Maxwell Technologies Inc. (NASDAQ:MXWL) is Attracting Smart Money

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Maxwell Technologies Inc. (NASDAQ:MXWL) reported that Viex Capital Advisors, Llc. has picked up 1,230,936 of common stock as of 2017-04-11.

The acquisition brings the aggregate amount owned by Viex Capital Advisors, Llc. to a total of 1,230,936 representing a 3.8% stake in the company.

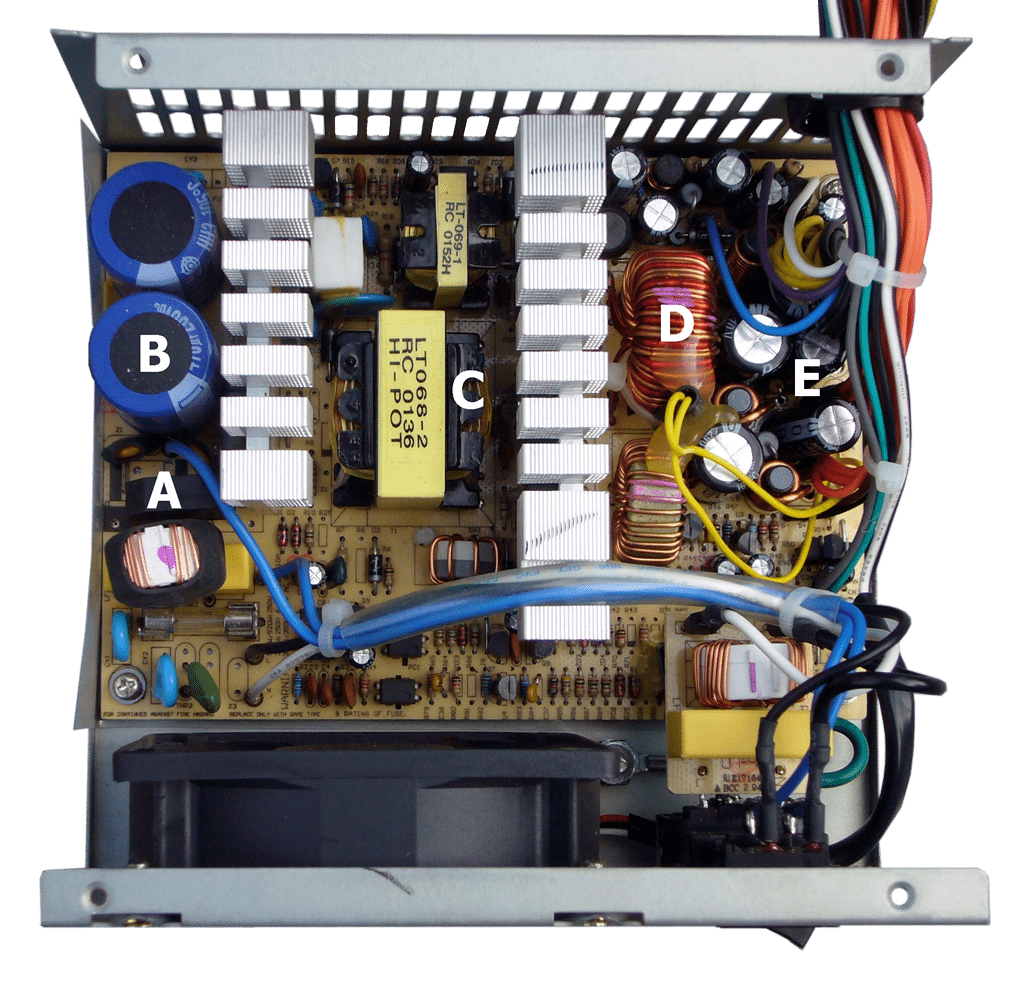

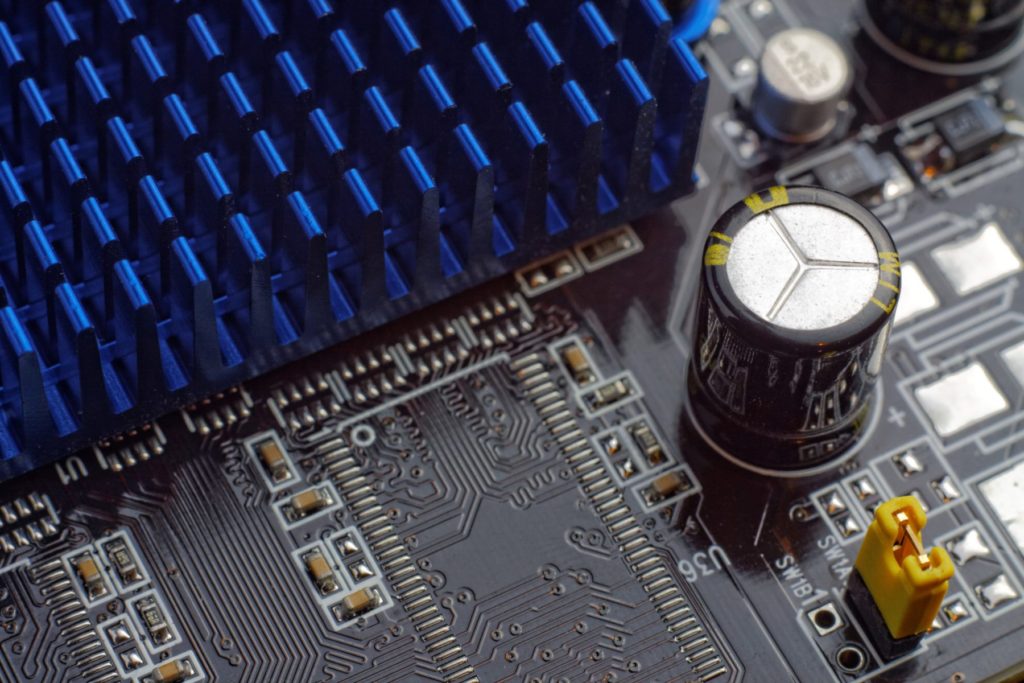

For those not familiar with the company, Maxwell Technologies, Inc. develops, manufactures and markets energy storage and power delivery products for transportation, industrial, information technology and other applications and microelectronic products for space and satellite applications. The Company offers three product lines: Ultracapacitors, High-Voltage Capacitors and Radiation-Hardened Microelectronic Products. The Company’s ultracapacitor cells and multi-cell packs, and modules provide energy storage and power delivery solutions for applications in multiple industries. The Company offers ultracapacitor cells with capacitances ranging from 1 to 3,400 farads. It designs and manufactures CONDIS high-voltage capacitors. These products include grading and coupling capacitors and electric voltage transformers. The Company’s radiation-hardened microelectronic products for satellites and spacecraft include single board computers and components, such as high-density memory and data conversion modules.

A glance at Maxwell Technologies Inc. (NASDAQ:MXWL)’s key stats reveals a current market capitalization of 186.81 Million based on 32.27 Million shares outstanding and a price at last close of $5.96 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2016-05-19, Howsmon picked up 2,000 at a purchase price of $5.53. This brings their total holding to 3,000 as of the date of the filing.

On the sell side, the most recent transaction saw Lyle unload 5,752 shares at a sale price of $5.75. This brings their total holding to 7,251.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Maxwell Technologies Inc. (NASDAQ:MXWL) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Pico Holdings Inc is Buying Ucp Inc. (NYSE:UCP) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Ucp Inc. (NYSE:UCP) reported that Pico Holdings Inc /new has picked up 10,401,722 of common stock as of 2017-04-11.

