CYBIN (CYBN) ISSUED A BUY RATING WITH A 1,539% UPSIDE!

Good Morning Traders, Cybin CYBN issued blockbuster news this morning that the FDA has cleared their proprietary molecule for the phase 2a study. Take a look at the news below and get ready for a big day. Cybin Inc. (NYSE American: CYBN) today announced that the U.S. Food and Drug Administration (“FDA”) has cleared its […]

Coeptis Therapeutics Could Revolutionize The Treatment of Cancer

Small Cap Exclusive is proud to present our research report on Coeptis Therapeutics a NASDAQ biopharmaceutical company trading under the ticker (COEP) that is developing innovative treatments in the field of cancer. Take a look at this chart below! There is very little resistance in L2 with market makers and the slightest bit of volume […]

Sharps Technology, Inc. (NASDAQ: STSS) Has An Accelerated Near-Term Path Product For The Commercialization & Accelerated Revenue Growth!

With An Accelerated Near-Term Path For Product Commercialization And Expanded Manufacturing Capacity, Sharps Technology, Inc. (NASDAQ: STSS) Will Have The Ability To Support The Industry With Innovative, Market Leading Injectable Drug Delivery Solutions And Accelerate A Path Towards Revenue Growth.

Newly NASDAQ-traded Sharps Technology, Inc. (NASDAQ: STSS) offers innovative injectable syringe solutions to a global healthcare crisis that is not being talked about nearly enough.

- Most syringes waste a significant amount of injectable medicine which is thrown away with the used needle/syringe.

- This adds cost and reduces the availability of life-saving injectable drugs for us all. Whether we are looking at a pandemic response, hard-to-manufacture drug products, or managing long-term chronic illness, we can’t afford to waste this precious supply.

- The problem is sufficiently worrisome that the Federal Government is passing new legislation (January 1, 2023) requiring pharmaceutical companies to pay financial penalties for injectable drugs which are thrown away with the syringe and not injected into the patient.

Sharps Technology Company Summary

Company Name: Sharps Technology, Inc.

Ticker: STSS

Exchange: NASDAQ

Website: www.sharpstechnology.com

Sharps Technology Company Summary:

Sharps Technology is a medical device and pharmaceutical packaging company specializing in the development and manufacturing of innovative drug delivery systems.

The company’s product lines focus on low waste and ultra-low waste syringe technologies that incorporate both passive and active safety features.

These features protect front line healthcare workers from life-threatening needle stick injuries and protect the public from needle re-use.

Sharps Technology has extensive expertise in specialized prefilled syringe systems and ready to use processing.

The company has a manufacturing facility in Hungary and has partnered with Nephron Pharmaceuticals to expand its manufacturing capacity in the US.

Sharps Technology has agreed to manufactured in collaboration with Nephron Pharmaceuticals at the Inject EZ facility in West Columbia, South Carolina.

Jan. 10, 2023

Announces the advancement of the Company’s specialized prefillable syringe (“PFS”) system product line, which will be manufactured in collaboration with Nephron Pharmaceuticals at the Inject EZ facility in West Columbia, South Carolina.

Braden Miller, Sharps Director of Product Management, commented, “Sharps has developed an alternative high-quality solution to glass syringes through the use of inert polymers such as Cyclic Olefin Polymer (COP) and Cyclic Olefin Copolymer (COC), which offers a high-quality solution compared to traditional glass syringe systems.

These polymer syringes have many of the same characteristics as current pharmaceutical glass designs to support long term drug stability and increase shelf life for customers in the pharmaceutical segment. Polymer syringes can also be made into custom configurations, which can eliminate breakage, minimize dead space, reduce contamination, and support the development of custom devices including autoinjectors.

The ability to produce these innovative products using advanced manufacturing techniques creates additional advantages in the areas of quality, performance and safety when compared to similar glass syringe products. We look forward to introducing this line of next generation products to the market.”

