Schuler Jack W Picked Up Biolase Inc. (NASDAQ:BIOL) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Biolase Inc. (NASDAQ:BIOL) reported that Schuler Jack W has picked up 20,728,060 of common stock as of 2017-04-17.

The acquisition brings the aggregate amount owned by Schuler Jack W to a total of 20,728,060 representing approximately 28.71% stake in the company.

For those not familiar with the company, BIOLASE, Inc. (BIOLASE) is a medical device company that develops, manufactures, markets and sells laser systems in dentistry and medicine. The Company markets, sells, and distributes dental imaging equipment, including cone beam digital x-rays and computer-aided design (CAD)/computer-aided manufacturing (CAM) intra-oral scanners, in-office, chair-side milling machines and three-dimensional (3-D) printers. It offers two categories of laser system products: WaterLase (all-tissue) systems and Diode (soft tissue) systems. Its brand, WaterLase, uses a combination of water and laser energy to perform procedures performed using drills, scalpels, and other traditional dental instruments for cutting soft and hard tissue. It also offers its Diode laser systems to perform soft tissue, pain therapy, and cosmetic procedures, including teeth whitening. Its Waterlase and Diode systems use disposable laser tips of differing sizes and shapes depending on the procedures being performed.

A glance at Biolase Inc. (NASDAQ:BIOL)’s key stats reveals a current market capitalization of 93.50 Million based on 67.66 Million shares outstanding and a price at last close of $1.32 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2015-10-21, Schuler picked up 33,762 at a purchase price of $0.95. This brings their total holding to 4,213,429 as of the date of the filing.

On the sell side, the most recent transaction saw Mulder unload 5,000 shares at a sale price of $1.25. This brings their total holding to 0.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Biolase Inc. (NASDAQ:BIOL) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Here’s Who Just Picked Up Angiodynamics Inc. (NASDAQ:ANGO) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Angiodynamics Inc. (NASDAQ:ANGO) reported that Avista Capital Partners Gp, Llc. has picked up 2,333,008 of common stock as of 2017-04-14.

The acquisition brings the aggregate amount owned by Avista Capital Partners Gp, Llc. to a total of 2,333,008 representing a 6.3% stake in the company.

For those not familiar with the company, AngioDynamics, Inc. designs, manufactures and sells a range of medical, surgical and diagnostic devices used by professional healthcare providers for vascular access, for the treatment of peripheral vascular disease and for use in oncology and surgical settings. The Company’s devices are used in minimally invasive, image-guided procedures. The Company offers products within three product groupings: Peripheral Vascular, Vascular Access and Oncology/Surgery. The Company’s Peripheral Vascular products include Fluid Management, Venous, Thrombus Management, as well as other core products. The Company’s BioFlo products incorporate Endexo Technology into the manufacturing and design of its Vascular Access products. Its Oncology/Surgery product offerings include its Microwave Ablation products, Radiofrequency Ablation (RFA) and its NanoKnife product lines.

A glance at Angiodynamics Inc. (NASDAQ:ANGO)’s key stats reveals a current market capitalization of 558.82 Million based on 36.79 Million shares outstanding and a price at last close of $15.19 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2014-04-14, Kapusta picked up 1,000 at a purchase price of $13.90. This brings their total holding to 27,005 as of the date of the filing.

On the sell side, the most recent transaction saw Burgstahler unload 384,184 shares at a sale price of $16.00. This brings their total holding to 381,406.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Angiodynamics Inc. (NASDAQ:ANGO) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Guess Who Picked Up Sunshine Heart Inc. (NASDAQ:SSH) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Sunshine Heart Inc. (NASDAQ:SSH) reported that Choi Ki Yong has picked up 245,000 of common stock as of 2017-03-28.

The acquisition brings the aggregate amount owned by Choi Ki Yong to a total of 245,000 representing a 9.1% stake in the company.

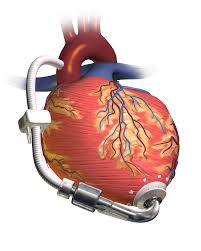

For those not familiar with the company, Sunshine Heart is a global medical device company founded by a cardiac surgeon that saw an incredible opportunity for how to treat heart failure. Heart failure (HF) affects millions and is a progressive condition that prevents patients from living normal lives. Sunshine Heart’s C-Pulse® Heart Assist System has CE Mark in Europe and is in a clinical study in the United States to determine if the C-Pulse System is safe and effective for treating moderate to severe heart failure. C-Pulse therapy is designed to reduce overall heart failure symptoms, improve quality of life, and reduce re-hospitalizations.

A glance at Sunshine Heart Inc. (NASDAQ:SSH)’s key stats reveals a current market capitalization of 4.68 Million based on 1.74 Million shares outstanding and a price at last close of $2.31 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2016-11-28, Erb picked up 80,000 at a purchase price of $0.22. This brings their total holding to 464,128 as of the date of the filing.

On the sell side, the most recent transaction saw Drayton unload 20 shares at a sale price of $5.27. This brings their total holding to 740.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Sunshine Heart Inc. (NASDAQ:SSH) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Here’s Who Just Picked Up Endologix Inc. (NASDAQ:ELGX) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Endologix Inc. (NASDAQ:ELGX) reported that Brown Capital Management Llc. has picked up 8,755,102 of common stock as of 2017-03-07.

The acquisition brings the aggregate amount owned by Brown Capital Management Llc. to a total of 8,755,102 representing a 10.58% stake in the company.

For those not familiar with the company, Endologix, Inc. is engaged in developing, manufacturing, marketing and selling medical devices for the treatment of aortic disorders. The Company’s products are intended for the treatment of abdominal aortic aneurysms (AAA). The AAA products are built on one of two platforms, including traditional minimally invasive endovascular repair (EVAR) or endovascular sealing (EVAS), its solution for sealing the aneurysm sac while maintaining blood flow through two blood flow lumens. The EVAR products include the Endologix AFX Endovascular AAA System (AFX), the VELA Proximal Endograft (VELA) and the Endologix Powerlink with Intuitrak Delivery System (Intuitrak). The EVAS product is the Nellix EndoVascular Aneurysm Sealing System (Nellix EVAS System). Its EVAS product is the Nellix EndoVascular Aneurysm Sealing System (Nellix EVAS System). It offers accessories to facilitate the optimal delivery of its EVAR products, including compatible guidewires, snares, and catheter introducer sheaths.

A glance at Endologix Inc. (NASDAQ:ELGX)’s key stats reveals a current market capitalization of 519.30 Million based on 82.93 Million shares outstanding and a price at last close of $6.54 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2016-12-14, Zenty picked up 3,000 at a purchase price of $6.51. This brings their total holding to 41,574 as of the date of the filing.

On the sell side, the most recent transaction saw Lima unload 4,710 shares at a sale price of $11.68. This brings their total holding to 37,884.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Endologix Inc. (NASDAQ:ELGX) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.