The acquisition brings the aggregate amount owned by Pico Holdings Inc /new to a total of 10,401,722 representing a 56.7% stake in the company.

For those not familiar with the company, UCP, Inc. is a homebuilder and land developer with a focus on residential land acquisition, development and entitlement, as well as home design, construction and sales. The Company operates in two segments: homebuilding and land development. The homebuilding and land segments include two geographic regions: West and Southeast. The Company operates in the states of California, Washington, North Carolina, South Carolina, and Tennessee. In California, the Company primarily operates in the Central Valley area (Fresno and Madera counties), the Monterey Bay area (Monterey County), the South San Francisco Bay area (Santa Clara and San Benito counties) and in Southern California (Los Angeles, Ventura and Kern counties). In Washington State, it operates in the Puget Sound area (King, Snohomish, Thurston and Kitsap counties). In North Carolina, South Carolina and Tennessee, its operations are in the Charlotte, Myrtle Beach and Nashville markets.

A glance at Ucp Inc. (NYSE:UCP)’s key stats reveals a current market capitalization of 89.45 Million based on 7.96 Million shares outstanding and a price at last close of $11.32 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2016-05-18, Cortney picked up 9,743 at a purchase price of $7.45. This brings their total holding to 25,493 as of the date of the filing.

On the sell side, the most recent transaction saw Buckingham unload 12,289 shares at a sale price of $12.03. This brings their total holding to 921,327.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Ucp Inc. (NYSE:UCP) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Duggan Robert Picked Pulse Biosciences Inc(NASDAQ:PLSE) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Pulse Biosciences Inc. (NASDAQ:PLSE) reported that Duggan Robert W has picked up 2,578,950 of common stock as of 2017-04-11.

The acquisition brings the aggregate amount owned by Duggan Robert W to a total of 2,578,950 representing a 18.2% stake in the company.

