Zynga ZNGA purchased for $12B

Zynga ZNGA purchased for $12B by Take-Two Interactive. ZNGA gaps up 46% with heavy trading volume this morning. Let’s take a closer look at Zynga.

Zynga Inc. ZNGA Company Summary

Company Name: Zynga Inc.

Ticker: ZNGA

Exchange: NASDAQ

Website: www.zynga.com

[thrive_leads id=’9825′]

Zynga Inc. ZNGA Company Summary

Zynga ZNGA is a global leader in interactive entertainment with a mission to connect the world through games.

Therefore with it’s massive global reach in more than 175 countries and regions, Zynga has a diverse portfolio of popular game franchises that have been downloaded more than four billion times. Just on mobile including CSR Racing™, Empires & Puzzles™, FarmVille™, Golf Rival, Hair Challenge™, Harry Potter: Puzzles & Spells™, High Heels!, Dragons!™, Merge Magic!™, Toon Blast™, Toy Blast™, Words With Friends™ and Zynga Poker™.

With Chartboost, a leading mobile advertising and monetization platform, Zynga is an industry-leading next-generation platform with the ability to optimize programmatic advertising and yields at scale.

Founded in 2007, Zynga is headquartered in California with locations in North America, Europe and Asia.

Why did ZNGA go up over 40% overnight?

Jan. 10th 2021

Take-Two to acquire all the outstanding shares of Zynga for a total value of $9.861 per share – $3.50 in cash and $6.361 in shares of Take-Two common stock, implying an enterprise value of $12.7 billion.

Transaction represents a 64% premium to Zynga’s closing share price on January 7, 2022.

Establishes Take-Two as one of the largest publishers of mobile games, the fastest-growing segment of the interactive entertainment industry.

Unifies highly complementary businesses, including Take-Two’s best-in-class portfolio of console and PC games and Zynga’s industry-leading mobile franchises.

Creates one of the largest publicly traded interactive entertainment companies in the world, with $6.1 billion in trailing twelve-month pro-forma Net Bookings for the period ended September 30, 2021.

Consequently, Transaction expected to deliver approximately $100 million of annual cost synergies within the first two years after closing, and more than $500 million of annual Net Bookings opportunities over time.

Take-Two TTWO Company Summary

Company Name: Take-Two Interactive Software, Inc.

Ticker: TTWO

Exchange: NASDAQ

Website: https://www.take2games.com/

Zynga Inc. ZNGA Company Summary

Headquartered in New York City, Take-Two Interactive Software, Inc. is a leading developer, publisher, and marketer of interactive entertainment for consumers around the globe.

We develop and publish products principally through Rockstar Games, 2K, Private Division, and T2 Mobile Games.

Take-Two TTWO products are designed for console systems, personal computers, and mobile, including smartphones and tablets.

Also, they deliver through physical retail, digital download, online platforms, and cloud streaming services. Take-Two TTWO common stock trades on NASDAQ under the symbol TTWO.

ZNGA 3 Month Chart

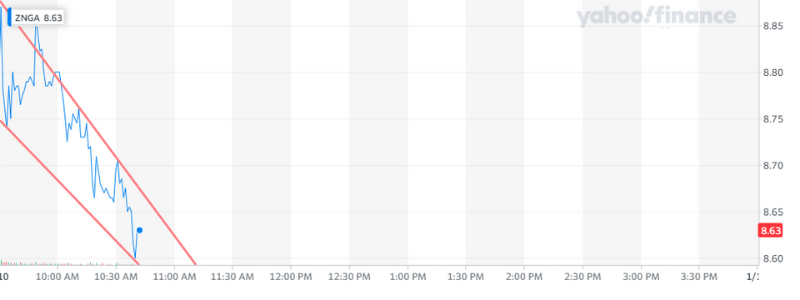

Zynga ZNGA 1 Day Chart

ZNGA Technical Analysis

After the announcement that Take-Two TTWO was acquiring Zynga Inc. ZNGA the stock gapped up with heavy trading volume by over 40%! Meanwhile TTWO suffers in PPS with a massive sell off.

ZNGA is shockingly consolidating after the massive run with a slight pullback. This is a good sign. Therefore, I would like to see it break $8.70 then $8.76 before I would take a position because normally there will be a massive sell off after a huge gap up like this.

[thrive_leads id=’9825′]

(OTCMKTS:BTCS) BTCS Inc. & Blockchain

Introduction

BTCS Inc. ( BTCS ) is an early adopting online e-commerce marketplace where merchandise is available for direct retail purchase using digital cryptocurrencies, such as bitcoin, litecoin, and dogecoin. The company name is an acronym of sorts for Blockchain Technology Consumer Solutions. It originally incorporated in Nevada in 2008 as Hotel Management Systems, Inc. and entered into an Exchange Agreement with BitcoinShop.us, LLC in 2014 formally changing its name to BTCS Inc. in July 2015.

