Why Sycamore Entertainment Group Inc (OTCMKTS:SEGI) Shares Slumped

Sycamore Entertainment Group Inc (OTCMKTS:SEGI) shares dropped 42.86% to $0.00040 and were unchanged in after-hours trading. Share prices have been trading in a 52-week range of $0.00 to $0.00. The company has a market cap of $971K at 1.39 billion shares outstanding.

Sycamore Entertainment Group Inc is an independent film marketing and distribution company that specializes in the acquisition, distribution and development of marketing campaigns. It focuses on participating in various other streams related to filmed entertainment content distribution, as well as various other activities related to funding the print and advertising of acquired feature films. Its film marketing and distribution operations include film acquisitions, publicity, print advertising, billboard advertising, film distribution and online marketing.

The company also offers services, including acquiring films; publicity and public relations, and online content writing and search engine optimization services. It provides distribution services for release commercial films. It represents independent film companies that create domestic and foreign feature films. Its operations include Film Library Development, Distribution, Print and Advertising Fund, and Production.

Just last week, Sycamore Entertainment Group announced that it has executed a “film rights purchase agreement” with top Hollywood producers.

We are excited to be working some of the best talents in Hollywood,” says Edward Sylvan, CEO of Sycamore Entertainment Group. “Our arrangement with LDJ Capital called for us to bring ‘best in class’ projects to the table, I feel we are accomplishing these objectives. We are looking forward to the time when we are able discuss the project in more detail. With the working capital in hand we are in the best position to increase shareholder value by spending on corporate marketing and executing on our lineup of film and TV projects.”

This contributed to more than 70% gains in Sycamore Entertainment Group shares at the start of the week but more than half of this was given back when it announced a self-imposed share issuance lockout.

The lack of trust in OTC issuers by Penny Stock traders has been a major roadblock to issuers when trying to raise the necessary working capital needed to grow their business. Sycamore is taking a first step in restoring that trust with its shareholders,” the company statement indicated. “Effective immediately, we will apply a self-imposed share structure lockout for a minimum of 60 days. During that time, there will be no issuances of new shares, nor will there be any increase to the authorized share capital. It is my opinion, that the current issued and outstanding is ideal to encourage liquidity and allows investors of all sizes to participate in our market.”

In effect, Sycamore Entertainment Group will not be engaging in any reverse split at any time whatsoever in order to provide traders and investors with the confidence that they can participate in the market and not have the share value be eroded due to unnecessary dilution.

We would like to send a message loud and clear that we support the trading and investing community and that we share common goals. The sooner that we can align our interests the faster we can move the company ahead. The new laws allow us to take the power away from dilutive financing options and places it back into the hands of the traders and shareholders who continue to support what we do,” it concluded.

DISCLAIMER: There is a substantial risk of loss with any speculative asset, especially small cap stocks. The opinions expressed are those of the author, and do not constitute recommendations to buy or sell a stock. Do your own research before committing capital.

Vaccinogen Inc. (OTCMKTS:VGEN) is Attracting Smart Money

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Vaccinogen Inc. (OTCMKTS:VGEN) reported that Mpm Bioventures Iii L.p. has picked up 134,452 of common stock as of 2017-02-13.

The acquisition brings the aggregate amount owned by Mpm Bioventures Iii L.p. to a total of 134,452 representing a 0.4% stake in the company.

For those not familiar with the company, Vaccinogen, Inc. is a biotechnology company. The Company is the developer of OncoVAX. OncoVAX is an active specific immunotherapy (ASI) that uses the patient’s own cancer cells to create a vaccine that in turn is used to block the return of cancer following surgery. OncoVAX is a patient specific immunotherapy for stage II colon cancer and its technology may have application in other tumor types, such as melanoma and renal cell carcinoma. The OncoVAX patient-specific vaccine consists of sterile, metabolically active, irradiated and non-tumorigenic autologous cancer cells, with or without fresh frozen Bacillus Calmette-Guerin (BCG) bacteria as an adjuvant. The Company has completed a Phase IIIa study of OncoVAX.

A glance at Vaccinogen Inc. (OTCMKTS:VGEN)’s key stats reveals a current market capitalization of 7.24 million based on 37.32 million shares outstanding and a price at last close of 0.169 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2014-12-26, Halldin picked up 934,580 at a purchase price of $5.50. This brings their total holding to 934,580 as of the date of the filing.

