS) offers innovative injectable syringe solutions to a global healthcare crisis that is not being talked about nearly enough.

- Most syringes waste a significant amount of injectable medicine which is thrown away with the used needle/syringe.

- This adds cost and reduces the availability of life-saving injectable drugs for us all. Whether we are looking at a pandemic response, hard-to-manufacture drug products, or managing long-term chronic illness, we can’t afford to waste this precious supply.

- The problem is sufficiently worrisome that the Federal Government is passing new legislation (January 1, 2023) requiring pharmaceutical companies to pay financial penalties for injectable drugs which are thrown away with the syringe and not injected into the patient.

Sharps Technology Company Summary

Company Name: Sharps Technology, Inc.

Ticker: STSS

Exchange: NASDAQ

Website: www.sharpstechnology.com

Sharps Technology Company Summary:

Sharps Technology is a medical device and pharmaceutical packaging company specializing in the development and manufacturing of innovative drug delivery systems.

The company’s product lines focus on low waste and ultra-low waste syringe technologies that incorporate both passive and active safety features.

These features protect front line healthcare workers from life-threatening needle stick injuries and protect the public from needle re-use.

Sharps Technology has extensive expertise in specialized prefilled syringe systems and ready to use processing.

The company has a manufacturing facility in Hungary and has partnered with Nephron Pharmaceuticals to expand its manufacturing capacity in the US.

Sharps Technology has agreed to manufactured in collaboration with Nephron Pharmaceuticals at the Inject EZ facility in West Columbia, South Carolina.

Jan. 10, 2023

Announces the advancement of the Company’s specialized prefillable syringe (“PFS”) system product line, which will be manufactured in collaboration with Nephron Pharmaceuticals at the Inject EZ facility in West Columbia, South Carolina.

Braden Miller, Sharps Director of Product Management, commented, “Sharps has developed an alternative high-quality solution to glass syringes through the use of inert polymers such as Cyclic Olefin Polymer (COP) and Cyclic Olefin Copolymer (COC), which offers a high-quality solution compared to traditional glass syringe systems.

These polymer syringes have many of the same characteristics as current pharmaceutical glass designs to support long term drug stability and increase shelf life for customers in the pharmaceutical segment. Polymer syringes can also be made into custom configurations, which can eliminate breakage, minimize dead space, reduce contamination, and support the development of custom devices including autoinjectors.

The ability to produce these innovative products using advanced manufacturing techniques creates additional advantages in the areas of quality, performance and safety when compared to similar glass syringe products. We look forward to introducing this line of next generation products to the market.”

Sharps Technology commenced manufacturing of their much-needed ultra-low waste smart safety syringe products in their European operation in Hungary.

Dec. 20, 2022

Announced they have commenced manufacturing of their much-needed ultra-low waste smart safety syringe products in their European operation in Hungary.

The plant has been producing products and will begin shipments to support the distribution and sales agreement with Nephron Pharmaceuticals by the end of the year, and customer agreements in Europe in early 2023. The production of these specialty syringe products will ramp up over the next several months to increase supply.

Sharps innovative syringe designs provide a beneficial set of features and advantages for the healthcare industry.

These syringe product features include a combination of ultra-low waste, passive and active safety, and reuse prevention.

By combining all these features and building them into a portfolio of syringe offerings, it will create product platforms that can help drive down the cost of healthcare treatments.

Sharps Technology signed of a distribution agreement with partner Nephron Pharmaceuticals

Dec. 13, 2022

Announced the signing of a distribution agreement with partner Nephron Pharmaceuticals. This is a strategic first step in building the larger partnership between the two companies and is in support of their recently announced collaboration.

“This distribution agreement opens so many possibilities for Sharps Technology and Nephron Pharmaceuticals,” commented Robert Hayes, Sharps Technology CEO. “The timing is perfect in that we are expanding our ability to supply innovative drug delivery systems at a point when the market is in demand for them. Through this distribution plan, Sharps Technology will be able to deliver increased capacity, driving growth for one of the high value product segments of our business.”