Various summaries of the company found online indicate that the company’s business includes:

- A cost-effective bitcoin mining services business, focuses on transaction verification

- A beta e-commerce marketplace for the aforementioned cryptocurrencies

- A bitcoin wallet based on a relatively well known technology and two-factor authentication for secure storage of bitcoin keys

According to various digital currency news sites and press releases dating back to 2014, BTCS claims to have invested in several technologies and firms including the GoCoin payment platform (which appears to be a solid player in the field), GEM (a Bitcoin API developer which is positioning itself as the go-to blockchain company in the healthcare and supply chain fields providing “bank grade” security) and what looks to have been an aborted attempt to merge with Spondoolies-Tech, Ltd. (a cryptocurrency mining equipment vendor) in 2015. Spondoolies shuttered operations in 2016 due to internal problems including inability to meet payroll.

For more info use link below :

https://www.otcmarkets.com/stock/BTCS/quote

Recent News and Trading:

Other recent occurrences include a default on a lease with CSC Leasing Company of numerous servers and power supplies resulting in the forfeiture of a $25,000 security deposit and, of course, the return of all of the equipment to CSC. At this point it is not clear whether this represents a drawback in BTCS’ ability to process e-commerce transactions or whether the capacity lost with the defaulted lease was made up for in other ways.

A visit to the website (shop.btcs.com) reveals a relatively random catalog of consumer items ostensibly available for purchase, but it appears that the bulk of products represented are merely placeholders, perhaps served up by external scrapers or scripts. In limited research, we were unable to find any items actually “in-stock” or “available” for purchase.

All time high was $1.37 per share in early February, 2014 with quite a fall off very shortly thereafter and a settling in at zero from June 1, 2016 to January of 2017, with a recent high of $0.18 in March, 2017. We’re seeing a lot of fluctuation within the $0.07 and $0.08 range over the past few days and since January of this year, daily volume has fluctuated from 120,000 all the way up to 30,000,000 and back down again, with volume for today at 3,389,582 at a closing price of $0.07. There was a 1/60 stock split in February of 2017.

| Market Cap | 3.06M |

| Beta | 2.88 |

| PE Ratio (TTM) | -0.01 |

| EPS (TTM) | -5.22 |

* Financial statements are incomplete and/or not up-to-date. We could not run down Income Statement, Balance Sheet or Cash Flows for 2017.

Conclusion:

Cryptocurrencies, including Bitcoin, are almost certainly here to stay. Even as the central banks may be attempting to subvert these alternative currencies, the technology behind the blockchain is solid and there is a wide community of developers and entrepreneurs pushing the boundaries and penetrating new sectors of the traditional online economy. There will likely continue to be hacks and breaches such as the $460M disaster that struck Mt. Gox in 2014, partially leading to a temporary decline in Bitcoin’s value, but the technology is simply too firmly entrenched and it stands to reason that security will improve. BTCS was a relative “mover and shaker” in the bitcoin/cryptocurrency world just three short years ago, but with a dearth of recent information to go on, the fact that their flagship website does not appear to be functioning yet (granted, it bears the “beta” designator) and the fact that filings are not up to date or complete may indicate this is one to view with careful scrutiny.

ProText Mobility Inc (OTCMKTS:TXTM) Shares Drop on Latest Acquisition

ProText Mobility Inc (OTCMKTS:TXTM) shares fell 20.83% on Monday to $0.00190 and were unchanged in after-hours trading. Share prices have been trading in a 52-week range of $0.00 to $0.01. The company has a market cap of $5.92 million at 1.95 billion shares outstanding.

ProText Mobility Inc is a company that develops, markets and sells software solutions for the mobile communications market primarily for protecting children from dangers derived from mobile communications and mobile device use. Its offerings include solutions with downloadable applications for mobile communications devices, such as SafeText, DriveAlert and Compliant Wireless.

Its SafeText is a service for mobile devices that provides parents a tool to help manage their children’s mobile communication activities. Its DriveAlert is a virtual lock-box, designed to curb mobile device use while driving and to help mitigate the risks of driving while distracted. Its Compliant Wireless is a mobile platform designed for small to large companies. The mobile solutions for the enterprise/corporate compliance are marketed under Compliant Wireless and those with consumer solutions are marketed under FamilyMobileSafety.