On the sell side, the most recent transaction saw Hanna unload 1,000 shares at a sale price of $3.61. This brings their total holding to 224,587.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Vaccinogen Inc (OTCMKTS:VGEN) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Primecap Management Co/ca/ Picked Up Accuray Inc. (NASDAQ:ARAY) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Accuray Inc. (NASDAQ:ARAY) reported that Primecap Management Co/ca/ has picked up 5,513,300 of common stock as of 2017-02-13.

The acquisition brings the aggregate amount owned by Primecap Management Co/ca/ to a total of 5,513,300 representing a 6.75% stake in the company.

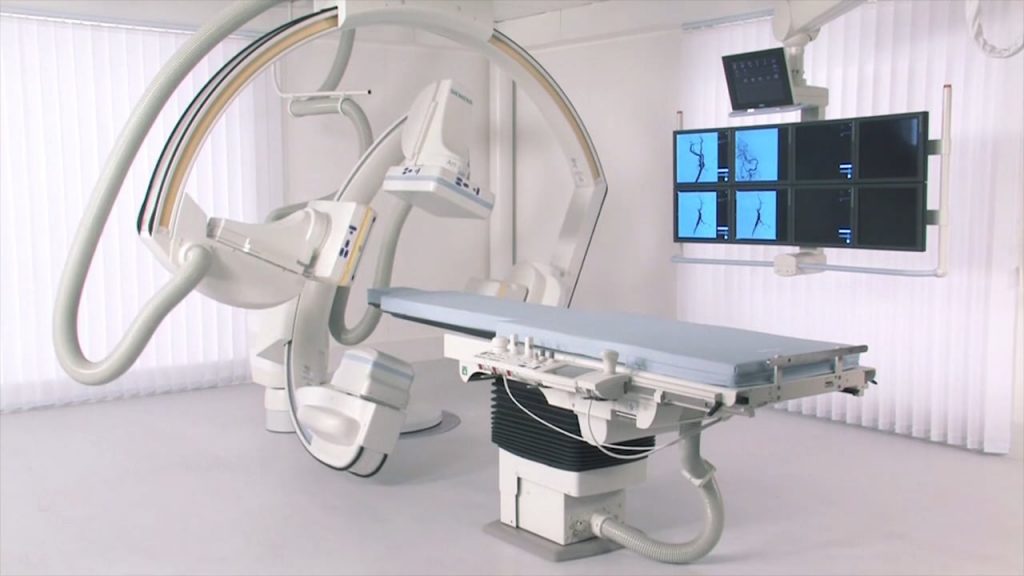

For those not familiar with the company, Accuray Incorporated is a radiation oncology company. The Company develops, manufactures and markets medical devices used in radiation therapy for the treatment of cancer patients. Its products include the CyberKnife Systems, the TomoTherapy Systems, and the Radixact Delivery Treatment Platform. Its technologies, the CyberKnife and TomoTherapy Systems, are designed to deliver treatments, including stereotactic radiosurgery (SRS), stereotactic body radiation therapy (SBRT), intensity modulated radiation therapy (IMRT), image guided radiation therapy (IGRT) and adaptive radiation therapy. The CyberKnife Systems are robotic systems that are used to treat various types of cancer and tumors throughout the body. The CyberKnife Systems track, detect and correct for tumor and patient movement in real-time during the procedure. The TomoTherapy Systems include the TomoTherapy H Series with configuration options of TomoH, TomoHD and TomoHDA.

A glance at Accuray Inc. (NASDAQ:ARAY)’s key stats reveals a current market capitalization of 455.94 million based on 82.90 million shares outstanding and a price at last close of $5.50 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2015-11-9, Levine picked up 50,000 at a purchase price of $7.12. This brings their total holding to 1,115,830 as of the date of the filing.

On the sell side, the most recent transaction saw Nouri unload 957 shares at a sale price of $6.80. This brings their total holding to 65,547.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Accuray Inc. (NASDAQ:ARAY) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

OrbiMed Advisors is Buying Ironwood Pharmaceuticals Inc. (NASDAQ:IRWD) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Ironwood Pharmaceuticals Inc. (NASDAQ:IRWD) reported that OrbiMed Advisors has picked up 2,524,000 of common stock as of 2017-02-13.