Sharps Technology commenced manufacturing of their much-needed ultra-low waste smart safety syringe products in their European operation in Hungary.

Dec. 20, 2022

Announced they have commenced manufacturing of their much-needed ultra-low waste smart safety syringe products in their European operation in Hungary.

The plant has been producing products and will begin shipments to support the distribution and sales agreement with Nephron Pharmaceuticals by the end of the year, and customer agreements in Europe in early 2023. The production of these specialty syringe products will ramp up over the next several months to increase supply.

Sharps innovative syringe designs provide a beneficial set of features and advantages for the healthcare industry.

These syringe product features include a combination of ultra-low waste, passive and active safety, and reuse prevention.

By combining all these features and building them into a portfolio of syringe offerings, it will create product platforms that can help drive down the cost of healthcare treatments.

Sharps Technology signed of a distribution agreement with partner Nephron Pharmaceuticals

Dec. 13, 2022

Announced the signing of a distribution agreement with partner Nephron Pharmaceuticals. This is a strategic first step in building the larger partnership between the two companies and is in support of their recently announced collaboration.

“This distribution agreement opens so many possibilities for Sharps Technology and Nephron Pharmaceuticals,” commented Robert Hayes, Sharps Technology CEO. “The timing is perfect in that we are expanding our ability to supply innovative drug delivery systems at a point when the market is in demand for them. Through this distribution plan, Sharps Technology will be able to deliver increased capacity, driving growth for one of the high value product segments of our business.”

- Each year almost 20 billion injections are administered, globally and the World Health Organization (WHO) are advocating for the use of low waste syringes, with passive safety devices which engage automatically and have auto disable features.

- STSS anticipates signing its first product orders any moment now this development will represent a huge milestone for this recently debuted NASDAQ company, and should provide them with a solid foundation for growth.

- The company has raised $16M to scale operations in the coming quarters as they begin to meet the strong and growing demand for smart safety syringes

The global vaccines market is projected to grow from $61.04 billion in 2021 to $125.49 billion in 2028 at a CAGR of 10.8% in the forecast period, 2021-2028.

Vaccines are the most powerful and cost-effective way to protect billions of people in the world, and according to the WHO, immunization awareness and government initiatives have helped prevent 2-3 million deaths a year.

The Covid-19 outbreak led to a shutdown of syringe manufacturing which in turn led to a supply shortage at a global scale.

Mergers and acquisitions of companies such as STSS are highly attractive and are providing the needed innovation to the vaccine market.

The rise in the need for vaccinations and immunizations, plus a surge in the geriatric population, an increase in the number of surgical procedures, as well as a rise in chronic diseases have contributed to a demand for syringes.

Specialty Syringes – Vial Application

- Global Smart Syringe Market @ $14 billion USD by 2026 w10.0%+ CAGR

- Types: Auto-Disable Syringes and Safety Syringes

- Applications: Vaccination and Drug Delivery

- End Users: Hospitals, HMOs and Clinics

- Target Markets: North America, Europe, and ROW

- Sharps Technology listed as a supplier

The Pre-Filled Syringe (PFS)/Ready- To- Fill (RTF) syringe product segment will be a priority for the company through its collaboration with Nephron, and is expected to be a gamechanger for the company.

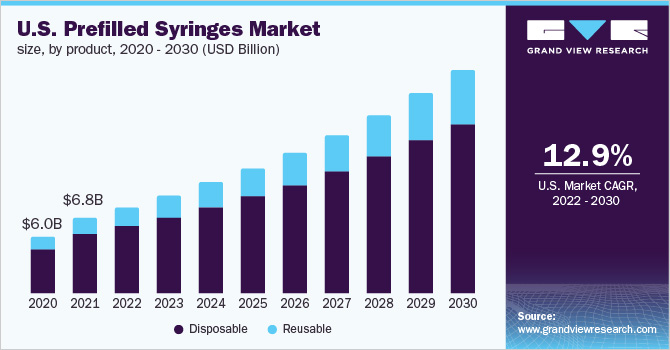

PRE-FILLED SYRINGES MARKET

- Pre-filled syringes have emerged as one of the fastest-growing choices for unit-dose medication as the pharmaceutical industry seeks new and more convenient drug delivery methods.