For those not familiar with the company, Pulse Biosciences, Inc., formerly Electroblate, Inc., is a development-stage medical device company using a platform technology called Nano-Pulse Electro-Signaling (NPES). NPES is a local and drug-free technology that utilizes nanosecond pulsed electric fields to induce cell signaling and the activation of cellular pathways in tissue. NPES provides treatment in a range of dermatology and aesthetic applications. It offers treatment for minimally invasive applications, such as cardiac ablation, lung disease, Barret’s esophagus, thyroid nodules, and ear, nose and throat (ENT) papillomas. The Company is developing a system for the delivery of NPES treatments, identified as the PulseTx system (PulseTx). The PulseTx system delivers NPES pulses through its tunable pulse generator and its planned suite of electrodes. The PulseTx system pulses are applied directly to tissue through electrodes, creating transient nanometer pores in cell and organelle membranes.

A glance at Pulse Biosciences Inc. (NASDAQ:PLSE)’s key stats reveals a current market capitalization of 351.73 Million based on 14.14 Million shares outstanding and a price at last close of $23.18 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2017-04-10, Duggan picked up 22,764 at a purchase price of $21.40. This brings their total holding to 2,578,950 as of the date of the filing.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Pulse Biosciences Inc. (NASDAQ:PLSE) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Snow Capital Management Picked Tidewater Inc. (NYSE:TDW) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Tidewater Inc. (NYSE:TDW) reported that Snow Capital Management Lp. has picked up 2,940,264 of common stock as of 2017-04-11.

The acquisition brings the aggregate amount owned by Snow Capital Management Lp. to a total of 2,940,264 representing a 6.2% stake in the company.

For those not familiar with the company, Tidewater Inc. provides offshore service vessels and marine support services. The Company operates through four segments: Americas, Asia/Pacific, Middle East/North Africa and Sub-Saharan Africa/Europe. Its Americas segment includes the activities of the Company’s North American operations, which include operations in the United States Gulf of Mexico (GOM), and the United States and Canadian coastal waters of the Pacific and Atlantic oceans, as well as operations of offshore Mexico, Trinidad and Brazil. The Asia/Pacific segment includes its Australian and Southeast Asian and Western Pacific operations. The Middle East/North Africa segment includes its operations in the Mediterranean and Red Seas, the Black Sea, the Arabian Gulf and offshore India. The Company’s Sub-Saharan Africa/Europe segment includes operations conducted along the East and West Coasts of Africa, as well as operations in and around the Caspian Sea, the North Sea, and certain other arctic/cold water markets.

A glance at Tidewater Inc. (NYSE:TDW)’s key stats reveals a current market capitalization of 43.19 Million based on 47.07 Million shares outstanding and a price at last close of $0.876 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2015-12-01, Bennett picked up 10,000 at a purchase price of $9.36. This brings their total holding to 67,801 as of the date of the filing.

On the sell side, the most recent transaction saw Fanning unload 20,110 shares at a sale price of $16.53. This brings their total holding to 42,064.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Tidewater Inc. (NYSE:TDW) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Here’s Who Just Picked Up Alliance Healthcare Services Inc. (NASDAQ:AIQ) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Alliance Healthcare Services Inc. (NASDAQ:AIQ) reported that Fujian Thai Hot Investment Co., Ltd. has picked up 5,537,945 of common stock as of 2017-04-11.

The acquisition brings the aggregate amount owned by Fujian Thai Hot Investment Co., Ltd. to a total of 5,537,945 representing a 51.1% stake in the company.

For those not familiar with the company, Alliance HealthCare Services, Inc. (Alliance) is a provider of outsourced healthcare services to hospitals and providers. The Company operates through three segments: Radiology Division, Oncology Division and Interventional Healthcare Services Division. The radiology segment comprises diagnostic imaging services, including magnetic resonance imaging (MRI), positron emission tomography/computed tomography (PET/CT) and other imaging services. The radiology segment also comprises radiation oncology services. The interventional healthcare services segment provides interventional healthcare through therapeutic minimally invasive pain management procedures medical management, laboratory testing and other services. The Company operates freestanding outpatient radiology, oncology and interventional clinics, and Ambulatory Surgical Centers (ASC) that are not owned by hospitals or providers. It operates over 560 diagnostic imaging and radiation therapy systems.

A glance at Alliance Healthcare Services Inc. (NASDAQ:AIQ)’s key stats reveals a current market capitalization of 136.64 Million based on 10.81 Million shares outstanding and a price at last close of $12.65 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2016-05-19, Longmore-Grund picked up 2,500 at a purchase price of $7.59. This brings their total holding to 2,500 as of the date of the filing.

On the sell side, the most recent transaction saw Spurlock unload 5,812 shares at a sale price of $29.53. This brings their total holding to 0.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Alliance Healthcare Services Inc. (NASDAQ:AIQ) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Here’s Who Just Picked Up Osi Systems Inc. (NASDAQ:OSIS) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Osi Systems Inc. (NASDAQ:OSIS) reported that Earnest Partners Llc. has picked up 951,611 of common stock as of 2017-04-11.