The acquisition brings the aggregate amount owned by OrbiMed Advisors to a total of 2,524,000 representing a 1.73% stake in the company.

For those not familiar with the company, Ironwood Pharmaceuticals, Inc. is a biotechnology company. The Company’s products Linaclotide provides patients and healthcare practitioners with a treatment option for adults in the United States and certain other countries with irritable bowel syndrome with constipation (IBS-C), chronic idiopathic constipation (CIC) and gastrointestinal (GI) disorders. It operates through human therapeutics segment. Linaclotide is also being developed and commercialized in other parts of the world by certain of its partners. It is engaged in developing therapeutic platforms for the treatment of vascular and fibrotic diseases, and refractory gastroesophageal reflux disease (GERD). Its IW-9179 is used for the treatment of gastroparesis and functional dyspepsia. The Company has conducted an exploratory Phase IIa clinical study of IW-3718 in patients with refractory GERD. It has two sGC development candidates, which include IW-1973 and IW-1701.

A glance at Ironwood Pharmaceuticals Inc. (NASDAQ:IRWD)’s key stats reveals a current market capitalization of 2.41 billion based on 130.86 million shares outstanding and a price at last close of $16.42 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2011-11-02, Hecht picked up 50,000 at a purchase price of $11.65. This brings their total holding to 72,803 as of the date of the filing.

On the sell side, the most recent transaction saw Hecht unload 32,994 shares at a sale price of $15.50. This brings their total holding to 4,670,322.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Ironwood Pharmaceuticals Inc. (NASDAQ:IRWD) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Guess Who Picked Up Integra Lifesciences Holdings Corp. (NASDAQ:IART) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Integra Lifesciences Holdings Corp. (NASDAQ:IART) reported that Caruso Richard E. has picked up 6,201,027 of common stock as of 2017-02-13.

The acquisition brings the aggregate amount owned by Caruso Richard E. to a total of 6,201,027 representing a 16.57% stake in the company.

For those not familiar with the company, Integra LifeSciences Holdings Corporation is a medical technology company. The Company focuses on the development, manufacturing and marketing of surgical implants and medical instruments. Its products are used in neurosurgery, extremity reconstruction, orthopedics and general surgery. Its segments include Specialty Surgical Solutions, which offers products, including specialty surgical instrumentation for a range of specialties. Its product category includes products and solutions for dural repair, precision tools and instruments, tissue ablation and neuro critical care, including product portfolios used in neurosurgery operation suites and critical care units, and Orthopedics and Tissue Technologies, which offers products of a combination of differentiated regenerative technology products for soft tissue repair and tissue regeneration products, and small bone fixation and joint replacement hardware products for both upper extremities and lower extremities.

A glance at Integra Lifesciences Holdings Corp (NASDAQ:IART)’s key stats reveals a current market capitalization of 3.20 billion based on 74.77 million shares outstanding and a price at last close of $42.90 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2011-11-02, Caruso picked up 2,000 at a purchase price of $28.46. This brings their total holding to 2,000 as of the date of the filing.

On the sell side, the most recent transaction saw Arduini unload 20,000 shares at a sale price of $80.02. This brings their total holding to 25,593.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Integra Lifesciences Holdings Corp. (NASDAQ:IART) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Here’s Who Just Picked Up Blackrock Muniyield Investment Fund (NYSE:MYF) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Blackrock Muniyield Investment Fund (NYSE:MYF) reported that Morgan Stanley has picked up 801,302 of common stock as of 2017-02-13.

The acquisition brings the aggregate amount owned by Morgan Stanley Funds to a total of 801,302 representing a 5.8% stake in the company.

For those not familiar with the company, BlackRock MuniYield Investment Fund (the Fund) is a non-diversified, closed-end management investment company. The Fund’s investment objective is to provide shareholders with as high a level of current income exempt from federal income taxes as is consistent with its investment policies and prudent investment management. The Fund seeks to achieve its investment objective by investing at least 80% of its assets in municipal obligations exempt from federal income taxes (except that the interest may be subject to the federal alternative minimum tax). Under normal market conditions, the Fund primarily invests in municipal bonds that are investment grade quality at the time of investment. The Fund may invest up to 20% of its total assets in securities rated below investment grade or deemed equivalent at the time of purchase. The Fund may invest directly in such securities or synthetically through the use of derivatives. BlackRock Advisors, LLC is the investment advisor of the Fund.