- With PFS/RTF syringes, pharmaceutical companies are able to minimize drug waste and increase product life span, while patients are able to self-administer injectable drugs at their home instead of the hospital.

Ready-To-Use – Pre-Filled Syringes:

- Types: Plastic and Type I B/S Glass

- Applications: Vaccines, Diabetes, Complex High Value Therapies (Gene-Therapy)

- End Users: Branded Pharma, CMOs, and Biologics

- Target Markets: North America

There is a growing demand for efficient and easy-to-use drug delivery devices and increasing efforts of healthcare professionals to reduce hospital errors are the principal factors driving the market growth.

STSS announced over the summer that it had completed its acquisition of Safegard Medical’s syringe manufacturing facility in Hungary.

The manufacturing facility is located 2 hours from Budapest (160km from Budapest Airport)

- 40,000 sq. ft. factory on 250,000 sq. ft. site

- 20-year history of safety syringe manufacturing

- FDA registered since 1999

- ISO 13485 certified

- CE Mark approved products

- Injection molding and assembly expertise

- ETO on-site sterilization capacity

“The acquisition of our first manufacturing facility is an important milestone in our transformation from an R&D-focused enterprise to revenue-generating commercial operations. With the acquisition now complete, with the addition of further assembly and manufacturing capacity, our team is confident we can deliver world-class products to meet the strong and growing demand for smart safety syringes, a market forecasted to reach $14 billion globally by 2026.”

Robert Hayes, CEO of Sharps Technology

IN SUMMARY

Sharps Technology, Inc. (NASDAQ: STSS) is the newest player in the drug delivery device market to go public and could see tremendous blue-sky growth in its future as it continues to ramp up its commercialization efforts.

- The Company recently announced a significant partnership with Nephron Pharmaceuticals with an anticipated launch into the market in early 2023.

- STSS anticipates shipping first orders of vial draw product by the beginning of 2023 and ready to fill product in mid-2023 to create initial revenue in 2023 and profits in early 2024.

- With the global shortage of syringes that comply with the World Health Organization (WHO) requirements, there is a strategic opportunity for STSS to take market share and support the healthcare industry with a better drug delivery platform.

- The combination of features and benefits for the Sharps products will save lives and eliminate the waste of critically needed medical treatments and therapies for the industry!

- There’s a key opportunity for STSS to grab a big piece of the market with its proprietary smart safety syringe technology designed to eliminate two million potentially infectious accidental needlestick injuries, as well as billions of dollars in medicine wasted with today’s inefficient syringes with their low-dead space feature.

To reiterate, the company anticipates signing its first distributor agreement during the fourth quarter of 2022, which could be at any moment!

Guess Who Picked Onconova Therapeutics Inc. (NASDAQ:ONTX) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Onconova Therapeutics Inc. (NASDAQ:ONTX) reported that Sabby Capital has picked up 702,896 of common stock as of 2017-05-01.

The acquisition brings the aggregate amount owned by Sabby Capital to a total of 702,896 representing less than 7.61% stake in the company.

For those not familiar with the company, Onconova Therapeutics, Inc. is a clinical-stage biopharmaceutical company. The Company operates through the identification and development of oncology therapeutics segment. It is focused on discovering and developing small molecule drug candidates to treat cancer. The Company has created a targeted anti-cancer agents designed to work against specific cellular pathways that are important to cancer cells. It has over three clinical-stage product candidates and various preclinical programs that target kinases, cellular metabolism or cell division in preclinical development. The Company’s lead product candidate, rigosertib, is being tested in both intravenous (IV) and oral formulations as a single agent, and the oral formulation is also being tested in combination with azacitidine, in clinical trials for patients with myelodysplastic syndromes (MDS), and related cancers. Its other product candidates include Briciclib and Recilisib.