- Each year almost 20 billion injections are administered, globally and the World Health Organization (WHO) are advocating for the use of low waste syringes, with passive safety devices which engage automatically and have auto disable features.

- STSS anticipates signing its first product orders any moment now this development will represent a huge milestone for this recently debuted NASDAQ company, and should provide them with a solid foundation for growth.

- The company has raised $16M to scale operations in the coming quarters as they begin to meet the strong and growing demand for smart safety syringes

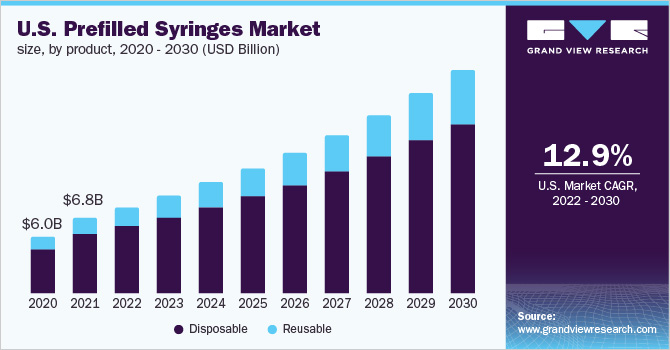

The global vaccines market is projected to grow from $61.04 billion in 2021 to $125.49 billion in 2028 at a CAGR of 10.8% in the forecast period, 2021-2028.

Vaccines are the most powerful and cost-effective way to protect billions of people in the world, and according to the WHO, immunization awareness and government initiatives have helped prevent 2-3 million deaths a year.

The Covid-19 outbreak led to a shutdown of syringe manufacturing which in turn led to a supply shortage at a global scale.

Mergers and acquisitions of companies such as STSS are highly attractive and are providing the needed innovation to the vaccine market.

The rise in the need for vaccinations and immunizations, plus a surge in the geriatric population, an increase in the number of surgical procedures, as well as a rise in chronic diseases have contributed to a demand for syringes.

Specialty Syringes – Vial Application

- Global Smart Syringe Market @ $14 billion USD by 2026 w10.0%+ CAGR

- Types: Auto-Disable Syringes and Safety Syringes

- Applications: Vaccination and Drug Delivery

- End Users: Hospitals, HMOs and Clinics

- Target Markets: North America, Europe, and ROW

- Sharps Technology listed as a supplier

The Pre-Filled Syringe (PFS)/Ready- To- Fill (RTF) syringe product segment will be a priority for the company through its collaboration with Nephron, and is expected to be a gamechanger for the company.

PRE-FILLED SYRINGES MARKET

- Pre-filled syringes have emerged as one of the fastest-growing choices for unit-dose medication as the pharmaceutical industry seeks new and more convenient drug delivery methods.

- With PFS/RTF syringes, pharmaceutical companies are able to minimize drug waste and increase product life span, while patients are able to self-administer injectable drugs at their home instead of the hospital.

Ready-To-Use – Pre-Filled Syringes:

- Types: Plastic and Type I B/S Glass

- Applications: Vaccines, Diabetes, Complex High Value Therapies (Gene-Therapy)

- End Users: Branded Pharma, CMOs, and Biologics

- Target Markets: North America

There is a growing demand for efficient and easy-to-use drug delivery devices and increasing efforts of healthcare professionals to reduce hospital errors are the principal factors driving the market growth.

STSS announced over the summer that it had completed its acquisition of Safegard Medical’s syringe manufacturing facility in Hungary.

The manufacturing facility is located 2 hours from Budapest (160km from Budapest Airport)

- 40,000 sq. ft. factory on 250,000 sq. ft. site

- 20-year history of safety syringe manufacturing

- FDA registered since 1999

- ISO 13485 certified

- CE Mark approved products

- Injection molding and assembly expertise

- ETO on-site sterilization capacity

“The acquisition of our first manufacturing facility is an important milestone in our transformation from an R&D-focused enterprise to revenue-generating commercial operations. With the acquisition now complete, with the addition of further assembly and manufacturing capacity, our team is confident we can deliver world-class products to meet the strong and growing demand for smart safety syringes, a market forecasted to reach $14 billion globally by 2026.”