In a press release, ProText Mobility Inc shared that it acquired Cannabis Biosciences Inc. from Plandaí Biotechnology Inc. In this transaction, ProText Mobility Inc acquired 100% of the capital stock of Cannabis Biosciences in exchange for 50 million shares of its common stock. According to Plandai, the shares will be distributed to Plandaí shareholders as a stock dividend and operate its two wholly owned subsidiaries as independent operating businesses.

“Where most pharma companies have chosen to focus on the non-psychoactive CBD chemical, we believe that this strategy limits the potential medical benefits. Recent third party studies have demonstrated the synergistic value of retaining the full chemical profile of cannabis. Our objective is to validate Cannabis Biosciences cannabis extracts to be not only full profile but also non-psychoactive, which will give researchers all of the benefits of cannabis without the unwanted side effects. The acquisition of Cannabis Biosciences by Protext properly aligns our pharmaceutical research under one roof, allowing us to further our cannabis studies as we strive to create a cannabis extract that can increase the well-being and potentially improve the lives of so many people,” said Roger Baylis-Duffield, CEO of ProText Mobility Inc.

Cannabis Biosciences was formed and incorporated by Plandaí Biotechnology in 2013 to legally develop non-psychoactive medicines from live cannabis plant using Plandaí’s proprietary processing and extraction technology. It intends to commence investigations in conjunction with independent researchers to develop and validate a full-profile cannabis extract, one that contains both CBD and the precursor acid form of THC found in the live cannabis plant.

In particular, the company’s investigations will be designed to show that the Cannabis Biosciences extraction process, which will use live leaf and low temperatures to extract the phyto-chemicals, should leave the acid forms of THC intact, resulting in a non-psychoactive extract with full medicinal potential.

DISCLAIMER: There is a substantial risk of loss with any speculative asset, especially small cap stocks. The opinions expressed are those of the author, and do not constitute recommendations to buy or sell a stock. Do your own research before committing capital.

Wrapmail Inc (OTCMKTS:WRAP) Sets Foot in Cannabis Industry

Wrapmail Inc (OTCMKTS:WRAP) shares were up 20.30% to $0.0800 and flat in after-hours trading. Share prices have been trading in a 52-week range of $0.01 to $0.15. The company has a market cap of $15.54 million at 146.01 million shares outstanding.

Wrapmail Inc is a company that provides document, project, marketing and sales management systems to business clients through its website and software. It offers WRAPmail, which is a method, system and software for extracting content for integration with electronic mail. WRAPmail is an e-mail templating system that adds graphics and letterhead to everyday e-mails. WRAPmail allows promoting the business.

To top it off, the company offers various solutions, which include WRAPmail Business, WRAPmail Personal and WRAPmail Enterprise. Its business edition solution is offered to any size organization and its personal edition solution is offered to any individual and community group. Its enterprise solution is offered for organizations wanting to host their own environment. It also provides all system integration support for an installation and features click notification alerts and analytical report.

In a press release last week, Wrapmail Inc announced that it acquired 100% of HealthMax Group, which is led by a team of high level scientists and business entrepreneurs and is at the forefront of the CBD market, offering product in its purest form using its proprietary Nano Technology. Its technology was designed to increase product efficacy significantly over just CBD alone, with products that are lab tested to be 99% pure and consistently rated among consumers as their favorite.

After getting to know David and the HealthMax team over the past month, we concluded this acquisition was a great opportunity for HealthMax to enter the public markets, and an incredible value proposition for our shareholders. Utilizing our collective resources, it’s with great enthusiasm we enter into this transaction,” said Wrapmail Inc CEO Marco Alfonsi.

Wrapmail Inc will begin the process to formalize a name and symbol change consistent with the new company profile. WRAPmail and Prosperity Systems will operate as wholly owned subsidiaries. HealthMax will continue to sell classic and nano-technology infused CBD products and is expanding its sales and distributions channels.

I am very proud of the progress we’ve made in the hemp industry over this short time span, as well as our advancements in nano-technology delivery of our imported all-natural hemp. HALO CBD is medicinal grade CBD, which is clear and does not have the harsh hemp taste, black color, residual solvents or toxic fillers like many competing products. Some analysts are projecting a 2-billion-dollar market for the hemp industry, and I think we are poised to be a leading competitor in this market with the addition of our multi-spectrum and nano-technology infused formulations,” said HealthMax Group President and COO David Posel.

He went on to say that HealthMax is expanding to large-scale production and engaging the food and beverage industry. The company plans to disrupt the market and set the bar for higher quality standards across the board.

DISCLAIMER: There is a substantial risk of loss with any speculative asset, especially small cap stocks. The opinions expressed are those of the author, and do not constitute recommendations to buy or sell a stock. Do your own research before committing capital.