A glance at Onconova Therapeutics Inc. (NASDAQ:ONTX) key stats reveals a current market capitalization of 22.72 Million based on 9.24 Million shares outstanding and a price at last close of $2.35 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2017-04-26, Bienen picked up 3,810 at a purchase price of $2.10. This brings their total holding to 12,724 as of the date of the filing.

On the sell side, the most recent transaction saw Kumar unload 20,000 shares at a sale price of 15.11. This brings their total holding to 276,500.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Onconova Therapeutics Inc. (NASDAQ:ONTX) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Arena Pharmaceuticals Inc (NASDAQ:ARNA) is Attracting Smart Money

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Arena Pharmaceuticals Inc (NASDAQ:ARNA) reported that Great Point Partners has picked up 30,000,000 of common stock as of 2017-04-28.

The acquisition brings the aggregate amount owned by Great Point Partners to a total of 30,000,000 representing less than 9.75% stake in the company.

For those not familiar with the company, Arena Pharmaceuticals, Inc. is a biopharmaceutical company. The Company is focused on developing small molecule drugs across a range of therapeutic areas. The Company has three primary investigational clinical programs: etrasimod (APD334) in Phase II evaluation for ulcerative colitis, APD371 entering Phase II evaluation for the treatment of pain associated with Crohn’s disease, and ralinepag (APD811) in Phase II evaluation for pulmonary arterial hypertension (PAH). The Company’s drug, Lorcaserin, is approved for marketing in the United States and South Korea for the indication of weight management. The Company’s drug candidates in clinical development include APD334 for autoimmune diseases, ralinepag for vascular diseases and APD371 for pain. The Company’s programs under collaboration include nelotanserin for dementia-associated psychosis, temanogrel for thrombotic diseases, and an undisclosed orphan GPCR for central nervous system (CNS) indication(s).

A glance at Arena Pharmaceuticals Inc (NASDAQ:ARNA)’s key stats reveals a current market capitalization of 409.39 Million based on 307.73 Million shares outstanding and a price at last close of $1.34 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2017-04-26, Munshi picked up 50,000 at a purchase price of $1.41. This brings their total holding to 51,875 as of the date of the filing.

On the sell side, the most recent transaction saw White unload 18,728 shares at a sale price of $1.99. This brings their total holding to 85,529.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Arena Pharmaceuticals Inc (NASDAQ:ARNA) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Chp Iii Lp Picked Teladoc Inc. (NYSE:TDOC) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Teladoc Inc. (NYSE:TDOC)reported that Chp Iii Lp has picked up 2,480,468 of common stock as of 2017-04-28.

The acquisition brings the aggregate amount owned by Chp Iii Lp to a total of 2,480,468 representing less than 4.6% stake in the company.

For those not familiar with the company, Teladoc, Inc. is a telehealth company. The Company offers telehealth platform, delivering on-demand healthcare anytime, anywhere, through mobile devices, the Internet, video and phone. The Company’s solution connects its Members, with its over 3,000 board certified physicians and behavioral health professionals treating a range of conditions and cases from acute diagnoses, such as upper respiratory infection, urinary tract infection and sinusitis to dermatological conditions, anxiety and smoking cessation. As of December 31, 2016, it served over 7,500 employers, health plans, health systems and other entities. As of December 31, 2016, these clients collectively purchased access to its solution for more than 17.5 million Members. As of December 31, 2016, it had over 30 health plans as Clients. Its solutions consist of an integrated technology platform, Provider network, consumer engagement strategies and entrenched distribution channels.

A glance at Teladoc Inc. (NYSE:TDOC)’s key stats reveals a current market capitalization of 1.31 Billion based on 54.36 Million shares outstanding and a price at last close of $24.80 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2016-03-17, Outland picked up 10,000 at a purchase price of $10.70. This brings their total holding to 69,089 as of the date of the filing.