Robert Hayes, CEO of Sharps Technology

IN SUMMARY

Sharps Technology, Inc. (NASDAQ: STSS) is the newest player in the drug delivery device market to go public and could see tremendous blue-sky growth in its future as it continues to ramp up its commercialization efforts.

- The Company recently announced a significant partnership with Nephron Pharmaceuticals with an anticipated launch into the market in early 2023.

- STSS anticipates shipping first orders of vial draw product by the beginning of 2023 and ready to fill product in mid-2023 to create initial revenue in 2023 and profits in early 2024.

- With the global shortage of syringes that comply with the World Health Organization (WHO) requirements, there is a strategic opportunity for STSS to take market share and support the healthcare industry with a better drug delivery platform.

- The combination of features and benefits for the Sharps products will save lives and eliminate the waste of critically needed medical treatments and therapies for the industry!

- There’s a key opportunity for STSS to grab a big piece of the market with its proprietary smart safety syringe technology designed to eliminate two million potentially infectious accidental needlestick injuries, as well as billions of dollars in medicine wasted with today’s inefficient syringes with their low-dead space feature.

To reiterate, the company anticipates signing its first distributor agreement during the fourth quarter of 2022, which could be at any moment!

CRXT Stock Price is back at it again, good gains! URGENT Report

Clarus Therapeutics Holdings Inc. CRXT Stock Price is up 14% in a month and 10% over the last 5 days.

Volume is interesting because it is down 65% but still up, very good sign actually.

Before we do, remember to stop what you are doing and 👇 Sign up for our newsletter to get the latest breakout stocks and trending stocks!

[thrive_leads id=’14274′]

Before we get started, I wanted to introduce myself to you. Hi 🙋♂️ I’m Alexander Goldman and I have been successfully trading breakout stocks and trending stocks for two decades now.

I’m now helping traders find breakout stocks. My claim to fame is the expert at finding trending stocks.

What do I mean by big winners?

Stocks that move more than 100% in a month! CRXT Stock Price could?

Does that always happen, NO! But, I’m very good! Take a look at this article I wrote, where I called 5 stocks, 3 losers and 2 winners and they all did what I thought!

The article is HERE where I shine a spotlight on trending stocks and breakout stocks!

Now, let’s go over some of the basic information on this stock before we get in the technical analysis

Clarus Therapeutics Holdings Inc. Company Information

Company Name: Clarus Therapeutics Holdings Inc.

Ticker: CRXT

Exchange: NASDAQ

Website: https://clarustherapeutics.com/

Clarus Therapeutics Holdings Company Summary:

Clarus Therapeutics Holdings, Inc. is a pharmaceutical company with expertise in developing androgen and metabolic therapies for men and women, including potential therapies for orphan indications. the company’s first commercial product is JATENZO. It is headquartered in Northbrook, IL.

Clarus Therapeutics stock price is due to News?

June 09, 2022

Announced that new data for JATENZO (testosterone undecanoate) will be presented in the form of an abstract at ENDO 2022, the Endocrine Society’s annual meeting, taking place at the Georgia World Congress Center in Atlanta June 11-14, 2022.

March 16, 2022

Announced the initiation of screening for the first patient in an investigator-initiated Phase 4 clinical trial designed to evaluate the efficacy and safety of JATENZO (testosterone undecanoate) oral softgel capsules for the treatment of adult hypogonadal men with chronic kidney disease (CKD). Clarus expects to announce results from the trial in the first half of 2023.

CRXT 5 Day Chart

CRXT Stock Price Technical Analysis:

Let’s go over 4 critical factors in regards to a trending stock.

The volume, which is basically demand of a stock is not consistent! In fact, it is down big right now, the good news it’s still up.

The news, is about as good as you can get!

The chart, it is bullish but it went up 85% in today and is now pulling back.

The fundamentals, the vertical is a very profitable one!

I believe Clarus Therapeutics stock could be a good one but not right now. I’m putting it on my watchlist and getting familiar with it, waiting for the right time. After this pullback it will consolidate and I will be watching it!