Here’s Who Just Picked Up Birner Dental Management Services Inc. (NASDAQ:BDMS) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Birner Dental Management Services Inc. (NASDAQ:BDMS) reported that Birner Mark A has picked up 579,023 of common stock as of 2017-01-26.

The acquisition brings the aggregate amount owned by Birner Mark A to a total of 579,023 representing a 31.1% stake in the company.

For those not familiar with the company, Birner Dental Management Services, Inc. is a dental service company. The Company provides business services to dental practice networks in select markets, including Colorado, New Mexico and Arizona. The Company provides a solution to the needs of dentists, patients and third-party payers by allowing its affiliated dentists to provide dental care in patient-friendly, family practice settings. The Company offers specialty dental services through affiliated specialists at some of its locations. The Company has approximately 47 affiliated dental practices (Offices) in Colorado and over 11 in New Mexico. It provides business services to approximately 68 Offices. The Company’s affiliated offices seek to develop long-term relationships with patients. Dentists practicing at its offices provide general dentistry services, including crowns and bridges, fillings (including gold, porcelain and composite inlays/onlays), implants and aesthetic procedures, such as porcelain veneers and bleaching.

A glance at Birner Dental Management Services Inc. (NASDAQ:BDMS)’s key stats reveals a current market capitalization of 17.67 million based on 1.86 million shares outstanding and a price at last close of $9.50 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2015-12-23, Wolf picked up 500 at a purchase price of $9.85. This brings their total holding to 50,317 as of the date of the filing.

On the sell side, the most recent transaction saw Genty unload 1,000 shares at a sale price of $12.66. This brings their total holding to 123,320.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Birner Dental Management Services Inc. (NASDAQ:BDMS) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Easton Pharmaceuticals Inc (OTCMKTS:EAPH) to Acquire iBliss Inc

Easton Pharmaceuticals Inc (OTCMKTS:EAPH) shares were up 19.21% to $0.0391 and flat in after-hours trading. Share prices have been trading in a 52-week range of $0.00 to $0.04. The company has a market cap of $39.61 million at 923.73 million shares outstanding.

Easton Pharmaceuticals Inc is a development-stage company engaged in various pharmaceutical sectors and others industries. It has a transdermal delivery technology called Viorra Delivery Matrix or VDM, which is incorporated in a line of therapeutic over-the-counter products.

Aside from that, the company also owns topically-delivered drugs and therapeutic/cosmetic healthcare products focused on cancer and other health problems geared towards female sexual dysfunction, wound healing, pain, motion sickness and other conditions. These products are in various stages of commercialization, including Nauseasol, which is a motion sickness gel; Skin Renou HA, which is an anti-aging wrinkle cream; Kenestrin Gel, which is a is a pain relief gel; Viorra, which serves as an aid to the relief of female sexual arousal disorder ; XILIVE, which is an early-stage cancer drug, and FSAD drug, which includes a water-based complex polymer matrix.

This week, Easton Pharmaceuticals Inc shared that it has signed a letter of intent to acquire 100% of revenue producing vaporizer manufacturer iBliss Inc of Canada. iBliss is a major vaporizer and e-liquids manufacturer that is enjoying strong international sales projected to conservatively reach and surpass $15,000,000 per year fairly quickly. With these sales, the company is able to make healthy margins in excess of 40%. It has sales in North America and recently adding several international markets in Europe, the Middle East and Russia which has it on track to reach $15,000,000 in sales.

We are very excited to be entering into this Agreement with Easton. With the support of Easton’s management, we will be able to continue our success and rapidly expand our sales internationally and launch our consumer health products through our e-liquids” stated iBliss President, Hung Tran.

Under this acquisition, iBliss will operate as a wholly owned subsidiary of Easton Pharmaceuticals and will be separate from its other business segments such it’s woman’s diagnostics, treatment and natural health products. After all, Easton Pharmaceuticals has a distribution agreement with multi-national pharmaceutical company Gedeon Richter and its Mexican subsidiary company Gedeon Richter Mexico S.A.P.I. de C.V. The companies are still expected to iron out more details of the acquisition in the coming weeks but the letter of intent marks the first step in their partnership.

Shares of Easton Pharmaceuticals have been on a tear since October last year, as volumes and investor interest picked up. This marked a strong upside breakout from the consolidation for the most part of the year before the bullish run ensued. For now, though, price could still make a pullback to the nearby $0.03 mark before heading further north.

DISCLAIMER: There is a substantial risk of loss with any speculative asset, especially small cap stocks. The opinions expressed are those of the author, and do not constitute recommendations to buy or sell a stock. Do your own research before committing capital.