On the sell side, the most recent transaction saw King unload 5,000 shares at a sale price of $25.75. This brings their total holding to 61,459.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Teladoc Inc. (NYSE:TDOC)

as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Here is Who Picked Incyte Corp (NASDAQ:INCY) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC),Incyte Corp (NASDAQ:INCY) reported that Baker Bros. Advisors has picked up 34,295,011 of common stock as of 2017-04-28.

The acquisition brings the aggregate amount owned by Baker Bros. Advisors to a total of 34,295,011 representing less than 16.7% stake in the company.

For those not familiar with the company, Incyte Corporation is a biopharmaceutical company focused on the discovery, development and commercialization of therapeutics. Its portfolio includes compounds in various stages, ranging from preclinical to late-stage development, and commercialized products, such as JAKAFI (ruxolitinib) and ICLUSIG (ponatinib). JAKAFI (ruxolitinib) is indicated for the treatment of patients with intermediate or high risk myelofibrosis (MF) and for the treatment of patients with polycythemia vera (PV) having had an inadequate response to or are intolerant of hydroxyurea. As of December 31, 2016, the Food and Drug Administration had granted JAKAFI orphan drug status for MF, PV and essential thrombocythemia. The primary target for ICLUSIG is B Cell Receptor-ABL, an abnormal tyrosine kinase that is expressed in chronic myeloid leukemia and Philadelphia-chromosome positive acute lymphoblastic leukemia. The Company also has a portfolio of selective janus associated kinases 1 (JAK1) inhibitors.

A glance at Incyte Corp (NASDAQ:INCY)’s key stats reveals a current market capitalization of 25.65 Billion based on 204.59 Million shares outstanding and a price at last close of $124.28 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2017-04-13, Bienaime picked up 1,000 at a purchase price of $139.66. This brings their total holding to 3,177 as of the date of the filing.

On the sell side, the most recent transaction saw Stein unload 5,000 shares at a sale price of $137.91. This brings their total holding to 14,648.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Incyte Corp (NASDAQ:INCY)

as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Here is Who Just Picked Ptc Therapeutics Inc. (NASDAQ:PTCT)

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Ptc Therapeutics Inc. (NASDAQ:PTCT) reported that Complete Pharma Holdings Ii, Llc. has picked up 6,683,598 of common stock as of 2017-04-27.

The acquisition brings the aggregate amount owned by Complete Pharma Holdings Ii, Llc. to a total of 6,683,598 representing less than 16.2% stake in the company.

For those not familiar with the company, PTC Therapeutics, Inc. is a biopharmaceutical company. The Company is focused on the discovery, development and commercialization of medicines using its expertise in ribonucleic acid (RNA) biology. Its product pipeline includes Ataluren (Translarna), PTC596 and RG7916. Its product candidate, ataluren, is an orally administered small-molecule compound for the treatment of patients with genetic disorders due to a nonsense mutation. Ataluren is in clinical development for the treatment of Duchenne muscular dystrophy caused by a nonsense mutation (nmDMD) and cystic fibrosis caused by a nonsense mutation (nmCF). PTC596 is an orally active small molecule that targets tumor stem cell populations by reducing the function, activity and amount of BMI1. RG7916 is an investigational oral therapeutic, which is in two clinical studies: SUNFISH, a trial in childhood onset (Type II/III) spinal muscular atrophy (SMA) patients, and FIREFISH, a trial in infant onset (Type I) SMA patients.

A glance at Ptc Therapeutics Inc. (NASDAQ:PTCT)’s key stats reveals a current market capitalization of 420.63 Million based on 34.56 Million shares outstanding and a price at last close of $12.01 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2016-03-03, Rothera picked up 2,000 at a purchase price of $6.23. This brings their total holding to 5,125 as of the date of the filing.

On the sell side, the most recent transaction saw Almstead unload 78 shares at a sale price of $11.82. This brings their total holding to 2,687.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Ptc Therapeutics Inc. (NASDAQ:PTCT) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.