Sign up for our newsletter 👇👇👇 to get the latest HOT stocks and trending stocks!

[thrive_leads id=’14274′]

Ocular Therapeutix OCUL Stock Price is down 21%, can it go recover? URGENT REPORT

Ocular Therapeutix OCUL stock price is down -21% in the last 5 days & volume is up over 500%, but can it bounce?

In this in depth report, I look at 5 KPIs: Technical Analysis, Volume, News Cycle, Fundamentals & awareness campaigns.

Before we get started, I like being methodical and easy to understand so I have developed a ranking system for my stocks. I call it, Alexander Goldman’s “HOT Stock Ranking!”

The official heat level for OCUL is, a 🔥1 out of 4

Before I get ahead of myself and just jump right into this exciting breakout stock, I wanted to introduce myself.

Hello 🙋♂️ My name is Alexander Goldman. I have been trading small cap stocks, breakout stocks and trending stocks for 20 years now. I established the coveted HOT Stock Reporting system.

To find out more about my story, CLICK HERE

[thrive_leads id=’28419′]

Ocular Therapeutix Company Information

Company Name: Ocular Therapeutix Inc.

Ticker: OCUL

Exchange: NASDAQ

Website: https://www.ocutx.com/

Ocular Therapeutix Company Summary:

Ocular Therapeutix, Inc. is a biopharmaceutical company, which engages in the development and commercialization of therapies for diseases and conditions of the eye. Its product pipeline includes Dextenza, OTX-TP, and OTX-TIC. The company was founded by Amarpreet S. Sawhney and Farhad Khosravi on September 12, 2006 and is headquartered in Bedford, MA.

OCUL stock price is due to News?

The U.S. Commercial Uptake of DEXTENZA.

- Net product revenue of DEXTENZA® for the quarter was $12.5 million, an 87% increase over the first quarter of 2021.

- In-market purchases were nearly 28,000 billable units for the quarter, with March accounting for approximately 10,500 billable units, setting a new record for a calendar month.

Compare Ocular Therapeutix OCUL stock Price vs Competitors

KalVista Pharmaceuticals KAVL HERE

Anika Therapeutics ANIK HERE

Trending Stock OCUL 5 Day Chart

OCUL Stock Price HOT Stock Grade:

OCUL is, a 🔥1 out of 4 . Here are my takeaways on it and why it is just a 1 out of 4. Hint, the financials are great and the news but it’s still a 1 of 4 because the chart is my primary KPI.

OCUL Trading Volume

The volume, the normal trading volume is established by the previous 30 days of trading and this stock is trading at an increase of 502% over the average. Normally, this indicates a higher demand in the stock or a sell off (selling pressure).

Trading 101: volume is measured in the number of shares traded. Traders look to volume to determine liquidity and combine changes in volume with technical indicators to make trading decisions. So, let’s take a look at the technical indicators.

OCUL Technicals

The technical analysis “chart reading”, this stock is down 22% on the 5 day chart and the overall trend for the long term chart, the 1 month, is down 31%. INSERT ANNALYSIS

Trading 101: Technical indicators are technical tools that help in analyzing the movement in the stock prices whether the ongoing trend is going to continue or reverse. It helps the traders to make entry and exit decisions of a particular stock. Technical indicators can be leading or lagging indicators.

OCUL News Cycle

The news, there is significant news, “Net product revenue of DEXTENZA® for the quarter was $12.5 million, an 87% increase over the first quarter of 2021.”

OCUL Fundamentals

The fundamentals, how a company is doing financially can be a serious KPI and there is no exciting financial filings associated with this stock.

Trading 101: Fundamental trading is a method where a trader focuses on company-specific events to determine which stock to buy and when to buy it. Trading on fundamentals is more closely associated with a buy-and-hold strategy rather than short-term trading.

OCUL Awareness

Marketing efforts “Awareness Campaigns” Just like advertising a prroduct is important, advertising a publicly traded company during a news cycle is critical for the stock price of a company.

I have not found marketing efforts around the investor awareness of this company. So, I have awarded this stock a 1 out of 4. Do you agree? Write me a line at [email protected]

Again, two heads are better than one, let’s work together to have the best trading year of our lives!