The acquisition brings the aggregate amount owned by Earnest Partners Llc. to a total of 951,611 representing a 5.0% stake in the company.

For those not familiar with the company, OSI Systems, Inc., through its subsidiaries, is a vertically integrated designer and manufacturer of specialized electronic systems and components for critical applications. The Company sells its products and provides related services in diversified markets, including homeland security, healthcare, defense and aerospace. The Company operates in three segments, which include Security, which provides security and inspection systems, turnkey security screening solutions and related services; Healthcare, which provides patient monitoring, diagnostic cardiology, anesthesia delivery and ventilation systems and defibrillators, and Optoelectronics and Manufacturing, which provides electronic components and electronic manufacturing services for the Security and Healthcare divisions, as well as to external original equipment manufacturer (OEM) customers and end users for applications in the defense, aerospace, medical and industrial markets, among others.

A glance at Osi Systems Inc. (NASDAQ:OSIS)’s key stats reveals a current market capitalization of 1.34 Billion based on 19.09 Million shares outstanding and a price at last close of $70.15 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2015-08-07, Ong picked up 1,000 at a purchase price of $67.00. This brings their total holding to 73,703 as of the date of the filing.

On the sell side, the most recent transaction saw Edrick unload 35,000 shares at a sale price of $73.14. This brings their total holding to 160,789.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Osi Systems Inc. (NASDAQ:OSIS) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Guess who picked Independent Bank Group Inc. (NASDAQ:IBTX) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Independent Bank Group Inc. (NASDAQ:IBTX) reported that Lee Thomas H has picked up 1,933,495 of common stock as of 2017-04-11.

The acquisition brings the aggregate amount owned by Lee Thomas H to a total of 1,933,495 representing a 7.0% stake in the company.

For those not familiar with the company, Independent Bank Group, Inc. is a bank holding company. Through the Company’s subsidiary, Independent Bank (the Bank), the Company provides a range of commercial banking products and services tailored to meet the needs of businesses, professionals and individuals. As of December 31, 2016, the Company operated 41 banking offices in the Dallas/North Texas area, the Austin/Central Texas area, and the Houston metropolitan area. The Company offers residential mortgages through its mortgage brokerage division. As a mortgage broker, the Company originates residential mortgages, which are sold into the secondary market shortly after closing. The Company also provides wealth management services to its customers, including investment advisory and other related services. The Company offers a range of commercial and retail lending products to businesses, professionals and individuals. Deposits are the Company’s principal source of funds for use in lending and other general banking purposes.

A glance at Independent Bank Group Inc. (NASDAQ:IBTX)’s key stats reveals a current market capitalization of 1.68 Billion based on 27.73 Million shares outstanding and a price at last close of $61.15 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2016-05-13, Radke picked up 4,000 at a purchase price of $33.86. This brings their total holding to 14,000 as of the date of the filing.

On the sell side, the most recent transaction saw Smith unload 10,000 shares at a sale price of $66.30. This brings their total holding to 90,151.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Independent Bank Group Inc. (NASDAQ:IBTX) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Moyes Jerry Picked Up Swift Transportation Co (NYSE:SWFT) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Swift Transportation Co (NYSE:SWFT) reported that Moyes Jerry has picked up 59,389,014 of common stock as of 2017-04-11.

The acquisition brings the aggregate amount owned by Moyes Jerry to a total of 59,389,014 representing a 44.6% stake in the company.

For those not familiar with the company, Swift Transportation Company is a multi-faceted transportation services company. As of December 31, 2016, the Company operated fleets of truckload equipment in North America from over 40 terminals near key freight centers and traffic lanes. The Company’ segments include Truckload, Dedicated, Swift Refrigerated and Intermodal. The Company’s other segments include its logistics and freight brokerage services, as well as support services that its subsidiaries provide to customers and owner-operators, including repair and maintenance shop services, equipment leasing, and insurance. As of December 31, 2016, the Company’s fleet consisted of 13,937 company tractors and 4,429 owner-operator tractors, as well as 64,066 trailers, and 9,131 intermodal containers. Its suite of service offerings include line-haul services, dedicated customer contracts, temperature-controlled units, intermodal freight solutions, flatbed hauling, freight brokerage and logistics.

A glance at Swift Transportation Co (NYSE:SWFT)’s key stats reveals a current market capitalization of 3.92 Billion based on 20.59 Million shares outstanding and a price at last close of $83.30 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2014-07-29, Riley picked up 4,000 at a purchase price of $21.41. This brings their total holding to 8,000 as of the date of the filing.

On the sell side, the most recent transaction saw Guin unload 40,000 shares at a sale price of $25.05. This brings their total holding to 3,601.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Swift Transportation Co (NYSE:SWFT) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.