A glance at Blackrock Muniyield Investment Fund (NYSE:MYF)’s key stats reveals a current market capitalization of 209.72 million based on 13.63 million shares outstanding and a price at last close of $15.36 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2015-10-16, Castellano picked up 1,000 at a purchase price of $15.18. This brings their total holding to 1,000 as of the date of the filing.

On the sell side, the most recent transaction saw Gabbay unload 100 shares at a sale price of $15.60. This brings their total holding to 0.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Blackrock Muniyield Investment Fund (NYSE:MYF) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Hudson Pacific Properties Inc. (NYSE:HPP) is Attracting Smart Money

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Hudson Pacific Properties Inc. (NYSE:HPP) reported that Vanguard Specialized Funds has picked up 9,881,236 of common stock as of 2017-02-13.

The acquisition brings the aggregate amount owned by Vanguard Specialized Funds to a total of 9,881,236 representing a 7.21% stake in the company.

For those not familiar with the company, Hudson Pacific Properties, Inc. is a full-service, vertically integrated real estate investment trust (REIT). The Company is focused on owning, operating and acquiring office, and media and entertainment properties in select growth markets primarily in Northern and Southern California, and the Pacific Northwest. It operates in two segments: office properties, and media and entertainment properties. Its investment strategy is focused on high barrier-to-entry, in-fill locations with favorable, long-term supply demand characteristics in select markets, including Los Angeles, Orange County, San Diego, San Francisco, Silicon Valley and Seattle. Its portfolio includes office properties, comprising an aggregate of approximately 14.0 million square feet, and media and entertainment properties, comprising over 0.9 million square feet of sound-stage, office and supporting production facilities. It also owns undeveloped density rights for over 2.6 million square feet of future office space.

A glance at Hudson Pacific Properties Inc. (NYSE:HPP)’s key stats reveals a current market capitalization of 5.27 billion based on 146.19 million shares outstanding and a price at last close of $35.74 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2016-05-19, Glaser picked up 3,000 at a purchase price of $26.88. This brings their total holding to 3,000 as of the date of the filing.

On the sell side, the most recent transaction saw Hpp unload 345,053 shares at a sale price of $35.00. This brings their total holding to 0.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Hudson Pacific Properties Inc. (NYSE:HPP) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Broadfin Capital is Buying Catalyst Pharmaceuticals Inc. (NASDAQ:CPRX) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Catalyst Pharmaceuticals Inc. (NASDAQ:CPRX) reported that Broadfin Capital has picked up 8,200,000 of common stock as of 2017-02-13.

The acquisition brings the aggregate amount owned by Broadfin Capital to a total of 8,200,000 representing a 9.88% stake in the company.

For those not familiar with the company, Catalyst Pharmaceuticals, Inc., formerly Catalyst Pharmaceutical Partners, Inc., is a development-stage biopharmaceutical company. The Company is focused on developing and commercializing therapies for people with rare debilitating diseases. The Company has three drugs in development: Firdapse, CPP-109 and CPP-115. The Company’s Firdapse is indicated for the treatments of lambert-eaton myasthenic syndrome (LEMS) and congenital myasthenic syndromes (CMS). Firdapse consists of the phosphate salt of amifampridine. The Company has completed the Phase III trial of Firdapse. The Company’s CPP-109 (vigabatrin) is a gamma-aminobutyric acid (GABA) aminotransferase inhibitor. CPP-109 is indicated for the treatment of Tourette’s Disorder. The Company’s CPP-115 is a GABA aminotransferase inhibitor. CPP-115 is indicated for the treatment of selected neurological indications, such as complex partial seizures and Tourette’s Disorder, and epilepsy.

A glance at Catalyst Pharmaceuticals Inc. (NASDAQ:CPRX)’s key stats reveals a current market capitalization of 92.94 million based on 82.97 million shares outstanding and a price at last close of $1.13 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2016-07-12, O’keeffe picked up 20,000 at a purchase price of $0.81. This brings their total holding to 432,126 as of the date of the filing.

On the sell side, the most recent transaction saw Winship unload 22,800 shares at a sale price of $3.34. This brings their total holding to 74,131.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Catalyst Pharmaceuticals Inc. (NASDAQ:CPRX) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.