To receive my 🔥🔥🔥🔥 HOT stock as a thank you for joining our FREE newsletter, sign up today.

To find out more about my story, CLICK HERE

👇 Sign up for our newsletter to get the latest 🔥🔥🔥🔥 HOT stocks and we can compare notes!👇

[thrive_leads id=’28419′]

URGENT, ANY Stock Price pulled back and is consolidating, is it time to buy?

Sphere 3D Corp. ANY stock price finally showed some life after the last 6 months it fell and fell. ANY is up 9% in the last 5 days with a volume spike of 21%. Let’s evaluate the factors to determine just how hot the stock is.

The official heat level for ANY is, a 🔥🔥🔥 3 out of 5.

Continue reading to see why I think it is just a 3 out of 5. There is some shocking takeaways from this article that you must read if you are interested in ANY.

If you are interested in finding out more about me, famed stock picker, Alexander Goldman or if you’re interested in my HOT grading system, sign up today, it’s FREE!

👇 Sign up for our newsletter to get the latest 🔥🔥🔥🔥 HOT stocks and trending stocks!👇 In fact, I will send you personally a 🔥🔥🔥🔥 HOT stock as a thank you for joining our FREE newsletter.

[thrive_leads id=’14274′]

Before I go over this exciting trending stock, I wanted to introduce myself. Hello 🙋♂️ My name is Alexander Goldman. I have been trading, at a very high level, breakout stocks and trending stocks for 20 years now. I’m accredited for establishing the coveted HOT grading system for trending stocks.

I found my home at Small Cap exclusive 4 years ago. Now, I’m helping traders find breakout stocks. Not to sound egotistical but I’m very good at finding small cap stocks that are winners.

What do I mean by big winners?

Stocks that move more than 100% in a month! ANY Stock Price could?

Does that always happen, NO! But, I’m very consistent! Take a look at this article I wrote below, where I called 5 stocks, 3 losers and 2 winners and they all did what I thought!

The article is HERE and I shine a spotlight on these breakout stocks and also those losers!

Now, let’s go over some of the basic information on this stock before we get in the technical analysis and how I came up with HOT grade.

Sphere 3D Company Information

Company Name: Sphere 3D Corp.

Ticker: ANY

Exchange: NASDAQ

Website: https://sphere3d.gcs-web.com/

Hot Stock Rating: 🔥🔥🔥

Breakout Stock Sphere 3D Company Summary:

Sphere 3D Corp. engages in the provision of solutions for stand-alone storage and technologies that converge the traditional silos of compute, storage and network into one integrated hyper-converged or converged solution. It offers solutions to the call centers, education, healthcare, professional firms, and telecommunication industries. The company was founded on May 2, 2007 and is headquartered in Toronto, Canada.

ANY stock price is due to News?

April 29th

Announced its plans to release financial results for the first quarter 2022 on Monday, May 16, 2022, after market close. A copy of the Company’s news release will be available on the Sphere 3D website at www.sphere3d.com.

Sphere 3D will expand the content of its earnings release to share additional information with its shareholders. The upcoming news release will include the following:

- First-quarter financial results

- CEO comments

- Bitcoin production and holdings update

- Bitcoin miners delivery update

- Merger termination insights

Trending Stock ANY 5 Day Chart

ANY Stock Price HOT Stock Grade:

The official heat level for ANY is, a 🔥🔥🔥 3 out of 5 . Continue reading to see why I think it is just a 2 out of 5. Here are my takeaways on SMCE and why it is just a 2 out of 5.

The volume, which is basically demand of a stock is solid with a 98% increase over the previous 30 day average.

The news, there is no significant news cycle circulating around SMCE stock price.

The chart, it is reversed its one month trend and 5 day but the 6 month is still bearish.

The fundamentals, SPHERE 3D is losing money but the trend is slowing down and there might be a change of circumstance soon based on the prevailing trend.

Marketing efforts, I have not found any awareness campaigns which kept it from a 4 out of 5.

To receive my 🔥🔥🔥🔥🔥 HOT stock as a thank you for joining our FREE newsletter, sign up today.

👇 Sign up for our newsletter to get the latest 🔥🔥🔥🔥🔥 HOT stocks and trending stocks!👇

[thrive_leads id=’14274′]

Infinity Pharmaceuticals INFI Stock Price has consolidated and could be ready for a run? URGENT URGENT

Infinity Pharmaceuticals INFI stock price is finally showing some life as it possibly reverses trend. SMCE is up 7% in the last 5 days and I will be evaluating many factors to determine just how hot the stock is.

The official heat level for INFI is, a 🔥🔥 2 out of 5.

Continue reading to see why I think it is just a 2 out of 5. There is some shocking takeaways from this article that you must read if you are interested in SMCE.

If you are interested in finding out more about me, famed stock picker, Alexander Goldman or if you’re interested in my HOT grading system, sign up today, it’s FREE!

👇 Sign up for our newsletter to get the latest 🔥🔥🔥🔥🔥 HOT stocks and trending stocks!👇 In fact, I will send you personally a 🔥🔥🔥🔥 HOT stock as a thank you for joining our FREE newsletter.

[thrive_leads id=’14274′]

Before I go over this exciting trending stock, I wanted to introduce myself. Hello 🙋♂️ My name is Alexander Goldman. I have been trading, at a very high level, breakout stocks and trending stocks for 20 years now. I’m accredited for establishing the coveted HOT grading system for trending stocks.

I found my home at Small Cap exclusive 4 years ago. Now, I’m helping traders find breakout stocks. Not to sound egotistical but I’m very good at finding small cap stocks that are winners.

What do I mean by big winners?

Stocks that move more than 100% in a month! INFI Stock Price could?

Does that always happen, NO! But, I’m very consistent! Take a look at this article I wrote below, where I called 5 stocks, 3 losers and 2 winners and they all did what I thought!

The article is HERE and I shine a spotlight on these breakout stocks and also those losers!

Now, let’s go over some of the basic information on this stock before we get in the technical analysis and how I came up with HOT grade.

Infinity Pharmaceuticals Company Information

Company Name: Infinity Pharmaceuticals Inc.

Ticker: INFI

Exchange: NASDAQ

Website: https://www.infi.com/

Breakout Stock Infinity Pharmaceuticals Company Summary:

Infinity Pharmaceuticals, Inc. operates as a biopharmaceutical company, which engages in discovering, developing and delivering medicines for people with cancer. It focuses on drug development. The company was founded by Steven H. Holtzman on March 22, 1995 and is headquartered in Cambridge, MA.

INFI stock price is due to News?

March 29th

Announced its full year 2021 financial results and provided corporate highlights.

“Based on the strength and breadth of eganelisib’s activity across mTNBC and mUC as well as ovarian cancer, SCCHN, and melanoma, we raised $92 million in early 2021 to advance eganelisib to its first registration-enabling study by the end of this year.

Trending Stock INFI 5 Day Chart

INFI Stock Price HOT Stock Grade:

The official heat level for INFI is, a 🔥🔥 2 out of 5 . Continue reading to see why I think it is just a 2 out of 5. Here are my takeaways on INFI and why it is just a 2 out of 5.

The volume, which is basically demand of a stock is significantly higher than thee norm at a 77% ratio. Hence, that is a strong indicator of interest which is one variable of PPS.

The news, there is significant news in the way of the 92 million dollars. This news is probably driving the volume spike.

The chart, it is neutral as of the 1 day and slightly bullish on the 5 day.

The fundamentals, there is no exciting financial filings associated with this stock.

Marketing efforts, I have not found marketing efforts around the investor awareness of this company.

In conclusion, I am in a hold pattern with INFI and will await a break of $1.20, a resistance point, to confirm a true reversal.

To receive my 🔥🔥🔥🔥🔥 HOT stock as a thank you for joining our FREE newsletter, sign up today.

👇 Sign up for our newsletter to get the latest 🔥🔥🔥🔥🔥 HOT stocks and trending stocks!👇

[thrive_leads id=’14274′]